Can propane play a part in Europe eliminating energy from Russia?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines how propane could help Europe separate from Russia’s energy supply.

Regular readers of Trader’s Corner know that in our last two editions, we looked at the ability of the U.S. to end the import of Russian crude and refined fuels and to offset Russian energy going to Europe. After writing those, we began to think about the role that U.S. propane might play in helping Europe wean itself off Russian energy.

Currently, U.S. propane inventory stands at just 33.308 million barrels and will likely end this winter toward the bottom of the range that inventories usually end winter. A key reason for the low inventory position has been high exports. The low inventories are occurring even as U.S. propane production runs at record highs. It would not appear that there is much room immediately to do more for Europe.

As we all know, propane supply is a byproduct of natural gas production and crude refining. The U.S. just banned crude and refined fuels from Russia. We assume the refined fuels will be replaced by increasing U.S. refinery throughput. That could quickly add to propane supply, but the volumes are low. It would only take around a 2 to 3 percent increase in U.S. refinery throughput to replace the Russian supplies. Refineries yielded an average propane output of 290,000 barrels per day (bpd) in 2021. A 2 to 3 percent increase would yield an additional 6,000 to 9,000 bpd of propane.

If Europe were to demand more U.S. refined fuels, then our refinery throughput could increase, yielding more propane. But we are still not talking huge volume increases – maybe another 10,000 bpd. Refineries could also tweak their process to make more propane and less propylene, but economics may not support that action.

On the natural gas side, the U.S. could certainly increase production. If the U.S. were to increase its crude production, there would be more associated natural gas and natural gas liquids production that would increase propane supply. We could also simply drill more natural gas wells. However, the limiting factor is our ability to export natural gas. Natural gas production is not going to increase if there isn’t a way to get it where the demand resides. As we addressed last Trader’s Corner, there isn’t a lot of new liquefied natural gas export capacity under construction, and the lead time for bringing a new facility online is quite long.

The portability of propane and a rather mature transportation system would make it an excellent choice for augmenting Europe’s energy supply. It’s also flexible in that it not only can be used directly as fuel, but it can be combined with methane in natural gas utility distribution systems to some degree, thereby adding Btu to those systems, as well.

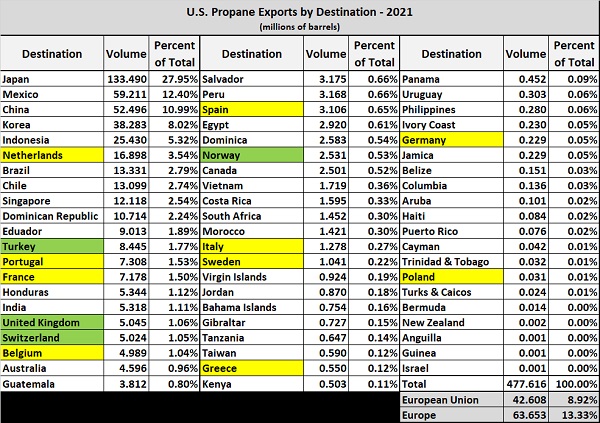

With the timeline possibly tight for increasing propane supply to Europe, we thought we would look at this problem from a different angle – something that wouldn’t necessarily take more U.S. production or even more propane exports. Here is a comprehensive table of U.S. propane exports in 2021 by destination.

There was a total of 477.616 million barrels of propane exported, or 1.309 million bpd. We believe the volumes to Canada and some to Mexico were by rail and pipeline in the range of 12.405 million barrels. That leaves 462.204 million barrels, or 1.266 million bpd, to move by ship.

There are 27 members of the European Union, and 10 (yellow) received propane imports from the U.S last year. There are 45 countries making up Europe. Four of those (green) that are not members of the European Union also received supplies from the U.S. The European Union received 42.608 million barrels, or 8.92 percent of all U.S. propane exports. Europe received 63.653 million barrels, 13.33 percent of all U.S. exports. The point is, the precedent for propane to Europe is already set. Relationships, routing and logistics are already in place.

China ranks third on the list of U.S. propane imports, taking 52.496 million barrels, 10.99 percent of total supply. China has blamed the U.S. for the war in Ukraine. It has also essentially provided the backing for Russia to invade Ukraine. It signed a trade agreement with Russia just months before the Ukrainian war that shows the invasion was expected. The trade agreement made all shipments Chinese property as soon as they were loaded onto ships. Thus, if the U.S. and its allies tried to block the shipments, it would be blocking Chinese, not Russian goods. China has also pledged to increase its shipments of Russian energy as both it and Russia anticipated the sanctions and embargoes the West is trying to impose.

We are not sure of the contractual obligations for U.S. companies that are shipping to China. However, it would seem appropriate to consider giving Europe priority to all shipments that are not contractually obligated to go to China. We doubt the U.S. government would step in to override contractual obligations, but given the situation, it is not out of the realm of possibilities.

India has not backed the West’s attempts to block Russian energy from flowing. It has stated, as the Ukrainian war rages, that it is willing to buy discounted Russian energy supplies, mostly crude. India was the 16th largest importer of U.S. propane at 5.318 million barrels, 1.11 percent of total propane exports in 2021. Again, given the situation, U.S. companies could perhaps consider European customers over Indian customers.

In summary, propane is a highly flexible source of energy, both in its uses and ability to transport and store. It seems reasonable to believe it could have an important role in helping Europe become less dependent on Russian energy.

The invasion of Ukraine has brought incalculable pain and suffering on innocent men, women and children. It would seem that China and India would prefer to get their energy from Russia, helping to facilitate the action. As more energy goes from Russia to those two countries, U.S. companies may have no other choice but to look to other markets, including Europe, to move its propane. Even if that is not the case, there is likely to be ample opportunity to do soul-searching in corporate boardrooms, not only for energy companies but almost every other sector in the aftermath of the invasion of Ukraine.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.