Falling domestic propane demand

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, shares trends in domestic demand.

Catch up on last week’s Trader’s Corner here: Correcting a common misconception about propane supply

Cost Management Solutions has started a monthly hedging webinar. The idea was the brainchild of our vice president, Dustin Delay. It has been well received, and attendance grows with each new webinar.

The focus of the webinars is to provide guidance on what tools propane retailers can use to manage supply-side price risk. There is also a lot of emphasis on what tools retailers can use to monitor market conditions, improving the chance of obtaining price protection at favorable prices. If you would like to attend a webinar, reach out to Dustin at dustin.delay@propanecost.com. He will get you on the attendee list and send you the link for the next webinar.

Our role in these webinars is to provide content. While the webinar focuses on hedging and price risk management, we provide a segment on propane fundamentals – factors that are driving propane prices or industry trends. We are going to show you a couple of charts that we used in the last webinar. We must warn you that if there are small, impressionable children in the room that you should not proceed, as we do not want to be responsible for the new words they might learn. Also, if you have a medical condition that could be triggered by despicable data, you may want to avoid venturing further.

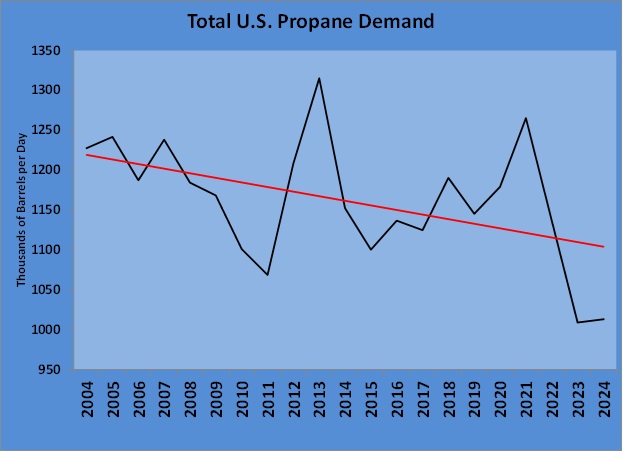

The chart above plots U.S. domestic propane demand for the last 20 years. In 2004, demand was 1.228 million barrels per day (bpd). This past year, the average demand was 1.013 million bpd. As the red trendline shows, this past year was not an anomaly. Domestic demand is trending down. This demand includes retail and petrochemicals. Petrochemicals account for around 250,000 bpd to 350,000 bpd of that total, influenced by prices and economic conditions.

Because of this trend, we believe that enhancing margins must be the focus of propane retailers. Most growth in our industry is happening by acquisitions/consolidation, as organic growth becomes more difficult. Chasing gallons is somewhat like chasing our shadow; we can expend a lot of energy while yielding little results. Lowering margin to gain market share might be a viable strategy when domestic demand for propane is increasing. But with demand declining, the windfall that might be hoped for by “buying” market share with a low retail price might never be realized.

If a retailer operates on a “buy at the rack and mark-it-up strategy,” it is very hard to grow margin. Gasoline stations have been stuck with low margins for their gasoline for years, but they have other ways of increasing revenues. Gasoline is marketed through convenience stores and other outlets. The real money is made in the stores, not at the pump.

Unless propane retailers are going to make their bobtails a combination ice cream truck and propane delivery vehicle, it is going to be hard to match the fact that gasoline stations have customers coming to them for other goods and services, thereby increasing revenue per customer interaction.

Unfortunately, propane retailers are going to the customer, so it is our bobtail and driver that are the exposure to the customer, and our customer concentration is literally one. One customer at a time is all we get. A Buc-ee’s we are not. Perhaps we could get contracts with Amazon and Uber Eats? We want to be in the driver meetings when you present these ideas.

If a propane retailer is using a buy-and-mark-it-up strategy, he is operating like the old gasoline stations that just sold gasoline, oil and windshield wiper blades. How many of those stations do you see around these days?

It is not practical to look at the gasoline/convenience store model for answers. Perhaps we can look toward utility company models for inspiration. If you think about it, retail propane is more akin to a utility company than a gasoline station.

Do you know any utility companies that do not offer average monthly billing? We are going to list some of the potential advantages without a lot of discussion because retailers already know most of them. We want to save our space to present a reason you may not have thought about. Here is a list of potential benefits of budget billing before we move on to our main reason:

- Revenue evenly spread over the year

- Accounts receivables risk reduced

- Provides a service that customers desire

- Increased margin

- Delivery and routing efficiency

- Better customer retention

There are probably more, but we can’t wait to get to the one we want to present. Let’s lean into it with another chart:

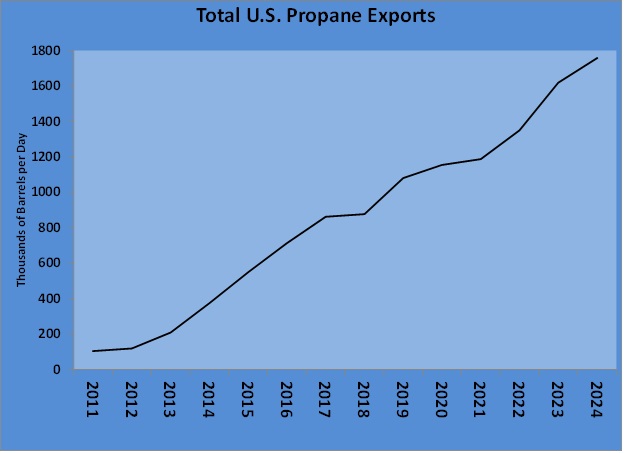

Propane exports are rising at a dramatic pace, while domestic demand is going down. On average, the United States exported 744,000 bpd more propane last year than it consumed domestically.

Midstream companies are building new export capacity, not assets to service the U.S. domestic market. In fact, pipelines that used to service the U.S. domestic propane market have been repurposed for other uses. The export market is mostly industrial, making the demand steadier than weather-related retail demand, thus better matching supply. Just a little more than a decade ago, midstream companies were taking propane retailers to play golf, dinners and asking how they could serve them better. Maybe not so much anymore.

This shift in the industry puts more pressure on propane retailers to provide the infrastructure to maintain supply security. Of course, one way to do that is to add more bulk storage near your retail market. Perhaps an alternative is to take control of your customers’ tanks. One would have to build a lot of bulk storage to match the capacity in all those customer tanks. One way to gain control is through budget billing.

With budget billing, the customer is indifferent as to when the propane goes into the tank. This allows the retailer to take advantage of when the market provides lower prices. The opportunity to enhance margin is present. But just as importantly, the retailer can make sure tanks are topped off before demand hits. It is much easier to route efficiently, thus lowering costs but also increasing the odds of staying ahead of high-demand periods when limited infrastructure will be tested.

We are not sure that budget billing is the right answer for every retailer. We do know a lot that do it, and we rarely hear negatives. What we do know is the retail pie is shrinking along with a focus on retail-related infrastructure. For a retailer to thrive, better margin is needed, and that might require some adventurous out-of-the-box thinking. And plenty of thought needs to go into enhancing supply security.

When we presented these charts at the webinar, we said they were real buzz-kill charts. It has been a pretty good winter on the demand side, so we thought, if we had to show these charts to propane retailers, they are probably more survivable with the better vibes the recent cold has provided in the industry.

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.