Propane pricing reflects oversupplied market

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines the current propane pricing environment.

Catch up on last week’s Trader’s Corner here: Propane inventory draw not concerning

In last week’s Trader’s Corner, we said that we were not concerned in the least about the large inventory draw reported by the Energy Information Administration for the week ending Oct. 3. We believed it to be an adjustment for the extremely large inventory build the previous week. We thought inventory builds would resume given the mild weather and they did with a 1.875-million-barrel build reported for the week ending Oct. 10. More additions to inventory before a sustained drawdown begins would not surprise us.

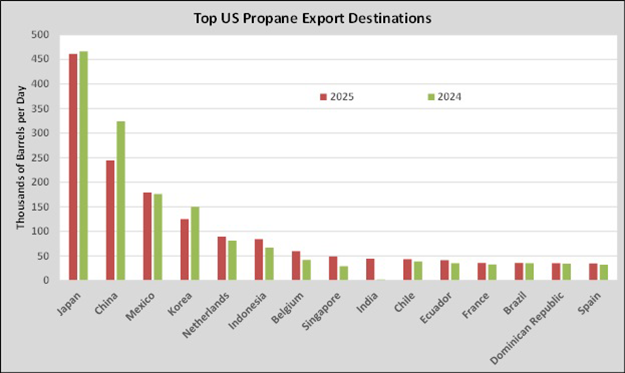

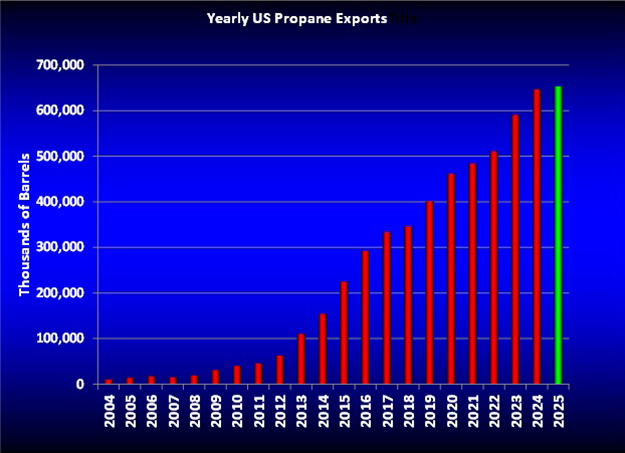

Stresses on supply may come at some point this winter but there is absolutely no indication of that now. Propane prices reflect the robust inventory position, strong propane production and mild weather. Propane prices bounced higher for a couple of days at the beginning of the week when it was reported that U.S. ships carrying propane, butane and ethane would not be subject to new port fees in China if the ships were not built in the United States. Hardly any ships carrying LP to China were built in the United States, so LP exports should not be impacted by the port fees. The corresponding bounce in propane prices was unlikely going to last for very long given the overall fundamental picture and the inventory build sealed its fate.

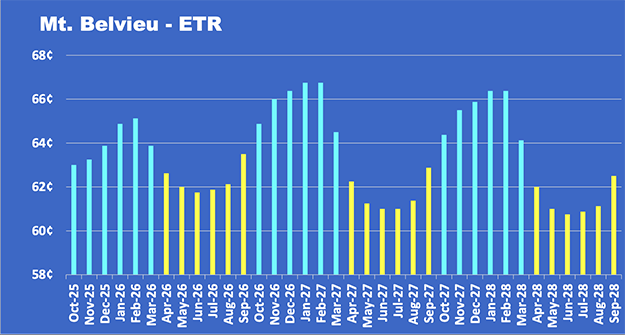

Propane in the United States is oversupplied, and prices are now reflecting that fact across the entire 36-month forward price curve.

The headline propane price is for the current month of October. But the value of propane is being established for a total of 36 months, through September 2028. In Chart 1, the winter months are in blue and the summer months are in yellow to help differentiate the seasonality of propane pricing. Note how the months of October 2026 through March 2027 are now higher than the current winter months. This is not typical, and the situation has developed over the last month or so.

Typically, a commodities price curve is backwardated, where the prices in the front of the curve are higher than prices further out. We need to understand why that is the case.

When the supply of a commodity is balanced with demand or there is even a slight undersupply, the valuations are almost always backwardated. Even in an oversupplied market like we have been having, prices can stay backwardated for a long time before flipping to the current pricing situation, which is known as contangoed.

The reason that a backwardated market is typical for commodities is that when pricing is normal, sellers are eager to make future sales at a price they know they can make money. They want to do that as far out as they can. Meanwhile, buyers tend to stay focused on a shorter timeframe. This dynamic creates a situation where there are more interested sellers further out than there are buyers. To entice the few buyers, sellers must take less for their product farther out. But if overall pricing is high enough, they are willing to do that to ensure a future operating profit.

When a commodity stays oversupplied for too long, the entire pricing structure falls to a point where sellers are no longer eager to sell their future production. It comes to a price point where sellers would just as soon take the risk that conditions will change and the commodities’ value will increase in the future rather than lock in future sales at little or no profit. At that point, the number of sellers in the future declines and prices farther out begin to rise. Yet, the oversupply situation persists, and sellers must sell their current production at whatever the market will bear. This can cause the current and nearby months to drop, sometimes significantly. Thus, the contangoed price curve is formed.

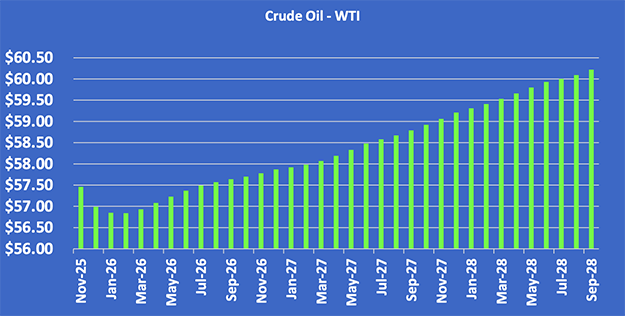

Crude’s price is very influential on propane’s price, especially in the further-out months.

The price curve for crude has become even more contangoed than propane and is contributing to the contangoed pricing structure for propane. With this kind of pricing structure, future sales tend to dry up. Crude is expected to be oversupplied next year, and yet the future pricing structure doesn’t reflect that reality. As a result, most of the buying and selling activity is taking place for the nearby months. Currently, it is enough to keep the front month of November and December higher than January. Some sellers will be willing to accept the seemingly inevitable low price which is reflected in the January and February pricing, with no hope of fundamental conditions improving before then. After that, the number of interested sellers will dwindle and price will rise as would-be sellers choose instead to wait and hope market conditions will swing their way over time.

If the oversupply situation continues as the calendar flips to a new month, prices will fall toward what you see in the front four months. In other words, the price curve will keep its current shape. And in fact, overall pricing may fall even more. You would see the same shaped curve but prices all along the curve could be even lower than they are now.

When the supply/demand balance for propane and/or crude moves away from oversupply, the price curve could quickly flip back to its normal backwardation. Large investment firms spend millions of dollars trying to figure out when that will occur. In our view, there are too many moving parts and unpredictable events that will ultimately determine when that will be to predict it with any degree of accuracy.

There comes a point when we must ask if it matters. It is more important to know where the value is in the pricing curve. For months, it was better to be a buyer of propane futher out because of the typical backwardated price curve. Now the opportunity is at the front of the curve. In other words, it is this winter that is the better value.

Currently, this winter’s price protection can be bought at around 10 cents under the 10-year winter price average. Further, this winter could be covered at 17 cents lower than where a buyer could have covered last winter at this same point in the year. If a buyer covered part of this winter’s supply at the current price of around 63 cents to 64 cents, could this winter average a lower price? Absolutely. In fact, current fundamentals for both crude and propane would suggest it might even be likely. But does it matter?

The opportunity to establish a price for customers that will likely be lower for them than last year and mitigate the possibility of a price rally off the table is here. The only argument for not doing so is fear that a competitor will buy propane lower if they simply buy at market prices all winter.

Let’s say the competitor does that. What must occur for the buyer of price protection at current prices to be hurt? First, the competitor will have to choose to give up a potentially better margin. If propane prices do fall, it probably means winter has remained mild. In that case, the competitor will be just as incentivized as the buyer at current prices to protect the margin. But we know there are those competitors that are incapable of logical decision making and will lower their price regardless.

So that brings us to the customer. Contrary to popular belief, customers’ lives do not revolve around propane. A buyer at current prices is probably going to bill them at or below last year’s prices. Furthermore, if the winter remains mild, usage will be down, which – combined with a good price – will result in low propane bills. The odds of losing customers in this case are relatively low in our view, but imagine if the buyer at current prices loses a few to a competitor that takes the risk of buying at market prices.

So, then the question becomes this: Is it the right decision to not protect all our customers from potentially higher prices out of fear of losing a few to a low-ball competitor should everything go against the decision to protect all customers from higher prices? It is hard to fairly answer that question without also considering this one: Is there a potential to gain more customers than will be lost in this scenario if, over time, you are the steady, predictable propane supplier year in and year out?

Unfortunately, we can’t answer these questions because the competitive conditions for each reader of this Trader’s Corner will be different. The relationships and goodwill built between each retailer and their customer base will be different. All we can do is to encourage readers to ask these questions. We will close by asking a couple more questions. Do we sometimes give our competitors more influence over our decision-making than is due while not giving our relationship with our customers enough credit? Does our fear of what our competitor will do sometimes cause us to pass on opportunities that would benefit our customers?

Charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.