Dip in US propane production not a concern

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why he is not worried about the recent dip in U.S. propane production.

Catch up on last week’s Trader’s Corner here: Top 10: The best of Trader’s Corner 2025

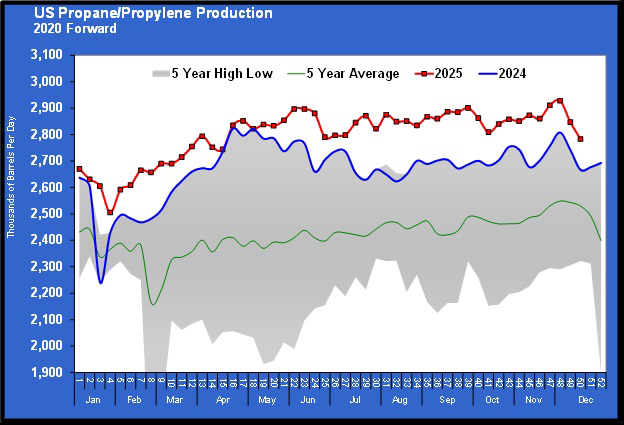

U.S. propane production has dipped over the last couple of weeks, which is something worth watching. However, we are not concerned at this point, given there was a similar dip this time last year.

Propane production reached a record high of 2.928 million barrels per day (bpd) three weeks ago, but has fallen off notably over the last couple of weeks. Were it not for the similar drop last year, we might be more concerned. For now, we will reserve real concern for next week should another drop occur.

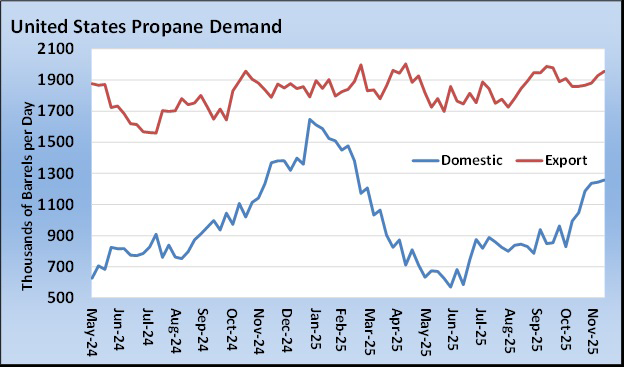

If you look at the chart above, you can see a pattern in production, with similar ebbs and flows between this year and last year. Drops in production during the winter can sometimes be weather-related. Extremely cold weather can be a problem for propane-producing wells and other parts of the supply chain, including fractionators.

But the more cyclical movement in production we see in the chart normally would seem to be something that occurs routinely or predictably – perhaps a unit at a fractionator is taken down at a similar time each year for maintenance.

The good news is that propane fundamentals are so well-positioned that temporary downturns in production can be easily accommodated. Even with the slowdown in production contributing to calls on propane inventories in recent weeks, U.S. propane inventories are just under 100 million barrels. They are nearly 10 million barrels above last year, or about 11 percent. Though down from the record peak of 106.094 million barrels set six weeks ago, they are still at a record high for this point in the year at 99.998 million barrels.

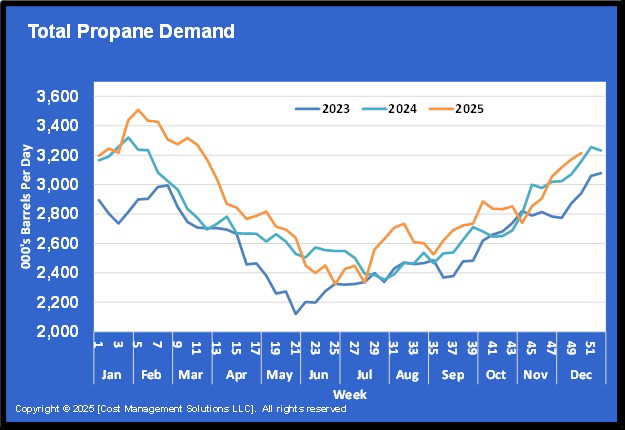

Further, demand is manageable.

Total propane demand from both exports and domestic consumption is just slightly above this time last year. For the week ending Dec. 12, total demand was 3.214 million bpd. A year prior, total demand was 3.158 million barrels. That is just a 56,000-bpd, year-over-year increase.

Meanwhile, production for the week ending Dec. 12, though down recently, was still 116,000 bpd higher than the same week last year.

For the four-week period ending Dec. 12, export demand averaged 167,000 bpd more than in the same period last year. Unfortunately, U.S. domestic demand averaged 111,000 bpd less.

The takeaway is that propane fundamentals are well-positioned to weather this downturn in demand, and a lack of growth in total demand year-over-year is helping to keep things comfortable.

It will take a continuation of the slowdown in propane production and likely an upturn in domestic demand to put any significant pressure on the market. And if that occurs, any resulting increase in price will likely slow export demand and keep supply and demand relatively balanced.

Charts courtesy of Cost Management Solutions.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.