How distillates impact propane retail operations

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains how distillate inventories and prices can impact propane retailers.

Catch up on last week’s Trader’s Corner here: Have we reached peak propane inventories?

Readers of Trader’s Corner are primarily propane retailers, propane consumers and others involved in the propane supply chain. But in today’s Trader’s Corner, we are going to look at distillates, and the subject may have more applicability to those in the propane supply chain than you might think.

Globally, distillate prices are elevated. A significant part of the reason is the war between Ukraine and Russia. Recently, Ukraine has had a lot of success attacking Russia’s refineries with drones. As a result, Russia has had to hold onto its gasoline and distillate supplies rather than exporting them.

This situation has European buyers looking to the United States for supply, which is limiting inventory builds and keeping upward pressure on prices.

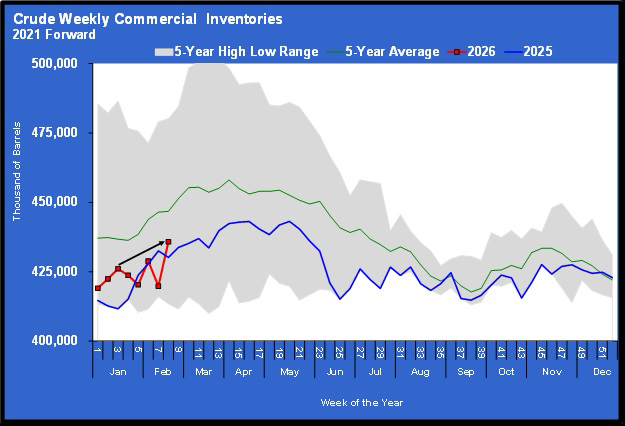

Distillate demand took a short break due to reduced airline travel during the government shutdown, but inventories remain below last year and the five-year average.

Interestingly, U.S. gasoline inventories are also low, in fact setting five-year lows for this time of year, yet there is a divergence in gasoline and distillate prices.

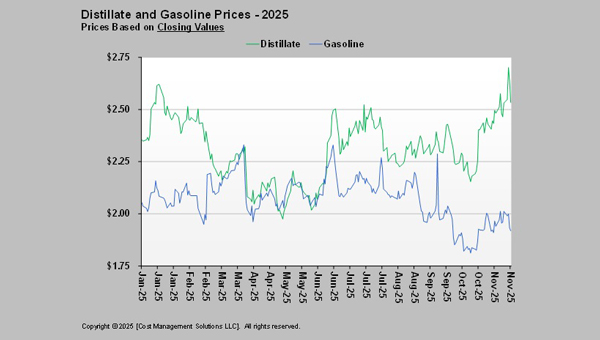

Since mid-summer, the overall trend in gasoline prices has been down, while it has been up for distillates. The chart above shows Ultra-low sulfur diesel (ULSD) at New York Harbor (distillates) compared to reformulated blendstock for oxygenate blending (RBOB) gasoline. RBOB is the primary component of gasoline and is blended with additives like ethanol to make finished gasoline.

The price divergence stems from demand. The demand for distillates has remained strong, while the demand for gasoline has been down. The tight gasoline inventory is more a result of refineries adjusting to make more distillates at the expense of gasoline production. So, though the inventories of both refined products are low, the higher demand for distillates compared to gasoline has pushed distillate prices higher, while the lower demand for gasoline has allowed gas prices to fall.

Some of you are both propane and heating oil retailers. It’s a good time for your propane customers, but not so good for your heating oil consumers. And for propane retailers that buy diesel to run their equipment, the relatively higher cost of diesel may be hurting their bottom line.

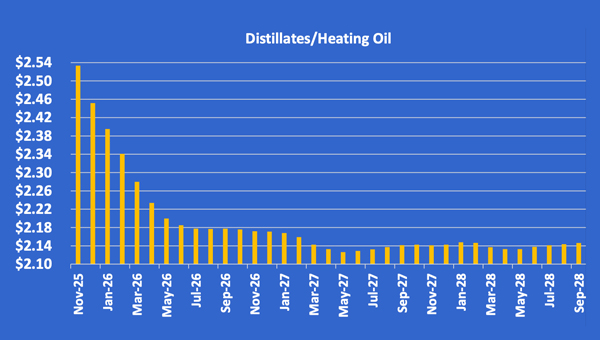

Regardless of which group you are in, you may be interested in Chart 3.

Chart 3 is the forward price curve for distillates. Whether you are supplying heating oil to end consumers or you are the consumer, this chart should be of interest.

Note how backwardated the price structure is for distillates/heating oil, where prices are high in the short term but fall off sharply the further out you go. We talk all the time about getting price protection on some of our future propane supplies, and we are looking for pricing structures like the one above. There is also the opportunity to hedge distillates, whether you are selling heating oil or consuming diesel, and the price structure above encourages hedging.

Looking at Chart 3, it’s obvious there could be an opportunity to set a price that is lower than the current or prompt price. The market is around $2.18 for the second half of 2026 and close to $2.14 for most of 2027.

There has always been a hedge market for heating oil retailers, just like there is for propane hedging. We help clients hedge both products. The problem with hedging diesel consumed by the retailer or trucking company has been the relatively low volume.

Distillate contracts or swaps are 1,000 barrels, or 42,000 gallons per month. Few retailers are going to consume that much diesel in their retail propane business. However, one of our trading partners will hedge much smaller volumes, which would make it practical for propane retailers to hedge their diesel fuel.

Hedges can be put in place on volumes of as little as 1,000 gallons per month.

If the war between Ukraine and Russia continues, the pressure on prices to rise as they approach the front of the price curve will remain. There is talk of a peace deal being worked on by the United States to end the war. If that happens, the price curve would likely become far less backwardated. So, as always, there is risk to locking down a future price.

So, the question is whether having a known cost of diesel in the future would be beneficial. The trader who does lower volumes charges a little above market price to do the hedges, so the retailer would be locking in above $2.14 to $2.18. The transaction cost would be around 3.5 cents per gallon for most low-volume hedges.

We provide distillate/heating oil pricing in our daily report and show the forward curve in our evening report every day. Most propane retailers that don’t sell heating oil probably blow right past the distillate pricing and forward curve, thinking it doesn’t apply to them. However, if your company is a significant consumer of diesel, you might want to take a gander to see if the forward pricing is providing an opportunity to turn an unknown business expense into a known one.

Charts courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.