Energy demand not slowing down

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, looks at how refineries have tried to keep up with energy demand, and explains why the current trends it may be unsustainable.

Catch up on last week’s Trader’s Corner here: Why propane prices are lower this year

A huge driver for energy markets this year has been the expectation of weak energy demand. Crude prices have been driven lower because it was assumed that the tariffs the United States is putting on its trading partners would hurt both the U.S. and global economies, driving down energy consumption. So far, energy consumption in the U.S. doesn’t appear to have been driven lower.

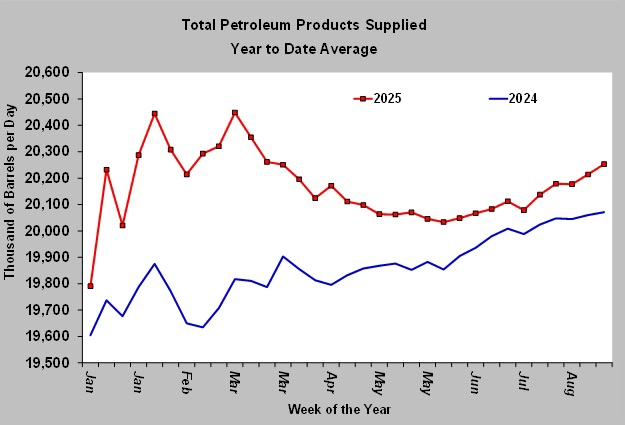

Chart 1 shows total petroleum products supplied (TPPS) in the United States. TPPS is essentially a total demand number for all products coming from a barrel of crude oil.

Instead of plotting the weekly TPPS number reported by the Energy Information Administration, which varies widely, making the chart hard to read, we plot the year-to-date average demand. Any point on the line is the average of that week and all weeks of the year before it. Through the week ending Aug. 15, average demand has outpaced last year. TPPS this year has averaged 182,000 barrels per day (bpd) higher than 2024.

To keep up with the demand, refineries have chewed up a lot of crude.

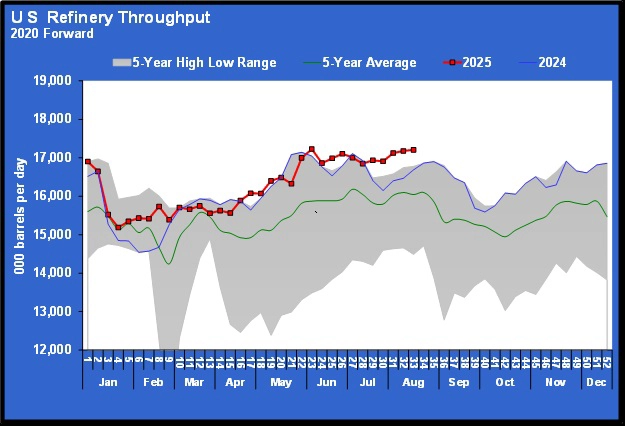

Last week, refineries processed 17.208 million bpd of crude. That was only slightly below the 17.226 million high for the year. It was 519,000 bpd higher than the same week last year.

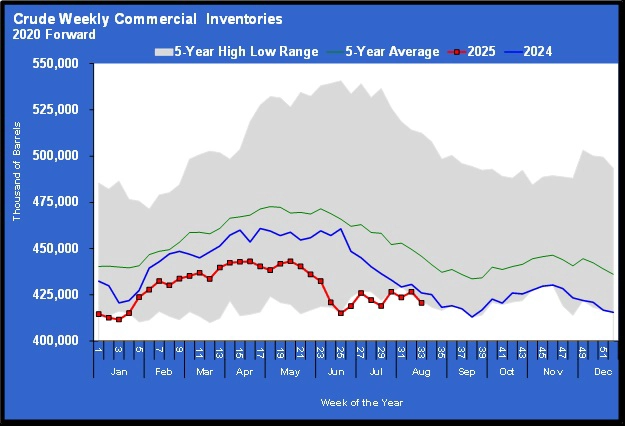

The high throughput rate, coupled with a slowdown in U.S. crude production, has caused U.S. crude inventories to fall to five-year lows.

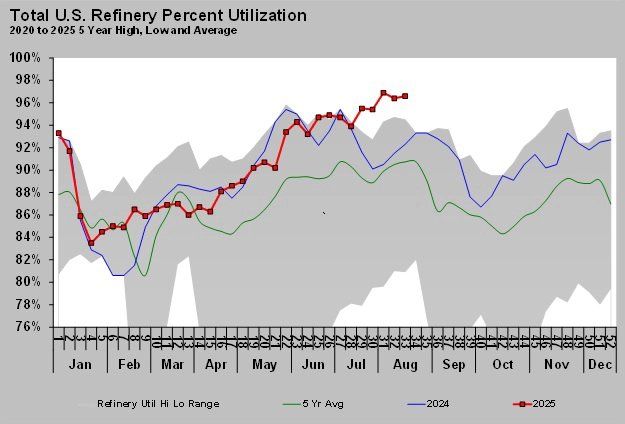

To keep up with demand, refineries are running hard.

Last week, refineries were running at 96.6 percent of capacity. At this time last year, the rate was 92.3 percent. Based on history, it is an unsustainable rate of utilization. Refineries have continued to increase utilization rates to the point where they have usually already started taking units down for maintenance.

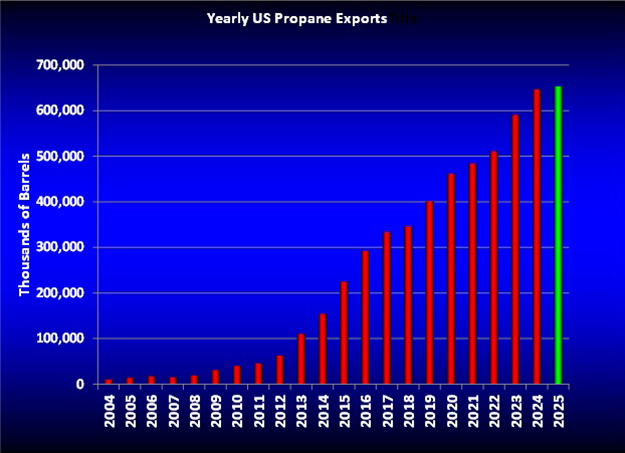

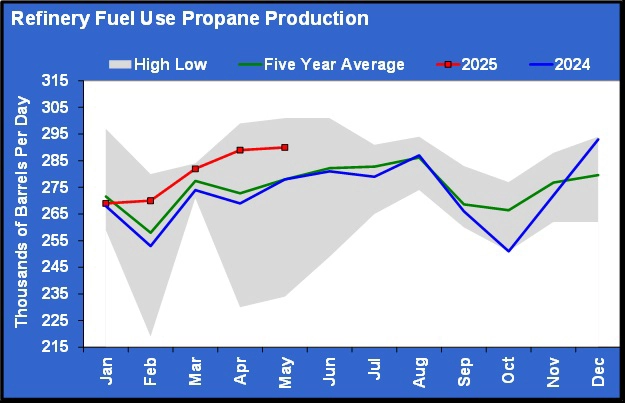

This trend has been good news for U.S. propane supply. The official data runs behind, but the chart below shows the amount of propane supplied by refineries through May.

In May, refineries provided 290,000 bpd of propane. We could legitimately expect the rate to be higher now. Most of that propane is sold in local markets around the refinery location. Refineries only provided 11.31 percent of the total U.S. propane supply in May, which is around their typical contribution. Though relatively small these days compared to propane supplied by fractionators and (to a much lesser degree) natural gas processing plants, propane from refineries is still an important component of supply for many retailers.

If a retailer is located near a refinery, picking up a load when demand is high can save time and transportation costs. The transport loads of propane received from refineries can be key in those high-demand periods.

As shown, refinery utilization always goes down in the fall as refineries shut down for maintenance after a long summer of gasoline production. But they are usually back up in the core winter months. However, as the percentage utilization chart above shows, it appears the maintenance is being delayed this year to keep up with gasoline demand. Further, the high utilization rates may mean that more and longer maintenance work may be needed when units are finally taken down.

That could make those critical loads obtained from refineries in the core winter harder to come by for retailers. It could also put more pressure on other supply sources, such as pipeline terminals.

U.S. propane inventories are on track to be in great shape to begin this winter. But that doesn’t necessarily mean it is going to be exactly where it is needed at a critical moment. Refineries sometimes serve a key role in getting the supply chain through a critical juncture when pipeline terminals are stressed.

But if refineries keep running at near maximum capacity deeper into summer than usual, they may be delayed in getting back online during the winter and thus put more stress on the propane supply chain. Many retailers have probably received calls from wholesalers responsible for marketing propane from refineries this summer who are looking to move some loads. Some of that propane may have been offered at attractive prices. But don’t be surprised if loads are harder than usual to come by this winter.

Charts and table courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.