Demand, inventory fluctuations lead to big price swing

Since last week’s Trader’s Corner, there was a dramatic change in U.S. propane prices. The price swing began on Tuesday, Jan. 19, coming out of the long Martin Luther King Jr. Day holiday weekend.

Chart: Cost Management Solutions

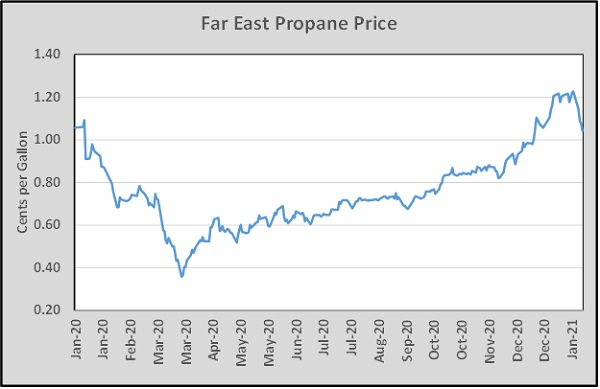

We noted in our morning update to daily subscribers a notable drop in Far East propane prices. Prior to the 19th, Far East propane prices had been very strong. The rise in prices began last March, but upward movement had increased during the winter months of 2020-21.

Far East propane had traded at 123 cents per gallon the previous Friday, a high for the year. The price dropped 8 cents to 115 cents on the 19th. Prices in Europe also fell but only by 3 cents.

Such a dramatic shift in the Far East market strongly suggested that something just changed in the market.

As U.S. trade opened on the 19th, propane prices tumbled like the Far East market. Traders reported that Asian buyers were canceling February cargoes, taking the upward pressure off prices.

Chart: Cost Management Solutions

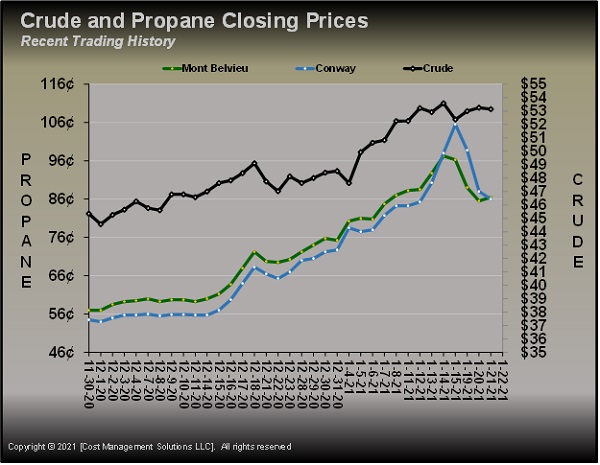

As the export market crumbled, speculative players long propane were forced out of positions. Selling to close long positions only added to the downward pressure on the market.

Mont Belvieu LST propane fell 10.75 cents, or 11.17 percent, in just two days. Not to be outdone, Conway, which had jumped 7.5 cents the previous Friday to 105.5 cents, tumbled 17.5 cents, or 16.59 percent, over the two-day sell-off.

By Thursday, Jan. 21, Mont Belvieu propane appeared to be finding a price floor. Traders said that some of the February cargoes that had been canceled were getting rebooked at the lower prices. Conway continued falling, closing below Mont Belvieu after trading at a 9.25-cent premium the previous Friday.

On Friday, Jan. 22, Mont Belvieu propane had resumed its downward movement, down 2 cents in early trade. Conway showed no sign of stabilizing, down 4.75 cents.

Overseas markets were down as well, off 4 cents in both Asia and Europe. The price spread between U.S. and Asian propane prices was running about half of its recent peak.

Chart: Cost Management Solutions

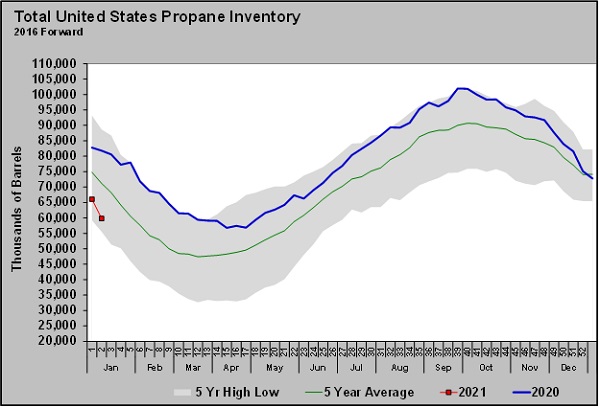

With the market turning decidedly bearish, it was suddenly set on end Friday when the U.S. Energy Information Administration (EIA) finally released its Weekly Petroleum Status Report, which had been delayed by both Martin Luther King Jr. Day and Inauguration Day.

The EIA reported a 6.230-million-barrel draw on U.S. propane inventory. That draw followed a 6.729-million-barrel draw the previous week, resulting in a nearly 13-million-barrel drop in inventory over the prior two weeks. With the draw on inventory over the winter, propane inventory has gone from setting five-year highs to 20.763 million barrels below last year.

The dramatic drop in inventory, the changing of the seasons, the potential drop in export demand, the changing political environment and the ongoing impacts of the pandemic give market participants a lot to consider. The propane market could stay erratic a while longer.

It is important to note that propane prices for the next two winters did not go up as much as the front month and, consequently, are not going down as much as prices fall.

Still, there has been some movement. Traders are reporting a lot of buying interest from the consumer side for the next two winters, so retailers should not expect that major bargains for future months were created with this pullback. But it still may be a time to take a look at where the next couple of winters could be hedged.

If the prices fit, it may be time to put in a layer of price protection when markets stabilize. Retailers haven’t had to worry much about rising prices the past couple of winters, but fundamental conditions are moving toward a little more price support for propane in the future.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.