February brings arctic air and red-hot propane demand

Last Wednesday, the U.S. Energy Information Administration reported U.S. propane inventory took a 4.508-million-barrel hit, dropping to 51.545 million barrels during the fifth week of the year. That is 20.277 million barrels, or 28.2 percent, below the same week last year. Inventory has been falling rapidly as demand ramps up.

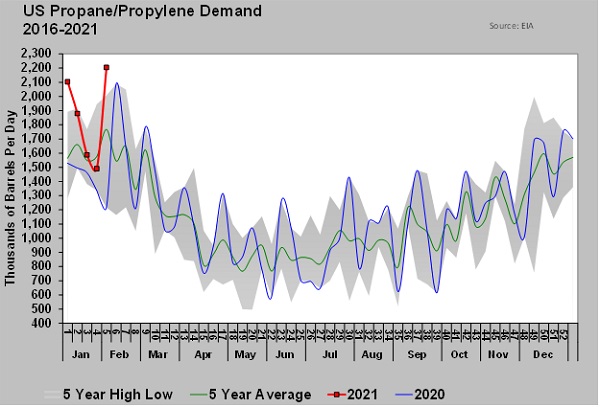

U.S. domestic propane demand increased a whopping 714,000 barrels per day (bpd) during the fifth week to 2.204 million bpd. It’s the highest propane demand rate on record and 116,000 bpd more than the same week last year.

Last year, domestic propane/propylene demand averaged 1.189 million bpd, up 37,000 bpd from 2019. We believe that stay-at-home orders related to the pandemic could have positively impacted propane demand last year.

It is our feeling that office buildings and retail establishments closed because of the pandemic were more likely to use natural gas. Sequestered workers likely used more propane. In addition, many restaurants had to resort to outdoor dining, and many have turned to propane to heat temporary spaces.

While the impacts of the pandemic are still in play, the fifth week’s huge domestic propane demand number was almost certainly related to the deep cold that’s gripping the U.S. During the first five weeks of this year, U.S. domestic propane demand has averaged 2.104 million bpd compared to 1.408 million bpd during the first five weeks of last year.

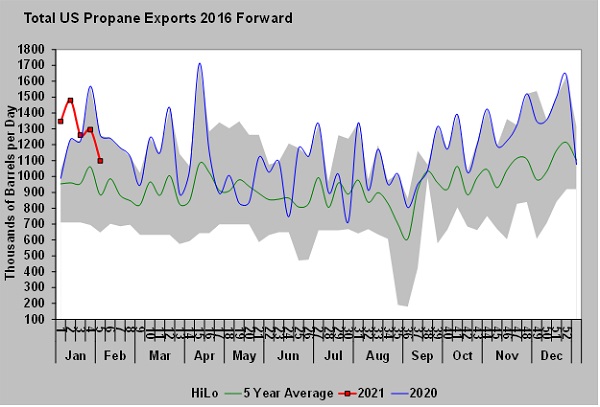

Demand for U.S. exports has also been robust. Exports were at 1.098 million bpd during the fifth week, down 197,000 bpd from the previous week. In 2020, exports averaged 1.153 million bpd, up 69,000 bpd over 2019. So far this year, exports have averaged 1.296 million bpd compared to 1.255 million bpd during the first five weeks of 2020.

Supply has valiantly tried to keep up.

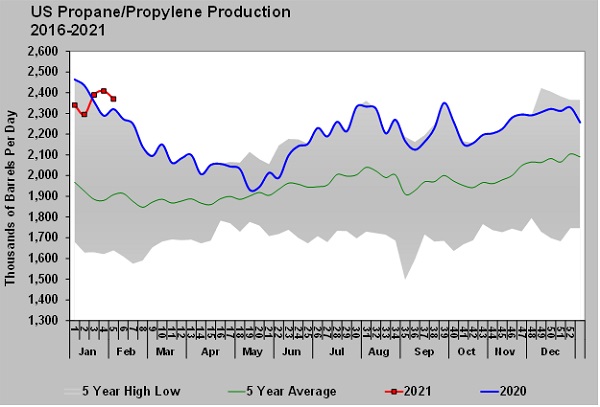

Natural gas processing and refining yield propane supply. Natural gas production is down about 3 percent, and refinery throughput is down about 8 percent. Nevertheless, U.S. propane production is setting new five-year high marks.

Over the first five weeks of this year, propane production has averaged just a half percent less than during the first five weeks of last year. The fifth week’s production was just 3.8 percent below the January 2020 production peak of 2.464 million bpd.

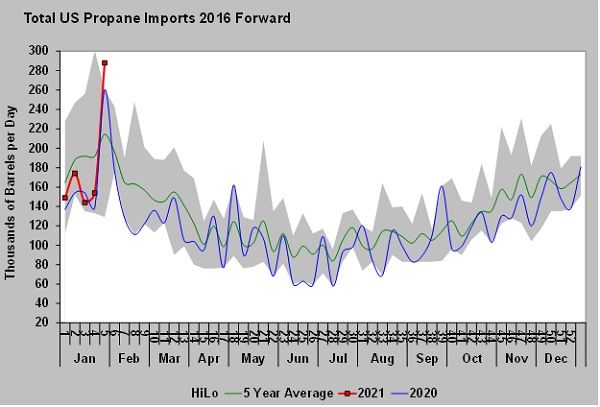

Propane imports were lagging, but they surged during the fifth week of the year. In 2020, propane imports ran 21,000 bpd less than they did in 2019. So far this year, they have averaged 13,000 bpd more than 2020. The year-over-year increase was aided greatly by imports of 288,000 bpd during the fifth week, up 134,000 bpd from the previous week and a new five-year high for week five of the year.

Despite the valiant efforts of supply to keep up, propane demand has overwhelmed it, leaving inventory to make up the difference. During the first five weeks of last year, U.S. propane inventory fell 4.212 million barrels. During the first five weeks of this year, it has fallen 21.232 million barrels.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.