Measuring PERC’s effectiveness

As we approach the 30th anniversary of the Propane Education & Research Council (PERC), those of us who have invested careers and/or capital in the propane industry have reason to be thankful to the leadership of the 1990s who, with a sense of posterity, created PERC.

In their foresight, these industry leaders envisioned an industry collaborator who would bring together experts and volunteers along with funding to do for the industry what it could not do separately to advance growth and safety.

Our industry is now at the crossroads of significant change – technological advancements, a dynamic energy market and decarbonization initiatives that threaten propane’s market share and possible existence as an industry. Therefore, PERC’s influence on the state of our industry and its future will be significant. This raises the question: Is PERC ready to help position the propane industry to compete in the future?

Let’s look back at PERC’s effectiveness.

▶ Has PERC been effective?

There is no industry consensus on how PERC effectiveness should be measured. This question nagged me during my six years as a councilor.

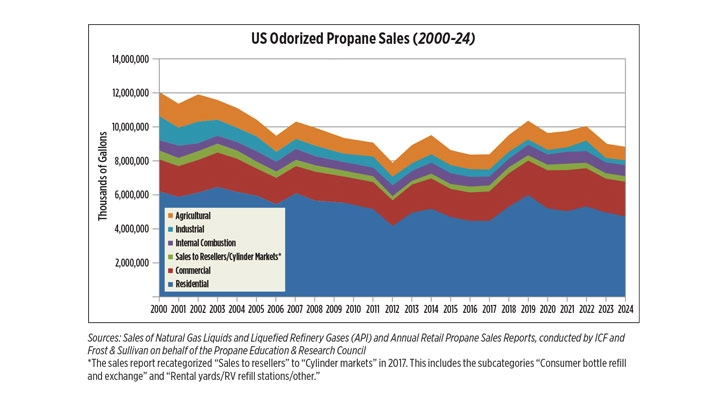

Is “industry gallons sold” the right measure? Is it fair to point the finger at PERC for the industry’s 25 percent decline in gallons sold since 2002 (12 billion vs. 9 billion in 2023), while PERC collected assessments of over $1 billion since its inception? In my opinion, no to both questions.

PERC has no customers, and neither does it directly develop new markets or sell the new technologies that were developed with PERC funds. PERC has little control over industry engagement – the propane marketer’s willingness to develop new markets, sell new propane technologies and use the resources created by PERC.

However, “gallons sold” as the widely accepted measure of the industry’s size has relevance to the question of PERC effectiveness. After all, PERC plays a key role in propane’s market share – messaging, development and commercialization of new technologies, emerging market development, and safety.

Now let’s look at some of the key factors in which PERC played a key role:

⦁ Messaging – For the past five-plus years, PERC’s environmental messaging campaign has been the most significant budget item. The environmental impact from using propane became PERC’s headline message. These headline messages emphasized how propane reduces carbon emissions and accelerates the path to zero to reverse climate change and ensure energy equity. PERC celebrated its “Path to Zero” book, which advocated the Inflation Reduction Act and a carbon tax as effective ways to achieve the book’s decarbonization premise. Was PERC’s environmental messaging campaign effective? No. In the end, PERC actions in this area didn’t help propane in its fight against our toughest competitor – electricity. The campaign’s environmental impact emphasis did not align with PERC’s consumer education priority as, according to PERC research, the energy consumer cares little about environmental impact when choosing an energy source.

⦁ Power generation rental equipment market – One of the better gallon-growth opportunities in the power generation market, which has been dominated by diesel. Propane has a great story. Our performance in the equipment rental market can be summed up with a comment by a power generation expert from a national rental company: “Propane is the best alternative fuel, but propane does not have the equipment I can trust for my customers.” Today, none of the three largest equipment rental companies (Sunbelt, Herc, United) offer a propane unit in their power generation equipment offering.

⦁ Autogas – Our industry remains eager for a dedicated propane bobtail despite significant PERC investment, time and credible partners (Freightliner and Cummins). PERC’s recent $6 million Nexio investment appears to be a Hail Mary to get a dedicated propane bobtail. While I fully support PERC making risky investments in strategic technologies, imagining a successful scenario for this project is difficult. Among the hurdles that must be overcome is building a reliable national service network, one of the factors that led to the Freightliner S2G demise.

⦁ School buses – One of the best diesel-displacement opportunities. Propane’s market share of only 5 percent has trended flat despite propane’s benefits, diesel’s challenges, EV bus challenges, eco-friendly pressure from school boards and a strong track record from the Roush/Blue Bird solution.

⦁ Commercial lawn care – One of the best off-season markets. The case for propane vs. gasoline is solid. Yet since 2017, propane has lost over 50 percent of its market share that was built, in part, by millions in PERC incentives. What does this say about our industry’s ability to defend our markets?

⦁ Safety – The adage “What gets managed gets measured” applies. While recent efforts have begun to measure and understand the industry’s safety loss incidents because of eroding consumer confidence in propane’s safety, it’s fair to ask why not before now? The council commissioned such a study in 2004 as it saw the need to understand the causes and frequency of safety incidents. Further, the National Propane Gas Association (NPGA) Affinity Insurance Program, adopted about 15 years ago, was designed to provide ongoing industry loss data to help manage safety loss incidents.

▶ Priorities for the next five years

Looking ahead, PERC’s priorities for the next five years should address:

⦁ Power shortages and rising electricity costs – Propane is the perfect solution to assuage consumer, policymaker and utility fears about inadequate power supply. Rising power costs will escalate consumer affordability concerns. The propane solution addresses both concerns. Peak power demand can be offloaded to propane applications, such as dual-fuel heat pump solutions that replace the electric heat strip. Propane’s affordability will become more compelling when considering price forecasts for electricity and propane. In many markets, propane will cost 50 percent less than electricity on a Btu basis by 2030. Energy reliability and affordability should become PERC’s headline message, replacing climate change and energy equity.

⦁ Residential market – If we lose this market, we will lose our relevance as an industry. We must respond to the threat of heat pumps, homebuilding incentives that favor electricity and the growing pro-electrification, anti-fossil fuel sentiment in many states and in the trades.

⦁ Diesel displacement – Propane’s advantages over diesel-dominated markets – especially in power generation and school buses – will get stronger. We as an industry must seize these opportunities.

⦁ Workforce – The demographic drought will get worse before it gets better. We must compete with every other industry that has become more proactive in partnering with technical schools. PERC’s HVAC Technical School Grant Program is an effective way to recruit and prepare the next generation for a propane career. We must work with national trades curriculum providers, such as the National Center for Construction Education and Research, to integrate propane into their gas fitting, plumbing and HVAC curriculum.

⦁ Industry engagement – An engaged propane marketer community that shares a sense of ownership in PERC’s success is an imperative to our future. Use the resources developed by PERC. Do the hard work of commercializing the new technologies developed by PERC. Be that link with your local technical school that will teach the next generation of technicians and drivers.

▶ The punchline

A rethink of PERC’s effectiveness and strategy is needed.

PERC’s headline message should be energy security and affordability. Keep propane’s clean energy message as part of the narrative while eliminating negative references to natural gas and diesel emissions. We must crack the nut of the very difficult task of commercialization of new technologies and development of emerging markets. Widespread propane marketer engagement in all areas is the X factor to our success.

Ultimately, it’s up to the industry leadership – the NPGA Executive Committee and the PERC council and staff – to chart our path for the future and to build upon the growth and safety vision of past industry leadership.

Randy Doyle has held various leadership positions during his long career in the propane industry. He is a member of the LP Gas Hall of Fame. He currently resides in Virginia but will relocate to Tulsa, Oklahoma, in 2026. He can be reached at RRD1974@outlook.com.

Editor’s note: In early December, PERC introduced a new three-year strategic plan that addresses some of the points brought forth here.

Related Articles

Dip in US propane production not a concern