Advice on demand for domestic propane retailers

Last Wednesday, the Energy Information Administration (EIA) reported a huge drop in U.S. domestic propane demand for the week ending Sept. 25.

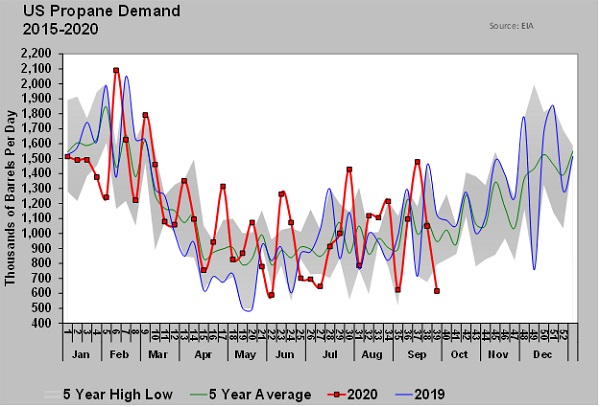

Domestic propane demand fell 434,000 barrels per day (bpd) to just 615,000 bpd. That was 520,000 bpd less than the same week last year. It was by far the lowest demand rate we have seen during week 38 of a given year.

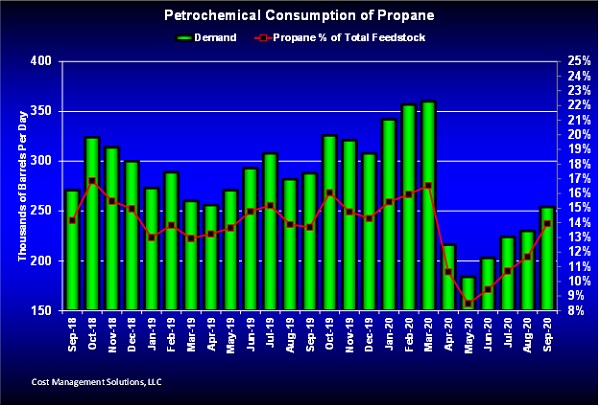

In September, industry estimates showed that U.S. petrochemicals consumed 254,000 bpd of propane. Petrochemical consumption is well below where it was before the pandemic. But if we take even this reduced petrochemical consumption away from total domestic demand, it leaves only 361,000 bpd of retail demand.

At the same time, the EIA also reported U.S. propane exports at 1.315 million bpd. That means propane exports were 3.64 times domestic retail demand. With domestic demand and exports combined, total demand was 1.930 million bpd, and retail propane demand was less than 19 percent of that total.

To be clear, U.S. domestic demand is a calculated number. The EIA is not getting direct reports from petrochemicals and retailers; it collects data on imports, exports, inventory levels and production. From those numbers, it implies or calculates domestic demand. Obviously, if there are inaccuracies in any of the areas reported, it is going to also adversely affect the accuracy of domestic demand. Furthermore, the petrochemical demand we use is a number from industry, not from the EIA. Although we have every reason to believe in the accuracy of that number, it is being collected from individual companies, and its accuracy is only as good as those companies’ reports. It is possible that, due to reporting discrepancies, this past week’s domestic retail demand number may not be entirely accurate. Let’s hope not since it is so low.

Nevertheless, the numbers provide context for a discussion about overall supply/demand. We did a video call this past week, and one of the questions asked was if we had any concerns about supply for this winter. The answer was that, for the propane market overall, we do not think the potential for a price spike is very high. We think we are set up for a stable pricing environment at the hubs this winter. The EIA just reported a 4.069-million-barrel build in U.S. propane inventory. That put inventory at 101.959 million barrels, just 875,000 barrels below the all-time high. The supply is spread evenly across regions. Barring a combination of extraordinary domestic heating demand and extremely high export activity, the hubs should have plenty of supply.

We do have concerns about getting supply from the hubs to local markets during high demand periods, and this is where the discussion above on domestic retail demand comes into play. Producers are not – and have not for some time – invested in infrastructure to meet U.S. retail demand. Pipelines that used to be in service to meet retail demand and were underutilized much of the year are now carrying other natural gas liquids. Mild winters have discouraged investment in secondary storage and rail facilities that might offset the loss of pipelines. Canadian producers have options to export to Mexico and Asia, leaving the U.S. Midwest as the market of last resort.

Retail demand is seasonal and therefore does not match up well with how propane is produced, which is fairly steady year-round. On the other hand, as the chart shows, petrochemical demand is fairly evenly distributed throughout the year. Much of propane exports are going to petrochemical companies as well. Producers and midstream companies are investing in infrastructure to meet the demand from the areas that better match up with the way that wells produce and fractionation plants operate, which is to ramp up to target rates and stay there day after day.

The lack of infrastructure investment in retail propane and the focus of producers and midstream companies in servicing other demand areas perpetually leaves retail propane vulnerable during any period of high demand. As retailers, we can get mad at the producers and midstream companies if we want, but if we are honest, we know they aren’t doing anything we wouldn’t if we could. If we could sell our propane steadily throughout the year rather than crammed into a few months, we could operate more efficiently and with less stress.

Retail propane has no choice but to respond to the new supply reality that has developed over the last decade. That could mean more investment in assets that will allow us to be reliable suppliers. That could be more storage or cooping in rail terminals. Those are expensive options to be sure but may be necessary.

However, there is potentially lower-hanging fruit. There is actually enough tertiary storage on the customer level to take most demand spikes out of the equation. The problem is that too much of that storage is at low levels until demand hits, and everyone scrambles to fill it up at the same time. We encourage that not to happen with summer fills, but that is all we can do – encourage. It may not be a lot of fun, but it can certainly be beneficial to move as many customers as possible to budget billing so that we gain control of tanks and thus inventory management.

Budget billing has a lot of advantages beyond inventory management, but with the realities of today’s logistical issues, perhaps none is more important. In general, the more our industry can bill and operate like a utility company and move away from the buy-and-mark-up model of a service station, the better off we will be in many respects.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.