Have we reached peak propane inventories?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines the recent Energy Information Administration (EIA) propane inventories report.

Catch up on last week’s Trader’s Corner here: No dip in propane prices this December?

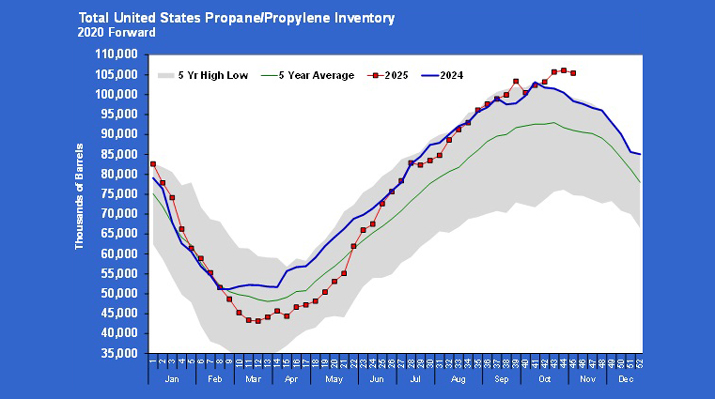

It is very possible the peak in propane inventories for 2025 has finally been reached. The EIA reported a 691,000-barrel draw for the week ending Nov. 7.

While it may have been the peak for the year, it was not the first draw on inventory for the winter of 2025-26. You will recall six weeks ago that inventories declined one week after an exceptionally high build. We said then that we would not be surprised if that was simply a data correction and that inventories would resume building, and they did.

If inventories for this year have indeed reached their summit, it came at 106.094 million barrels, a new record high to start a winter. The previous record of 103.135 million barrels was set last year. It also came during the last week of October. Only three times since 2003 has the peak in propane inventories been reached in November, so the inventory build is certainly overdue to end.

Perhaps there is finally enough cold weather to push domestic demand high enough to consistently cause calls on inventory for the remainder of winter. Though another inventory build is unlikely, all the cold weather that many are expecting had best come to fruition or we would not count out another inventory build to occur this month. If another inventory build should occur, it might not be enough to set another peak. So, the odds are the height of this year’s inventory summit is known.

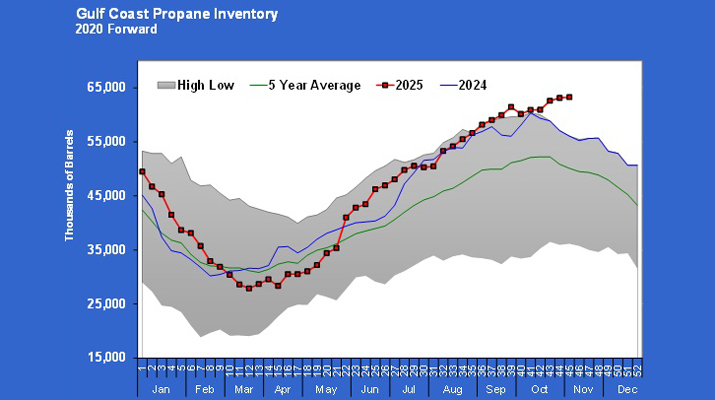

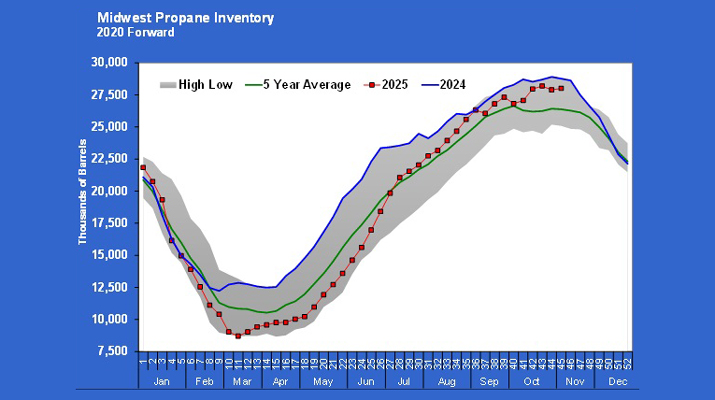

But there was something strange in this past week’s inventory draw. If we told you that both Gulf Coast and Midwest inventories increased last week and yet inventories declined, would that surprise you, given those two regions held 86.6 percent of the reported inventories? Surprised or not, that is exactly what happened.

The Gulf Coast held 60 percent of the nation’s propane inventories last week after increasing 148,000 barrels.

Midwest inventories held 26.6 percent of overall inventories with a 119,000-barrel week-to-week increase. Even inventories in the two western regions that held 5.495 million barrels combined, or 5.2 percent of supply, was up 129,000 barrels.

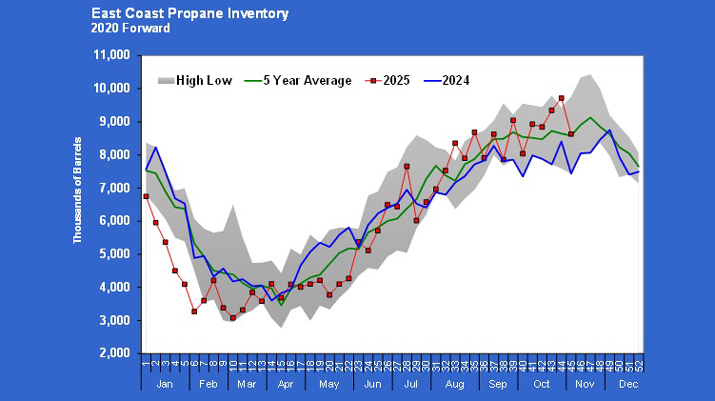

The entire inventory draw was attributed to the East Coast region, which fell 1.087 million barrels to 8.631 million barrels.

The previous week, East Coast inventory was reported at a record high for the 44th week of the year at 9.718 million barrels. Despite the draw, inventories were at the five-year average and still 1.197 million barrels, 16.1 percent, above week 45 last year.

With inventories holding their own on the East Coast, it keeps pressure off the pricing hubs of Mont Belvieu and Conway. As a result, propane prices have resisted going higher with crude. In fact, as we write on the morning of Friday, Nov. 14, propane is up less than 1 percent at MB ETR and Conway and is flat to lower at the other two MB pricing points, even with crude up 2.61 percent.

This separation with crude prices has been going on since the inventory data release occurred, which suggests propane traders were not the least fazed by the higher-than-expected inventory draw that occurred for the week ending Nov. 7. The 691,000-barrel draw was far more than the average draw of 48,000 barrels predicted by a survey of industry analysts.

U.S. propane production was at a robust 2.873 million bpd, and imports chipped in 114,000 bpd of supply. That is a total of 2.987 million bpd of supply. Propane exports have been strong, chewing up 1.929 million barrels of the supply last week. That meant it only took 1.058 million bpd of domestic demand for supply and demand to balance. Domestic demand came in at 1.158 million bpd, resulting in a 100,000-bpd call on propane inventories.

Surely, at this point in the winter there will be enough domestic heating demand to keep inventories on the decline. Perhaps it is the fact that we are wearing short pants and a short sleeve shirt, the outside temperature is 75 degrees, and that our office door is open so we don’t suffocate that makes it less than a sure thing from our perspective.

Charts courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.