Conway propane prices hold unusual premium over Mont Belvieu

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, addresses the price comparison between Conway propane and Mont Belvieu.

Conway propane is now trading at a premium to Mont Belvieu (MB) LST propane.

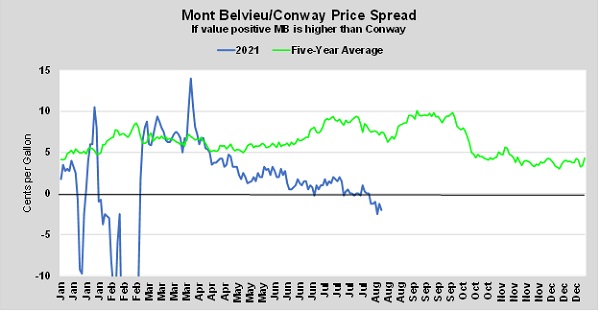

The chart shows the price difference between the two hubs in cents per gallon. When the line is above zero, Mont Belvieu is higher, holding a premium to Conway. When it is below zero, Conway is holding the premium. Currently that is the case.

It was also the case this past winter when supplies got very tight in the Midwest, causing a spike in Conway’s price. At one point in February, Conway propane actually held a 36-cent premium over MB LST.

The differential got back to normal in March. Mont Belvieu usually holds the premium since the Midwest is typically oversupplied, causing production to move from the Midwest to the coasts. On the coasts, propane producers have the option of selling their supply to petrochemical companies and to overseas buyers. To cover the cost of transportation, Conway propane usually runs about 5 cents lower than MB LST.

Normal didn’t last long, however. By April, the spread between Mont Belvieu and Conway was beginning to close, and that trend has continued to the point where Conway is now at over a 2-cent premium to Mont Belvieu. For years, the trend has been to hold slightly less inventory in the Midwest. The amount of oversupply there made holding large amounts of inventory unnecessary and hurt producer returns.

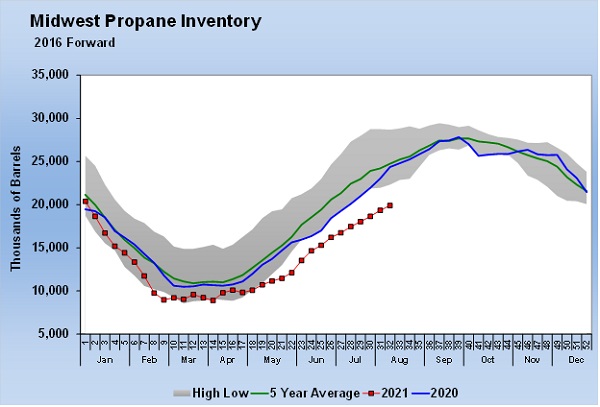

For example, in 2015, the high inventory level was 29.804 million barrels. Last year, the high inventory level was 27.832 million barrels. Another issue has been a lack of infrastructure investment in the Midwest to address peak demand periods. Last year, the issues may have been more related to the shutdowns of crude and natural gas production during the pandemic. Suddenly, the amount of local supply wasn’t available, putting pressure on the now lower levels of inventory.

The unusual premium that Conway propane is holding over Mont Belvieu this summer at first glance appears to be a reaction to the tightness in Midwest supply that developed last winter. We could conclude that producers are raising the price to try to hold more inventory in the Midwest. If that is the case, it’s not working. As the chart above shows, Midwest inventory is setting five-year lows and has been doing so each week since May.

Midwest propane production may not have bounced back as well as other areas since the pandemic. There are theories that producers had committed large volumes to go to the coasts and are now struggling to fulfill their obligations due to the lower production rates. The theory goes that these producers are out buying propane on the spot market, driving prices higher. They are still shipping this propane to the coasts – just getting a lower netback.

Of course, the other theory is there is just so much demand for export that Midwest producers are no longer having to discount to cover the transportation costs. Buyers are simply willing to pay the higher price to get the product they need. There is a lot of new demand for propane in Asia, driven by new propane dehydrogenation (PDH) plants. These plants take propane and convert it to higher-valued propylene.

At some point, propane’s price may get to the point of curbing the demand from these PDH units, but most analysts don’t think that is happening anytime soon. One trader we work with believes U.S. propane inventories will decline again this week due primarily to high export rates. Other analysts think propane prices have more room to run before the demand destruction from the PDH plants will occur.

While these PDH plants may have the option of cutting back on their demand, it may be right when U.S. propane retailers and consumers need the most supply. Mother Nature will be in control, with propane retailers and consumers inheriting high prices and limited supplies right at the wrong moment. Consumers may be able to turn the thermostat down to reduce the pain of higher prices, but there is a limit to what they can do. Plus, we have to remember there has been a trend to move into the suburbs during the pandemic and work from home. That could mean thermostats that were once turned lower during work and school hours will be set higher this year with workers and students operating from home.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.