Following up on refinery utilization

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, revisits the topic of refinery utilization leading up to heating season.

Catch up on last week’s Trader’s Corner here: Energy as a weapon in Russia’s invasion of Ukraine

At the end of August, we wrote a Trader’s Corner expressing concerns about the high utilization rates at refineries and how, if that continued, it could mean supply from refineries might not be available at critical junctures this winter. We knew that at some point, refineries would take units down for annual maintenance, and the longer they waited, the less likely they would have them up and running at critical propane demand time.

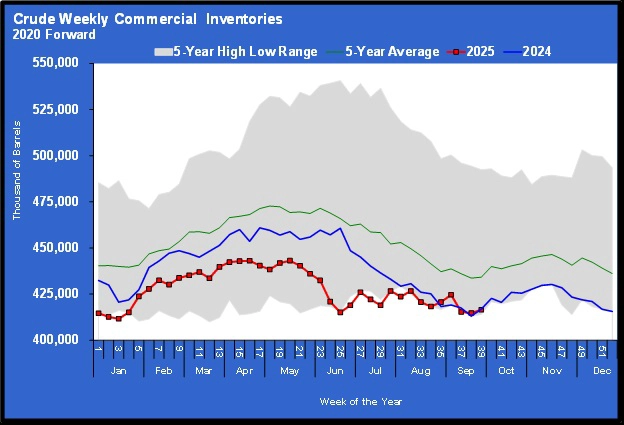

We began the analysis by showing that, despite expectations of weak energy demand, the total petroleum products supplied in the United States were running 182,000 barrels per day (bpd) higher through August of this year, compared to the same time last year. Higher demand was causing refineries to run units hard to keep up. The result was low crude inventories as refineries processed more. Even now, crude inventories remain near five-year lows.

The high throughput rate, coupled with a slowdown in U.S. crude production, has caused U.S. crude inventories to fall to five-year lows.

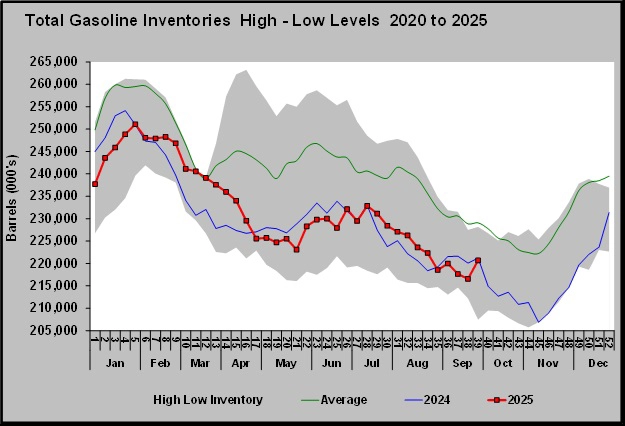

Despite high throughput, refiners were having a hard time keeping up, and gasoline and distillate inventories were not in good shape. They have improved since the end of August, but they still aren’t in great shape.

Last year’s gasoline inventories ran low, and they were even lower at the end of August of this year. Thankfully, there was an exceptionally large build this past week that got inventories closer to last year’s levels.

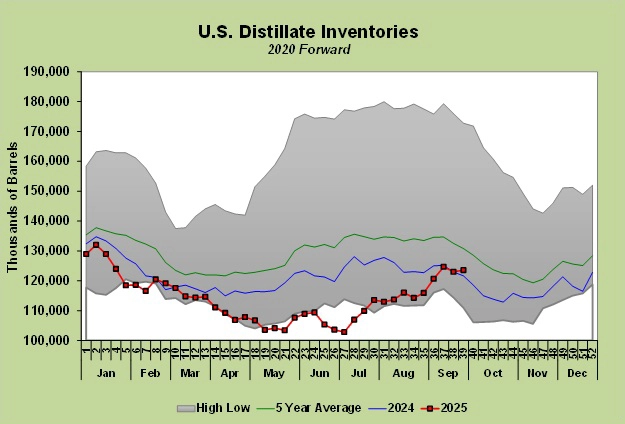

Distillate inventories were in even worse shape at the end of August.

At the end of August, distillate inventories were also near five-year lows. Thankfully, they too have recovered, but in August, it looked like there would be no end to refineries having to keep running at high rates to keep up.

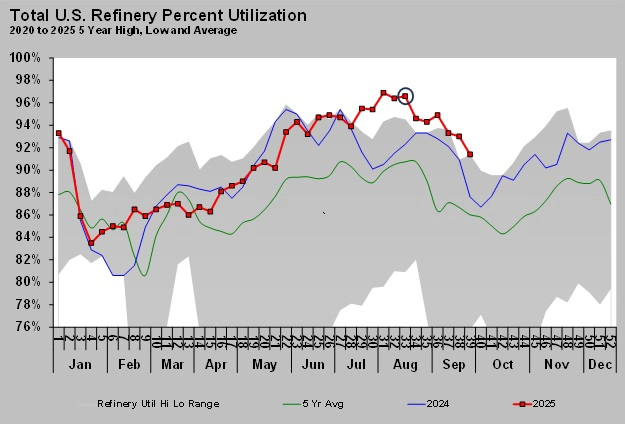

Chart 4 shows the percentage of available U.S. refinery capacity that is being used each week. The circled data point is where utilization was running at the end of August when we wrote the Trader’s Corner expressing our concerns about winter supply from refineries.

The week after that, utilization rates dropped sharply, which was a relief. They have continued lower in a more seasonal pattern. Still, the rate of utilization is much higher than last year and the five-year average. Though high, the fact that utilization is at least falling at this point relieves some of our anxiety about supply. Nonetheless, we would feel more comfortable if utilization would continue to fall, letting us know more refiners are taking care of maintenance before the high-demand period for propane arrives.

The weather has been very warm, and heating degree-days are already running well behind normal for this season. But high-demand periods will almost certainly appear, and we would like refineries to be through with maintenance and running strong again when it happens.

Refineries only provide about 10 to 12 percent of the U.S. propane supply, but they can be important from a logistical point of view during high-demand periods. The industry needs every link in the supply chain to be present and strong when demand hits hard.

Charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.