Expanding your price protection window

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, September 24 at 10 a.m. CDT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses why propane buyers should consider expanding their price protection window.

Catch up on last week’s Trader’s Corner here: Rail strike, big propane export numbers explained

In this week’s Trader’s Corner, we show why it would be wise for propane buyers to expand the time frame in which they obtain price protection beyond one year.

Traditionally, propane retailers seeking to protect themselves and their customers from higher prices have focused on just the upcoming winter months.

That tradition stems from the fact that, for many years, the primary way retailers got protection from higher prices was by doing pre-buys with suppliers. Pre-buys are generally only offered for the upcoming winter, which defined a retailer’s buying horizon.

Today, that has changed. There is a robust swap market available for retailers that allows them to look for opportunities to get the price protection they need over a three-year horizon. We will compare the current propane pricing situation with last year’s to show you how important breaking the old paradigm of “one year at a time” can be.

One of the benchmarks that we think many propane retailers look at when considering price protection is how the cost of it compares to what they paid for it the previous year. In our daily reports, we show what it cost to do price protection for the winter months last year beside what it currently costs.

As we updated those comparisons at the beginning of last week, we immediately knew we wanted to share what we were seeing with readers of Trader’s Corner. Currently, a series of six even volume swaps that provide price protection from October 2024 through March 2025 is around 81 cents at Mont Belvieu. Pre-buys would be based off the same market valuations. On this same day last year, a buyer would have been getting offers of 72 cents to cover that October 2023 through March 2024 period.

However, things are quite different when we look at the current cost of price protection for October 2025 through March 2026. The current cost of protection for that time frame is 76 cents. At this time last year, buying price protection for another year out was 78 cents.

Current market valuations mean that buyers focused only on this upcoming winter are considering getting price protection 9 cents higher than was available last year, yet a buyer considering next winter is getting the opportunity to get that price protection for 2 cents less than what was available last year.

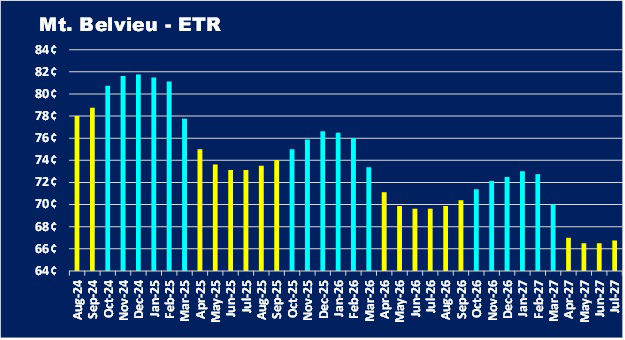

Below is the current propane forward price curve that covers the entire three-year period that swaps are available to propane buyers.

Chart 1: Mt Belvieu – ETR

The chart reflects where buyers and sellers are coming together to do propane swaps not only for this month but as far out as July 2027. The value of propane is much higher in the front of the curve, for this winter, than it is for the next two winters. Quite simply, the opportunity for propane buyers is not for this coming winter but rather the next two winters.

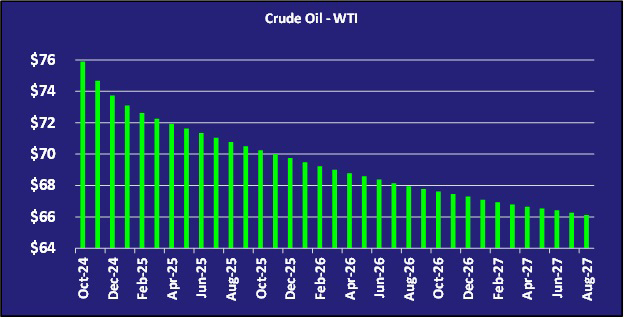

In the current market, propane buyers and sellers are largely allowing crude valuations to dictate propane valuation. Below is the current forward price curve for WTI crude.

Chart 2: Crude Oil – WTI

The overall shape of the propane and crude price curves is very similar with the exception that propane reflects seasonal influences.

When propane valuations are based primarily on crude’s valuation, it reflects what is perceived to be a well-supplied propane market. There is nothing currently in propane’s fundamental outlook that appears to make propane sellers believe their propane should hold a premium down the road.

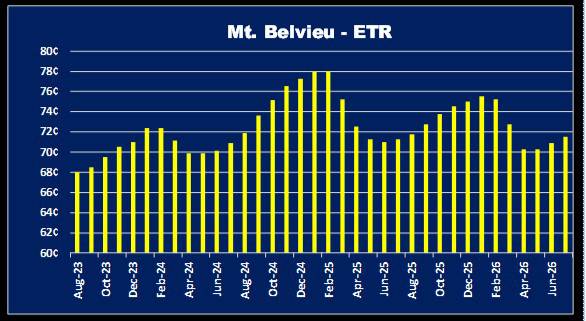

Below is what the propane price curve looked like at this time last year.

Chart 3: Mt. Belvieu – ETR

Our first thought when we reviewed last year’s curve was that crude’s price curve was probably shaped differently as well. It wasn’t. The shape of crude’s forward price curve at this time last year was very much the same as this year’s. Though the shape of the curve was the same, crude prices overall were higher at this time last year. Front month, crude was around $84.

Still, unlike this year, traders (buyers and sellers) were valuing propane much differently than this year, and the reason had to have been a difference in the perception of propane fundamentals. Propane inventories this year are only 2.5 percent less than this time last year. So, there was something more driving the valuation.

As we looked through our reports from last year, we noted comments that propane inventories were setting five-year highs, and prospects for winter demand were weak. Meanwhile, there was a belief that propane exports would begin increasing further out. Propane sellers were willing to concede that likely demand for their propane in the near term was not good and therefore were willing to take less for it, but they were not willing to extend that pessimism very far into the future.

Our conclusion in comparing the two years is that propane was getting undervalued last year in the front of the price curve more so than it is getting overvalued in the front of the curve this year.

But our goal here is not to evaluate why propane was getting valued differently between the two years but rather to focus on how the opportunities were different for propane buyers between the two years.

At this time last year, the opportunity was to buy the winter of 2023-24 and not the further out winters. Front-month propane at this time last year was valued at 35 percent of crude, which was low compared to this year’s 43 percent.

Unlike last summer, the opportunities this summer to buy price protection at favorable numbers for the nearest winter have been far and few between. However, the numbers for the next two winters have been consistently favorable. If a buyer expands his horizons, he will have a lot more opportunities to buy at favorable numbers. If his horizon is short, the opportunities may be very limited.

October 2026 through March 2027 can be covered at around 70 cents for Mont Belvieu as we write. That is 8.5 cents below the actual average price for those months over the past 10 years. If a buyer takes advantage of that opportunity, he greatly decreases his chances that the price protection bought will be unfavorable. However, a buyer of this winter price protection would be doing so slightly above the 10-year winter price average, which puts him at more risk to falling prices.

Buyers that expanded their buy horizon greatly increase the chances of holding price protection at favorable numbers, thus reducing the chances of forcing an unfavorable buy when the buy window is short and the pressure to do something – anything – is high. Propane buyers need to break the old paradigm of “one year at a time.” The good opportunities are often further out. Tight buy windows make buyers feel out of control and that any decision made will be bad. A longer buying horizon gives buyers more control, more opportunity, reducing both stress and risk.

All charts courtesy of Cost Management Solutions

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.