Reflecting on the past year of propane

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, looks back at how propane has behaved this year.

Catch up on last week’s Trader’s Corner here: Dip in US propane production not a concern

It’s a time of year when we are often reflecting on whether someone or something has been naughty or nice over the past year. For the most part, propane has been nice. Conversely, its cousin, heating oil, has been rather naughty.

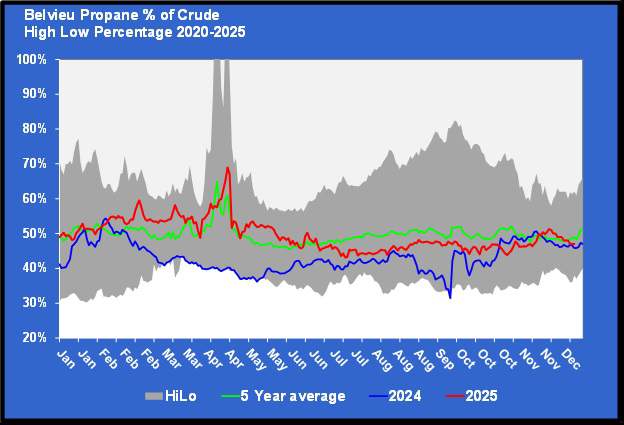

As we write, heating oil/distillates are trading at a price equivalent to $1.41 of propane at the New York Harbor trading hub. Meanwhile, propane is 66 cents at Mont Belvieu Energy Transfer (ETR), 62.5 cents at Mont Belvieu Enterprise (ENT) and 60 cents at Conway. Currently, heating oil is valued at 155 percent of a barrel of WTI crude, while propane is between 43 percent and 47 percent of WTI.

Chart 1 shows Mont Belvieu ETR propane’s value relative to WTI crude’s value in a simple percentage comparison.

Propane’s value relative to crude’s value at MB ETR has been higher this year than last year, at 49 percent this year compared to 43 percent last year. But it has averaged just under the five-year average of 50 percent and equal to the 10-year average of 49 percent.

Conway propane has averaged 46 percent of WTI crude this year compared to 41 percent in 2024. But it has been below its five- and 10-year averages of 48 percent and 46 percent, respectively.

The higher value relative to crude this year is more a reflection of the weaker fundamental conditions that have developed for crude this year, with it being oversupplied as OPEC+ has raised its production quotas, than it is a change in propane’s negative fundamentals.

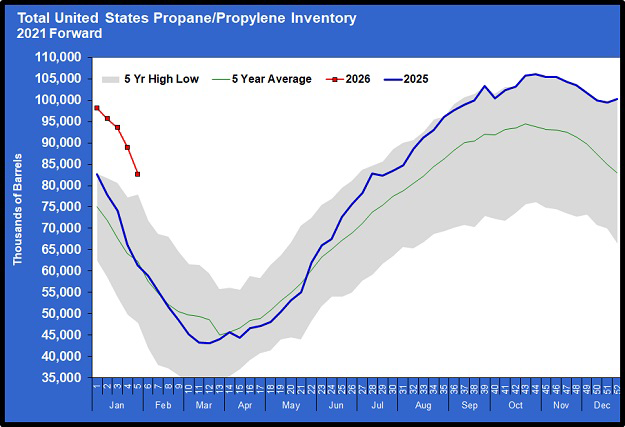

In fact, there has been nothing negative about propane fundamentals from the perspective of propane buyers and consumers in 2025. Propane production has been at record levels for much of the year, averaging 131,000 bpd more than last year. That resulted in propane inventories reaching a record high of 106.094 million barrels ahead of the winter drawdown period. Even though inventories have been declining, they are still at record highs for this time of year.

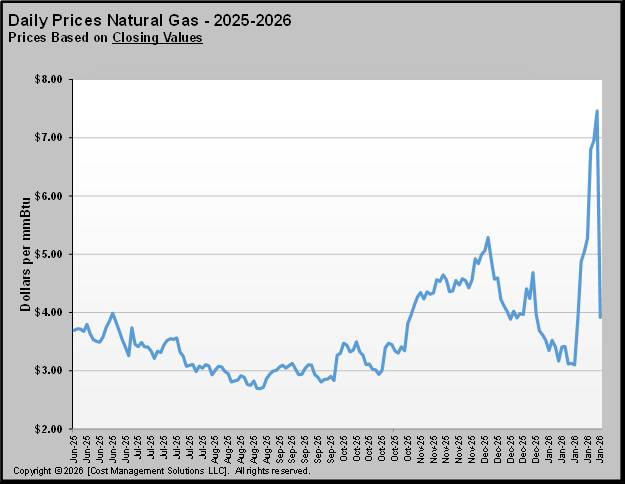

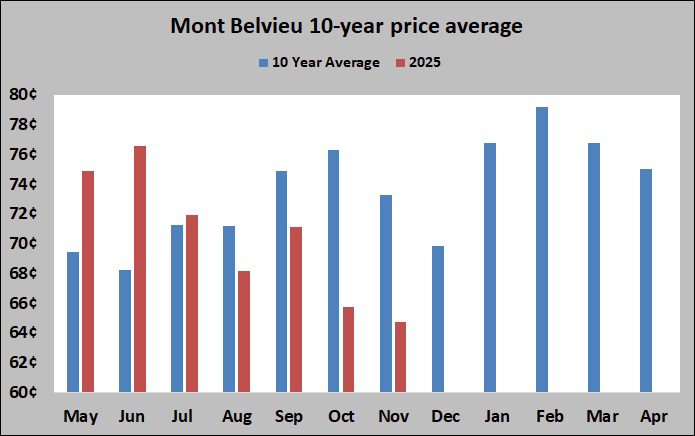

The better metric for revealing propane’s niceness this year is its average price relative to history during this winter period. Because of the spike in April, propane has averaged slightly higher this year than its 10-year price average, which is a key benchmark for us.

But if we narrow our focus to the winter months, MB ETR propane averaged 65.2045 cents per gallon. It averaged 76.0600 cents per gallon during those months last year. The 10-year price average for those months was 74.7914 cents. The December MB ETR price average has been 67.5174 this month compared to 77.6875 cents last year and the 10-year average of 69.7463 cents.

At Conway, the price average was 58.3697 cents in October and November and has averaged 62.1736 cents so far this month. Last October and November averaged 73.442 cents and December 73.3839 cents. The 10-year average for October-December propane has been 69.9180 cents.

It is the season of giving, and propane has been a very generous Btu for retailers and consumers in 2025.

Charts courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.