Bad propane pricing environment could have been worse

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains the current propane pricing environment.

Catch up on last week’s Trader’s Corner here: Crude inventories down as refineries roar

If you are a propane retailer looking to buy price protection for the upcoming winter, it is not a good pricing environment. As of now, the upcoming winter, October 2025 to March 2026, is valued at an average price of 84 cents in Mont Belvieu (MB) and Conway. That is a few cents higher than at this time last year, and last year, there wasn’t a good price protection environment at this point either.

Our benchmark for when valuations are favorable to buyers is to compare the current valuation to the long-term actual price history for the period. We use the 10-year average price, which for the October-to-March period has been 73.5 cents at MB and 73.8 cents at Conway.

That means a buyer of price protection at current valuations would be locking in prices that are around 10.5 cents to 11.2 cents higher than the average winter price for the last 10 years.

Does that mean price protection bought now has no chance of being beneficial? No. In three of the past 10 years, winter prices have averaged more than the current valuations. And in each of those cases, the winter average was significantly more than current valuations. The winter of 2014-15 averaged 118.1 cents, the winter of 2021-22 108.3 cents and the winter of 2022-23 105.1 cents.

It does mean that price protection bought at current valuations has a greatly reduced chance of being an asset for propane retailers and the customers they are trying to protect. Given that three of the past 10 winters have had actual price averages in the mid-40s, the risk of locking in prices at current valuations is quite substantial. As bad as the current price protection environment is, it could have been worse.

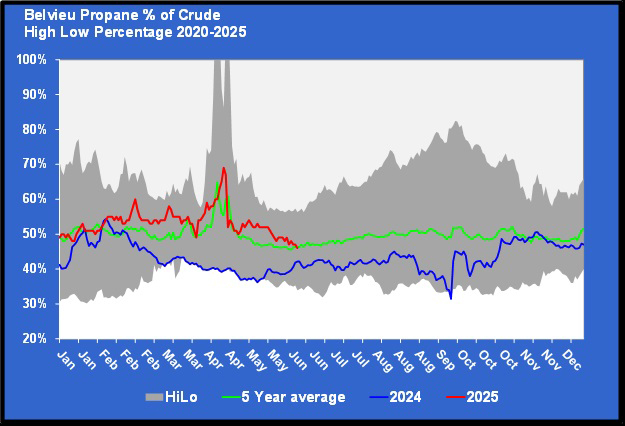

U.S. propane inventories have had two great builds over the last three weeks that took them from well below the five-year average to nicely above it. That has taken the pressure off propane prices to follow crude higher.

Crude has been trending higher because of all the geopolitical developments that threaten crude supplies. The latest is the shooting war between Iran and Israel. It is possible Israel could take out Iran’s crude exporting facilities, and it is possible Iran could attempt to block the Strait of Hormuz through which 20 million barrels per day of crude passes, which is about 20 percent of global demand. WTI crude is up $14.05 per barrel or 23 percent this month. Propane is up only 11 percent over the same period because of the improving propane fundamentals.

As a result, propane’s value relative to crude dropped to its five-year average. It is still above last year, but given where inventories were four weeks ago, it is quite a positive development to have propane valued at its five-year average relative to crude.

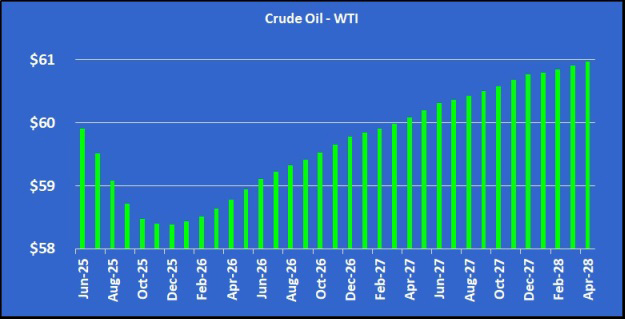

Geopolitical developments since the beginning of May have changed the crude valuation landscape, which has, of course, impacted propane’s valuations. At the beginning of May, we wrote a Trader’s Corner about the impact of crude forward price curves on propane prices. If you have time, it might be good to reread that article, given the current situation. It shows how quickly the market can change based on the perception of supply. Below is what the crude price curve looked like then.

At the time, OPEC+ was raising production, and there were positive developments concerning a possible peace deal in the Russia-Ukraine war and the United States-Iran nuclear negotiations. Crude prices had been pushed lower because of more supply from OPEC+ and the possibility of even more supply from Russia and Iran if negotiations were successful. While crude prices were low at the front of the curve, sellers held their prices higher further out. Quite simply, sellers were willing to take the chance that the situation would change and crude prices would go up. They were unwilling to lock in future production at low prices. Their gambit paid off thanks to the latest geopolitical developments.

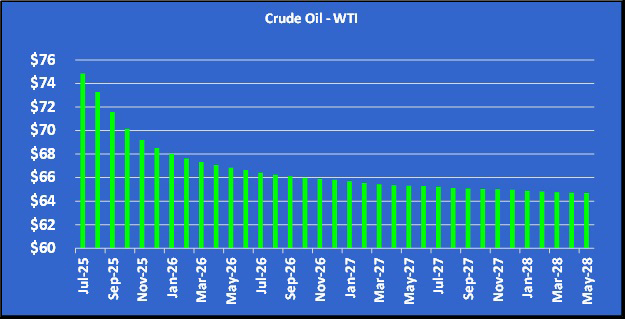

Below is what the current crude price curve looks like.

Look at October crude as an example of the change. It is now valued at $12 per barrel higher than it was on May 1. Even though the bottom curve crude is lower in the future, which is typical in commodities markets when they are normally supplied or undersupplied, even prices further out are higher than they were on May 1.

In early May, crude sellers were unwilling to lock in sub-$60 crude longer term, but today, they are willing to accept mid-$60 crude longer term, which caused the reshaping of the price curve.

The reshaped crude curve means that once again, the better opportunities for propane buyers are further out. Unfortunately, even the valuations of further-out winters aren’t great compared to the 10-year price average. For October 2026 through March 2027, propane is valued at 74 cents, which is 10 cents better than this winter. It still isn’t quite into the preferred buy zone, but it’s close. The winter of October 2027 to March 2028 is valued at 73 cents, which does mean price protection could be made slightly below the 10-year price average.

It’s not a great price protection environment for propane buyers, but it could have been far worse if propane inventories had not recovered over the last few weeks, allowing propane prices to resist the rise in crude. And the opportunities for buyers that do exist have shifted firmly back to the further-out time frames.

Charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.