Exports key to determining winter propane prices

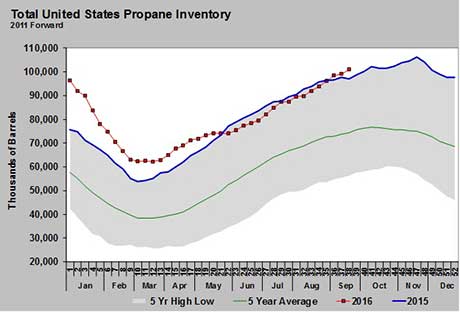

This past week, the U.S. Energy Information Administration (EIA) reported U.S. propane inventory increased 1.963 million barrels. The above-average build for week 36 of the year pushed inventory over the century mark to 101.090 million barrels. From the end of May until three weeks ago, this year’s propane inventory had been below where it was during the same week in 2015.

Over the last three weeks, inventory rose back above 2015 levels and is setting record highs for each of those weeks. Inventory is now closing in on the all-time record of 106.202 million barrels set in the middle of November last year. In fact, just three more builds the size of last week’s will eclipse that mark, and there are still nine weeks to go before last year’s all-time high was hit.

Propane retailers may be perplexed that propane prices actually moved higher on the day the inventory data was released as well as the day after moving against falling crude prices. But perhaps they shouldn’t be. Last year, when propane was setting record highs each and every week, propane prices increased 10 percent in Mont Belvieu and nearly 17 percent in Conway throughout September. It was a month in which crude prices were flat. It is the time of year when seasonal impacts affect propane markets.

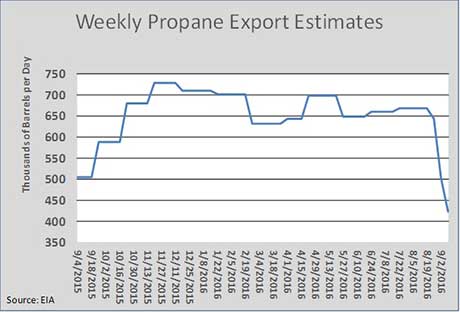

One thing that is different is that propane exports were higher last September than they are this September. Exports were on a general upward pattern one year ago, though there was a slight dip between August and September. This year, exports have been falling over the past three weeks and have dropped to just 424,000 barrels per day (bpd), according to EIA. That is the lowest rate of exports since November 2014. By comparison, exports were running at 505,000 bpd last September and more export capacity has been added since then.

After September 2015, there were sharp increases in propane exports. By late October, exports had increased to 680,000 bpd. In November and December, exports reached their all-time highs of 729,000 bpd. Note that these export numbers are weekly estimates by EIA. As we will show below, actual exports often run much higher. Propane sellers may very well be looking at last year’s history of strong fall and early winter exports and be hoping for the same this year.

Propane exports recently have been hammered by Asian buyers walking away from contracted cargoes. There are reports that some of those companies are in financial trouble and that at least one has gone bankrupt. About 7 million barrels in exports were canceled this month. However, we are seeing some reports of interest in more spot cargoes for October. Again, propane sellers may be hanging their hat on a rebound in exports over the rest of winter similar to last year.

If they are correct, the gambit will pay off for the producer. However, if export activity does not mimic what occurred last year, seller resolve could quickly dissolve.

This is certainly a dilemma for propane buyers. Do you bet on increased exports like last winter or do you bet against it? A retailer betting on it would be a buyer now. A retailer betting against it would stay short supply heading into winter. This winter’s pricing environment for retailers and their customers could be highly dictated by how much U.S. propane the rest of the world will demand.

What makes the stakes even higher on this bet is that export capacity will be higher this winter than it was last winter. The capacity and ability to ship a lot of propane is available. In fact, the last official monthly data from EIA showed the U.S. exported 27.706 million barrels of propane during June. That is a staggering 923,533 bpd of exports, and it far exceeded EIA’s weekly estimate of 649,000 bpd that month.

These days, it isn’t enough to ask how is winter demand going to be and limit the discussion to the United States. Winter demand in the entire Northern Hemisphere must be a part of the conversation.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.