Decreasing crude supply may hinder propane supply

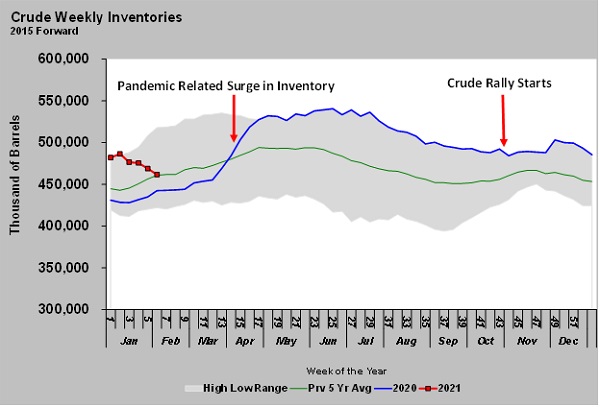

Crude prices have increased since the first of November. The upward price pressure had not been related to crude supply, at least not at the beginning of the rally. The rally in crude began when companies announced they developed effective vaccines against COVID-19. At the time of those announcements, crude inventory was setting five-year highs.

Just before the effects of the pandemic on economic activity and energy demand, crude inventory was below its five-year average. The lockdowns had an immediate impact on crude demand. Producers were slower to react, causing a significant jump in crude inventory. You may recall that the turmoil caused crude to briefly trade negative in April 2020. It then traded around $40 per barrel through most of the summer and into the fall, with inventory remaining at five-year high levels for each week of the year.

When the rally in crude’s price began in November, inventory was still at five-year highs. The rally was not a reflection of current conditions but rather what traders believed about the impacts of the vaccines on future demand. Obviously, the beginning of the price rally was well ahead of any noticeable changes in crude inventory. Those did not begin until the third week of this year.

In just four weeks, crude inventory has gone from setting a five-year high for the second week of the year to its five-year average level. It would appear crude traders were right to begin buying crude when it was in the $40-per-barrel range in anticipation of what higher demand would do to the supply-and-demand balance. Those that bought crude then have seen a $20, or 50 percent, gain. Fundamentals are now supporting the higher prices, which was not the case in the first 2 1/2 months of the rally.

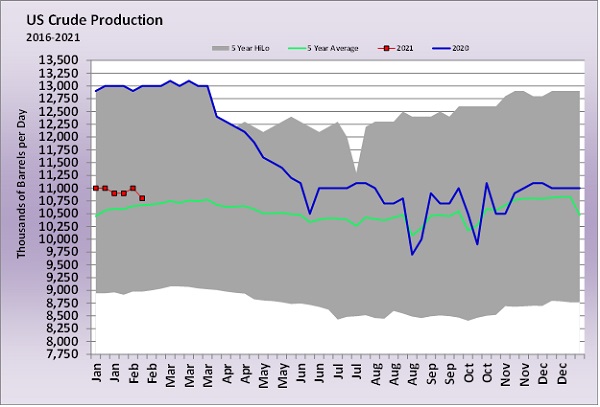

U.S. crude production was setting record highs of 13.1 million barrels per day (bpd) before the pandemic. Over a couple of months post lockdown, it fell to around 11 million bpd.

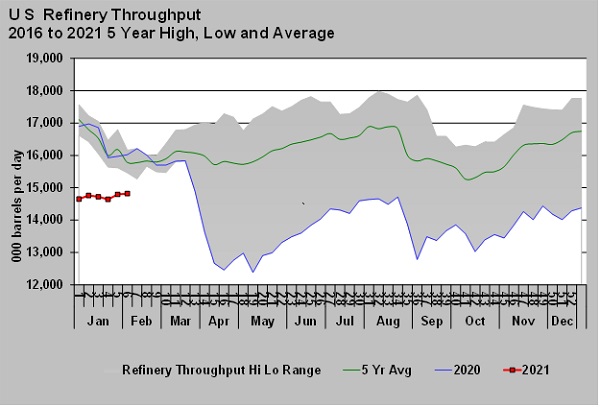

Note how refinery throughput (crude demand) fell off much more quickly than production (crude supply). Refinery throughput then recovered during the summer, whereas crude production did not. Both were affected by hurricanes late in the summer. Refinery throughput has been recovering since October, post hurricanes, while crude production has remained mostly flat.

For the week ending Feb. 12, U.S. crude production was 2.3 million bpd below its peak. Refinery throughput was 1.391 million bpd below its peak. That is potentially a 900,000 bpd higher call on inventory. Meanwhile, U.S. crude imports were down 649,000 bpd from a year ago, and crude exports were up 298,000 bpd. That was nearly a 1-million-bpd net import/export drop to U.S. supply for the sixth week of the year.

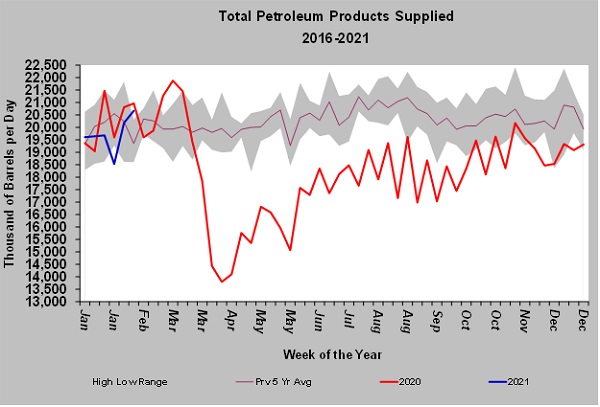

The chart below shows total petroleum products supplied (TPPS). TPPS is essentially the demand for all products made from crude. Last week’s demand was above the five-year average and only 300,000 bpd less than last year during the same week. Despite the lockdowns, U.S. demand is recovering, but supply is not.

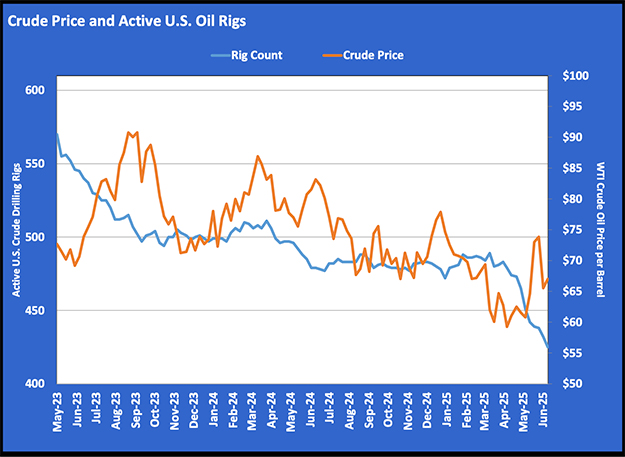

Drilling for crude has been increasing, but so far it has only been enough to offset normal well depletion rates. Through the summer, we talked a lot about the systemic damage that was being done to the U.S. oil and gas sector because of the low prices during the pandemic. The U.S. shale industry was already struggling with investor interest before the pandemic. Its lenders have been hammered since the pandemic. There is very little interest in investing in or loaning to companies drilling for crude in higher-cost shale formations.

Thus, U.S. producers have to watch capital spending closely. The consequence is a lack of response from the supply side to the increases on the demand side. That is putting upward pressure on West Texas Intermediate crude’s price. It is pressure that many are betting will continue at least for the remainder of this year. A decrease in that pressure is likely to come from increased supply from foreign producers, not U.S. producers.

However, imported crude will not help U.S. natural gas liquids (NGL) supplies. Much of our NGL growth has come from associated production with crude wells. If U.S. production of crude remains off, then it will be necessary to increase NGL production through more drilling of NGL-rich natural gas wells. In any case, the rapid growth in propane supply seen in recent years is not likely to happen this year, and propane supply could increase at a slower pace beyond 2021. The potential for a higher-priced propane market is certainly present.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.