Big build in crude inventory follows previous week’s draw

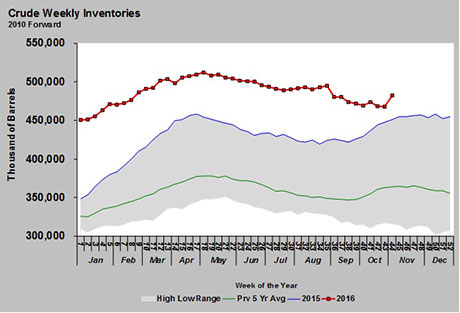

For the week ending Oct. 28, the U.S. Energy Information Administration’s (EIA) Weekly Petroleum Status Report revealed U.S. crude inventory increased by a record-high 14.42 million barrels. Inventory had never risen that much since EIA began collecting data in the 1980s.

What we found curious about the inventory build was that EIA had surprised traders the previous week by reporting a draw of 553,000 barrels. That made the two-week average 6.9335 million barrels for a total of 13.867 million barrels.

Most of the big build was attributed to an incredible rise in crude imports – from 7.016 million barrels per day (bpd) to 8.995 million bpd. The jump in imports was 1.979 million bpd, or 28.21 percent. For comparison, imports during the same week last year were at 6.943 million barrels.

What was also curious about the inventory changes reported by EIA over the last two weeks is that they were not close to what the American Petroleum Institute (API) had reported. For the week ending Oct. 21, API reported an inventory build of 4.8 million barrels. For the week ending Oct. 28, API reported a build of 9.3 million barrels. The two-week build reported by API was 14.01 million barrels, or 7.05 million barrels per week.

It certainly appears to us, as we look at the data, that EIA may have been off on its reported crude inventory change for the week ending Oct. 21, which resulted in an adjustment on this last report. EIA recently changed its methodology in collecting export data, and it is possible the kinks haven’t been completely worked out of the new process.

Still, crude markets reacted to the data reported. The record inventory build reported by EIA added to the velocity of the downtrend in crude. As propane buyers, we probably shouldn’t expect anywhere close to that kind of build in crude inventory going forward. Propane and crude are already in a bearish trend. However, we must be careful not to let such inventory anomalies make us more bearish than is warranted. In fact, crude is now reaching price levels that could once again bring in buyers and turn crude prices higher. Propane prices would likely follow.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.