How events in Venezuela affect US crude supply

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores how the U.S. military’s recent actions in Venezuela could impact U.S. crude oil supply.

Catch up on last week’s Trader’s Corner here: Propane inventory build is a shocker

The tension between Venezuela and the United States that’s been building for years is rooted in the widely held belief that Venezuelan President Nicolas Maduro was not duly elected by the people. He was accused internationally of rigging elections.

President Donald Trump designated Maduro and the drug cartels in Venezuela as narco-terrorists. He said Maduro and the cartels were one and the same. He had the Coast Guard attack boats running drugs to the United States. A drug export facility was destroyed.

Eventually, the United States put a blockade on Venezuela’s crude exports to force Maduro out of power. The United States bargained with him intensely to relinquish power and leave the country. He would not. Finally, Trump made the decision to forcibly remove him from power using U.S. military special forces, which captured him and brought him to the United States to face criminal charges.

The politics go much deeper than that, of course, but the United States has desired regime change in Venezuela for a long time. To put pressure on the country to get rid of Maduro, Trump has used crude as a political weapon during both of his terms in office. In his first term, Trump stopped allowing U.S. refiners to import crude oil from Venezuela.

The damage to Venezuela was probably less than it was to the United States. Venezuela quickly found buyers for its crude, though it received less due to higher transportation costs. Unfortunately for the United States, its primary economic rival, China, became the primary buyer of Venezuela’s production.

To understand the implications of losing Venezuela as a crude supplier, one must go back many years.

There has not been a new refinery built in the United States since the 1970s. Capacity increases have come from the expansion of existing refineries. When refineries were being built, much of the crude being produced in the United States was heavy crude. From 1970 to 2006, U.S. crude production declined. The peak was 11.3 million barrels per day (bpd), but by the end of the period, it was 6.83 million bpd.

In 1970, the United States imported 3.16 million bpd, with consumption at 14.7 million bpd. By 2006, consumption was at 20.69 million bpd and imports at 12.39 million bpd. Imports peaked the prior year at 12.55 million bpd.

Since U.S. refineries were designed to process heavier crudes, the refiners sought sources of heavy crude as U.S. production declined and consumption grew. Refiners found that heavy crude in Canada and Venezuela. Logistically, it made sense for Venezuelan crude to supply refiners on the U.S. Gulf Coast, which is where the bulk of U.S. refining resides.

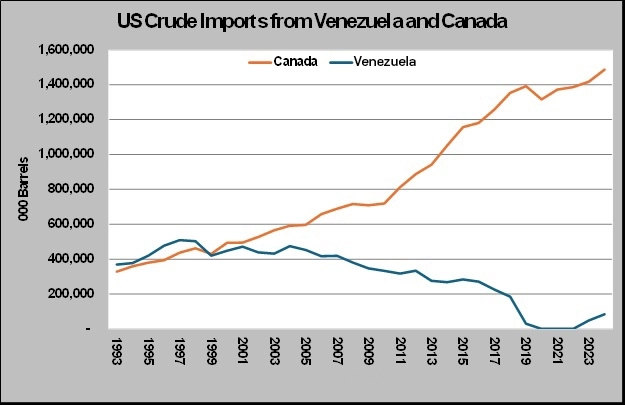

Our data on crude imports only goes back to 1993.

But even at that point, crude imports from Venezuela were higher than those from Canada. Heavy, sour crude supply from Venezuela was a critical piece of U.S. supply.

However, over the years, due to neglect and politics, Venezuelan production declined. For the United States, that meant pipelines had to be built to get Canadian heavy crude to Gulf Coast refiners. The shale gas revolution that began in 2010 was a great boon to U.S. crude supplies overall. However, crude from shale formations is mostly light crude. U.S. refineries to this day still need to blend heavy crude with light crude to run properly and yield the needed products, making the import of heavy crude necessary.

The loss of Venezuelan supply increased costs and made the United States highly dependent on one supply source, Canada, for its heavy crude. This dependency grew as fewer conventional wells that might produce heavier crudes in the United States were drilled. The surplus of light crude grew, as did the shortage of heavy crude. The shutdown of new pipeline construction from Canada under President Joe Biden’s administration exacerbated the logistical situation.

U.S. policies and politics under Trump and Biden made the heavy crude shortage harder to manage. Regardless of whether one agrees with the policies and politics, the situation has increased U.S. energy costs and become a national security issue.

Trump announced that Venezuela was going to ship 30 million to 50 million barrels of crude to the United States now that Maduro is no longer in power. He has also been courting U.S. oil executives, encouraging them to invest in Venezuela’s crude industry and revitalize it, but this is likely to be a very hard sell.

Venezuela is sitting on 303 billion barrels of crude. That is the largest proven reserves in the world. Prior to 1976, U.S. oil companies were heavily invested in developing those reserves. Then, President Carlos Andres Perez nationalized the oil industry, seized assets of U.S. companies and effectively kicked them out in the following years.

Over the years, due to corruption and a lack of foreign investment, Venezuela’s crude industry fell into a sad state, producing just 1.1 million bpd, ranking 16th in the world, despite its vast reserves.

Some production increases could be made in a relatively short time, but it will take years and massive investments to fully exploit the resource, and then decades to get a suitable return on the investments. Having been burned already, U.S. companies are not going to get involved without significant assurances that their investments will be protected.

The multibillion-dollar question is whether the U.S. government can make such assurances. The United States made the bold move of arresting Maduro, but one could make a strong argument that Venezuela is just a puppet state of the cartels and political militias, and it really doesn’t matter who the face of the government is or whether elections once again become “fair” if the groups with guns have the real power.

How in the world, short of destroying the cartels and militias, does the United States know that a legitimate government can be formed in Venezuela and become a viable trade partner for the United States, much less a safe place to invest?

Trump is saying the United States is basically going to run Venezuela until he is satisfied that a legitimate and pro-U.S. government is running the show. But that seems like an untenable position. It could take years to achieve that outcome.

Trump seems confident he can find companies to invest in Venezuela’s oil industry and revitalize it. We are not so confident that the political situation in Venezuela will become stable enough to allow that to happen.

The only way we can see it happening in the short term is if the government and the people of the United States ensure that oil companies don’t lose their investments should a repeat of 1976 occur. That is likely to be a political quagmire as well. It is not very popular to use taxpayer money to bail out oil companies these days.

Still, the United States needs a second reliable and abundant source of heavy crude. Venezuela is certainly the answer. The motivation for the government and oil companies to make this work will be there. If it works, it will help U.S. energy consumers and taxpayers as well. But producing crude is going to be the easy part. Orchestrating real change in Venezuela that could lead to democracy again, while keeping the people of the United States behind the effort, will be the real challenge.

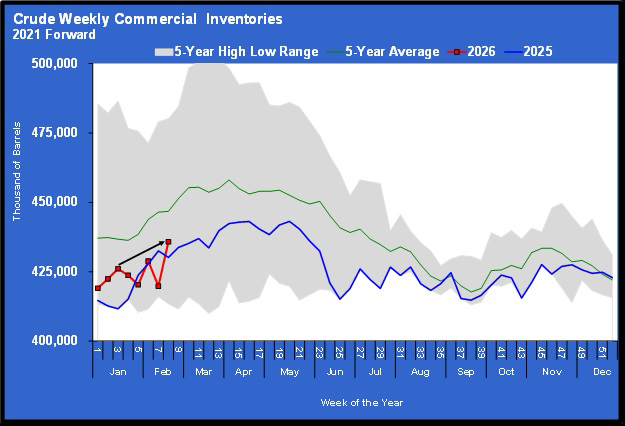

We are having a hard time contemplating the political nightmare that sorting this out is going to be. We think crude markets are having the same difficulty, and that is contributing to recent crude price volatility.

For the most part, it seems people are happy that Maduro is no longer in power. Even most Venezuelans are reported to believe it is good. But like all of us, they are still uncertain what it all means and if it will result in real change in Venezuela. Trump has a reputation for taking challenging situations head-on. There is a good chance he has a tiger by the tail this time around that will take tremendous effort and the expenditure of a lot of political capital to tame.

We hope this turns out to be good for the United States, and especially for the citizens of Venezuela, but our concern is that removing Maduro from office may have done little to change the political situation on the ground. It was likely only the first of many difficult political choices for the Trump administration.

What we can say for certain is that if the Venezuelan oil industry can be revitalized and the United States is a recipient of its exports, it will be good for the United States. It would be a second reliable source of heavy crude, which would help both economically and with national security.

Chart courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.