Examining Mont Belvieu, Conway price spread

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, examines why prices between Mont Belvieu and Conway are closing.

There have been some folks surprised by Conway propane pricing near Mont Belvieu propane for so long. With this Trader’s Corner, we are going to provide some insight into why the price spread is tightening.

Prior to the shale gas revolution over the last couple of decades, the Midwest was a “store in summer” and “sell in fall and winter” propane market. This worked to some degree when the U.S. was net short propane. Since the Midwest does not have the refining and petrochemical influence of the Gulf Coast, it was highly dependent on winter heating demand. The store play could be beneficial, especially in high-demand winters.

However, when shale production became prevalent, the U.S. became net long propane, requiring about 1.2 million barrels per day of exports to maintain balance. As a result of the oversupply, propane prices in the Midwest dropped, and the seasonal rise in prices could no longer be depended upon. Propane flowed from Canada to the Midwest, and as much propane as possible moved from the Midwest to the Gulf Coast. Prices needed to be about 5 cents below Mont Belvieu to cover the transportation cost. There were several products sharing the pipeline capacity and not enough propane could move south in the summer.

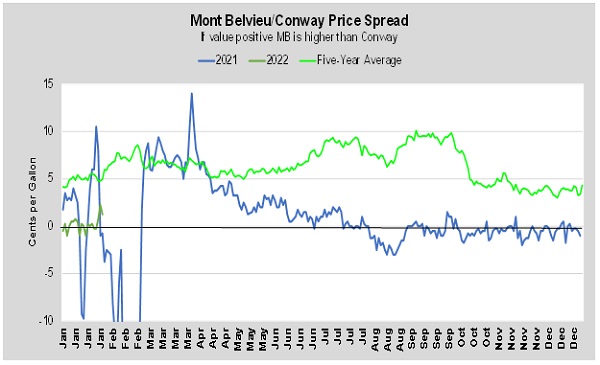

As the five-year average in Chart 1 shows, the Conway discount to Mont Belvieu would rise in the summer months as Midwest propane tried to move by truck and rail to other markets.

The perpetually low values for Midwest propane had the industry looking for alternatives. Canadian producers started putting large train loads of propane together to go to Mexico. They have subsequently added waterborne capacity from Canada’s west coast supplying Japan. The pandemic upset some of that movement, but it was getting back on track as 2021 progressed.

Domestically, the big change came in the direction for production from Marcellus and Utica shale plays in Ohio and Pennsylvania. Initially, this product had moved by pipe and rail west to Conway. But then, pipelines had fed propane to the Midwest and Northeast from Mont Belvieu during the winter months were reversed and converted to moving lighter NGLs south out of Marcellus and Utica.

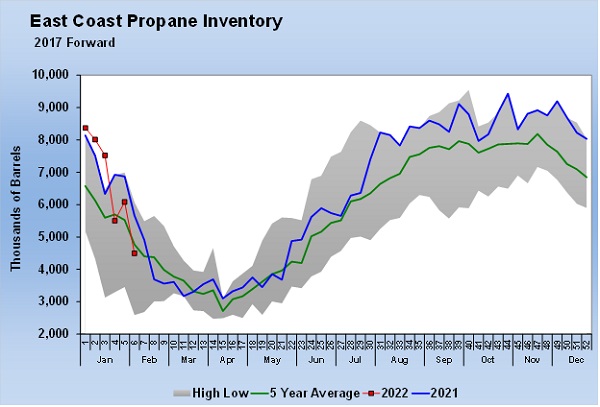

The development of the Marcus Hook, Pennsylvania, export and storage operations changed the direction of Midwest propane from Conway toward the East to supply export demand and the Northeast domestic market. Initially, the product moved by rail, but eventually the Mariner East pipeline system made the movement easier.

Further developments came when U.S. production in the West was able to bypass Conway and move directly to the Gulf Coast. The pandemic also tightened Midwest supply to some degree since it caused less production in the Bakken. That is an area that has tended to lag other shale fields in resuming drilling and well completion since the pandemic.

As a result, the typical 5-plus cent discount for Conway propane has been eliminated recently. Through this process, there has been less propane inventory held in the Midwest since production could essentially keep up with winter demand.

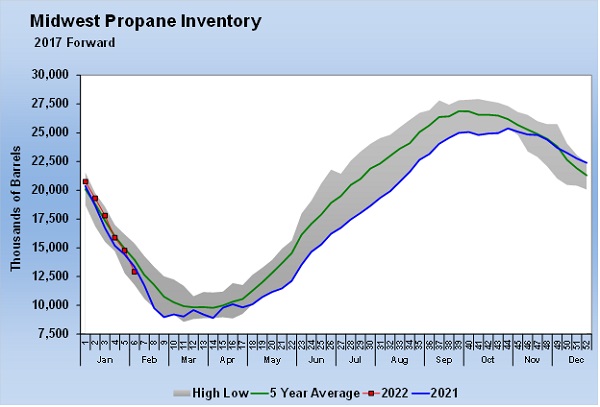

In 2015 and 2016, the yearly average inventory position in the Midwest was just over 23 million barrels. Over the last four years, that inventory position has been on either side of 19 million barrels. Meanwhile, the average annual inventory position on the East Coast has gone from around 5 million barrels to 6.5 million barrels.

As winters remained mild, more and more of the Midwest production became termed up to move out of the region. With less inventory held and more barrels contractually bound to leave the region, the Midwest became susceptible to high winter demand periods, which showed itself in early 2021 when winter storms spiked demand and disrupted supply. During that time, Midwest propane traded at a significant premium to Mont Belvieu (see blue line in chart 1).

We believe these changes are structural and not temporary or transitory. We should continue to see Canadian producers prioritizing the Mexico and Japan markets over the U.S. Western U.S. NGL producers will continue to prefer moving production directly to the Gulf Coast where possible. Marcellus and Utica producers will continue to move product east and north. As a consequence, there won’t be as much demand to move product directly between Conway and Mont Belvieu, and that should allow Conway propane prices to stay more level with Mont Belvieu pricing.

The dynamic should continue to change with the possible development of a petrochemical complex around the Marcellus and Utica shale production areas. If this comes to fruition, it would provide more demand in the region for Midwest production, likely causing weather and crop drying demand to have less influence on pricing. Overall, this demand would likely be price positive for Midwest propane. If the Midwest market becomes relatively higher priced as a result, it will impact product flows. For example, Canadian producers could start finding favorable netbacks again and shift flows back to the U.S.

As it stands now, we think that Midwest propane buyers should continue to plan for and expect less of a price discount to the Mont Belvieu market going forward. We also think it would be wise to prepare for supply tightness in high-demand winter periods that could dramatically increase propane prices for short durations.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.