Drop in exports a key factor in late-winter price weakness

There have been two primary factors behind the late-winter weakness in propane prices: rising propane production and lower propane exports. This week’s Trader’s Corner takes a look at the effects lower exports have had on propane prices.

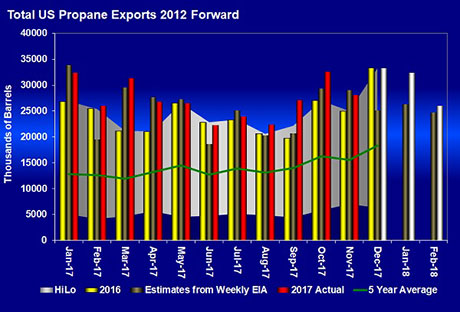

It’s important to look at the export landscape in order to understand the current state of propane and why price weaknesses developed over the last couple of months.

U.S. Energy Information Administration (EIA) official export data is available for January 2017 through November 2017. Comparing the yellow bars (2016) with the red bars (2017) shows consistently higher export volumes for 2017. During those 11 months, exports increased 39.9 million barrels year over year.

The growth in exports through the majority of 2017 – along with the fact that the winter of 2017-18 started with inventory 21.8 million barrels lower than the previous year – drove propane prices to their highest point early this winter.

However, the situation has dramatically changed over the last three months, based on EIA weekly export estimates. First, let’s compare December 2017 and January 2018, since we have a full month of weekly estimates for those months. The brown bar is EIA’s weekly estimate on exports compared with the official export number (white) for the same month one year ago. Based on the weekly estimates, combined December 2017 and January 2018 exports were 14.625 million barrels lower than the previous December and January. That drop in export volumes, along with sharp gains in propane production at the end of the year, changed the pricing environment for propane.

We only have two weeks of data for February. Using those two weeks, exports are on pace to be 1.339 million barrels less than February 2017. This would put exports for December 2017 through February 2018 at 15.604 million barrels less than the same three-month span one year ago.

We anticipated export rates would rebound last week, and they did. The export rate for the first week of February was just 696,000 barrels per day (bpd), which put us on pace to see a 20.8 million barrel year-over-year drop in exports during the December 2017 through February 2018 timeframe. However, exports jumped 369,000 bpd last week to 1.065 million bpd, cutting the projected deficit to last year by a quarter of what it was after just one week of February data.

There is no doubt that export declines during the core of winter helped keep prices under control at the trading hubs and are a key reason for the late-season softness in propane prices. At this point, we do not believe the decline in exports will carry into the summer months. We might expect them to move back to where they were in the 2016 summer months or maybe even higher based on the growth pattern that has been occurring.

A rebound in export rates is the key data point to watch as we transition out of winter. With increased propane production, if export rates do not bounce back this summer, the pricing environment will remain bearish. If they do bounce back to 2016 levels or higher, look for a stabilization in propane prices and perhaps a slow, steady appreciation in propane prices this summer and fall, similar to what we saw last year.

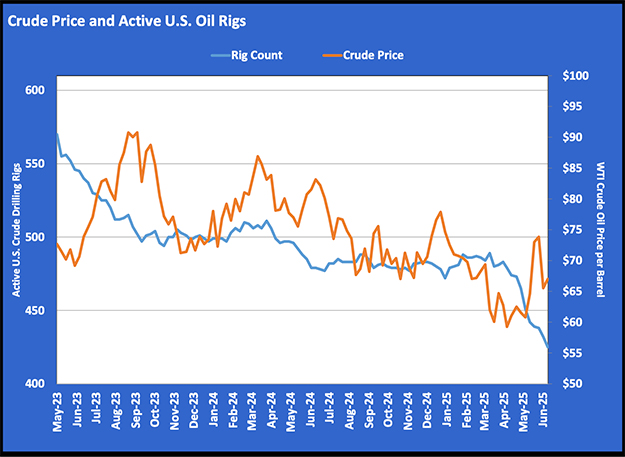

An end to the fall in crude prices may also be necessary to see an appreciation in propane prices going forward.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.