Steady propane prices for 2025-26 winter

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why propane prices have been steady this winter.

Catch up on last week’s Trader’s Corner here: Propane inventories decline more than average

So far this winter, propane retailers and consumers have enjoyed relatively steady propane prices.

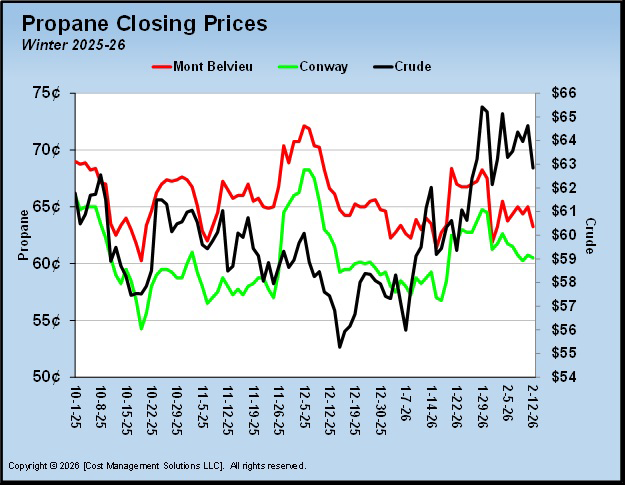

Chart 1 plots propane closing prices from Oct. 1, 2025, and overlays crude prices so we can see where propane followed crude and where it diverged.

Of course, there has been some variation in the price of propane given the multitude of influences on it, not the least of which is crude’s price. But what has been avoided is a dreaded spike in prices that can shock consumers into shopping for a new propane supplier and, worse yet, considering other energy sources.

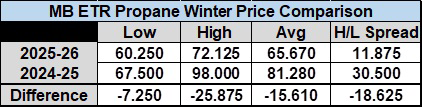

Table 1 compares this winter with last winter over the same period at the Mont Belvieu ETR pricing point.

Mont Belvieu ETR propane has averaged 65.67 cents per gallon this winter compared to 81.28 cents during the same period last winter. The average hub price is down 15.61 cents this year. The trading range was between a low of 60.25 cents and a high of 72.125 cents, resulting in a high/low spread of 11.875 cents.

Last winter was higher-priced, and there was more volatility for retailers and customers to navigate. The high/low spread was 30.5 cents. This year’s high price was 25.875 cents lower than last year’s high price.

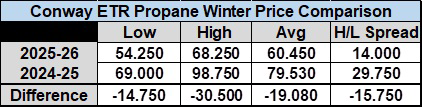

Table 2 shows similar results at Conway.

Conway’s propane prices have averaged 19.08 cents less than last year. The high was 30.5 cents below last year, and the spread between the high and low was easier to navigate, being 15.75 cents less than last year.

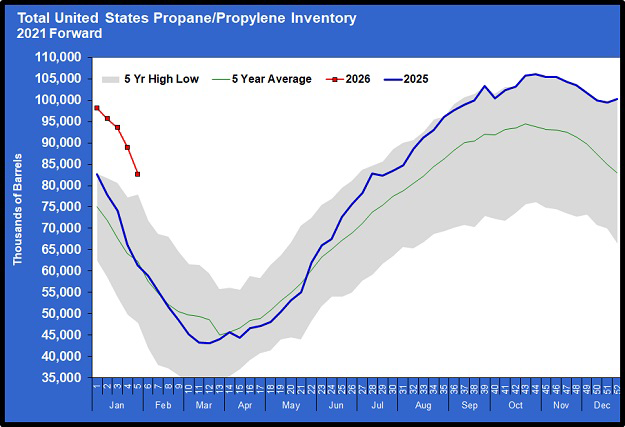

There is still a possibility that pricing could get crazy before the end of this winter, but the odds don’t favor it. U.S. propane inventories are at record highs for this time of year, and the weather outlooks would not suggest a tremendous amount of pressure on those inventories through the end of winter. It appears that something very unusual and unexpected would have to happen over the next couple of months to change the year-over-year comparisons significantly.

If we look back at Chart 1, we can see that propane largely followed crude’s price in the early part of winter. But as winter moved on and the pressure stayed off inventories, propane prices started separating from crude.

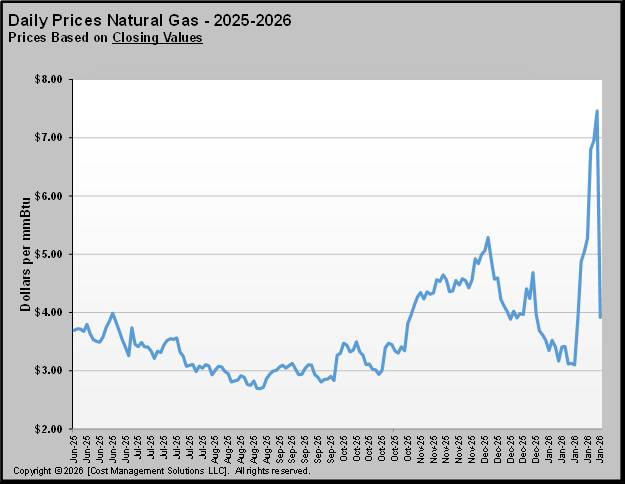

That separation has been most obvious since the start of 2026, with geopolitical events driving crude higher, but propane not following, as fundamentals weighed on propane markets.

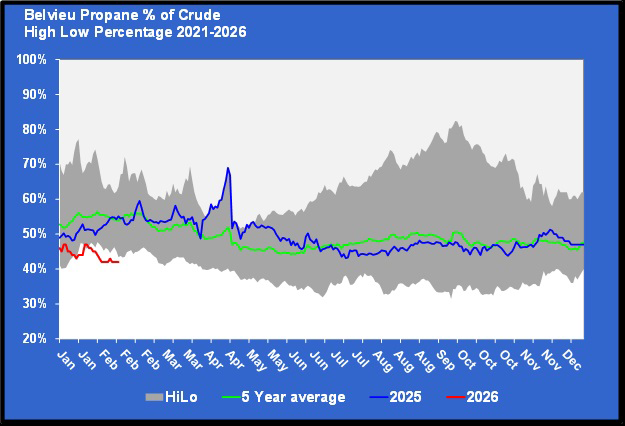

Chart 2 plots propane’s value relative to crude’s value on a simple percentage basis at MB ETR. The value of propane is setting five-year lows relative to the value of WTI crude. That means that propane is a relatively low-priced Btu, hopefully keeping it favorably viewed by consumers.

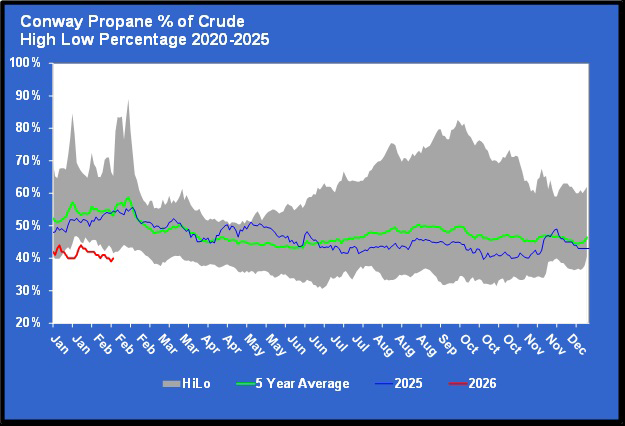

The situation in Conway is similar, as seen in Chart 3.

Conway has been setting a new five-year low in relative value to WTI most of this year.

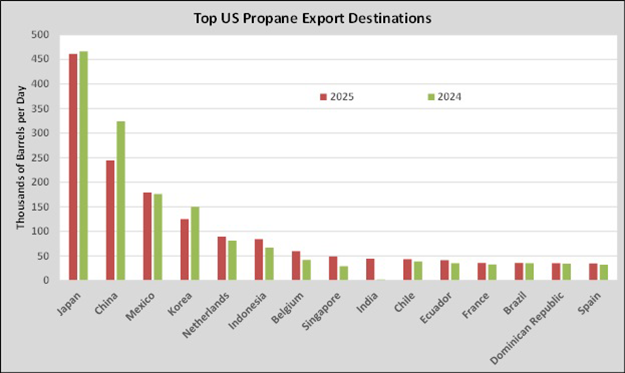

This pricing comparison is simply a reflection of how well-supplied propane has been this year. Inventories have not been remotely stressed. Any price issues have been downstream of the hubs, where logistical issues always come into play.

The good news is that the oversupply situation for propane is likely to continue for the foreseeable future. It is highly probable that propane inventories will exit this winter at record highs. If U.S. crude and natural gas production hold up, there should be plenty of barrels headed to storage this summer.

Charts and tables courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.