Fractionation more of a contributor to inventory tightness than originally thought

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains how fractionator throughput has contributed to propane inventory tightness.

Catch up on last week’s Trader’s Corner here: Update: Solving for the unknown in crazy April propane prices

When we wrote the Trader’s Corner evaluating the cause of high April Mont Belvieu (MB) propane prices, we gave fractionation a pass from being much of a culprit. We blamed the tightness almost exclusively on high demand. Upon further analysis, we now realize giving fractionation a free pass on the issue was incorrect. We now know that fractionator throughput is low and contributes to the tightness in inventories.

Remember that total propane inventories are a combination of estimated propane in a natural gas liquids mix called Y-grade upstream of the fractionators and the inventory of spec propane downstream of the fractionators. The U.S. Energy Information Administration (EIA) refers to the propane downstream of the fractionators as ready-for-sale (RFS) propane. When we were writing the article a couple of weeks ago, we looked at the current week only and estimated that fractionators had processed about 98 percent of the Y-grade that had been received. We falsely concluded that was a good rate.

Since then, we have evaluated fractionation over a longer period, which led us to a different conclusion. Evaluating fractionation correctly will give us better insight into whether the conditions that caused the current supply tightness have a chance of improving in the coming weeks and months.

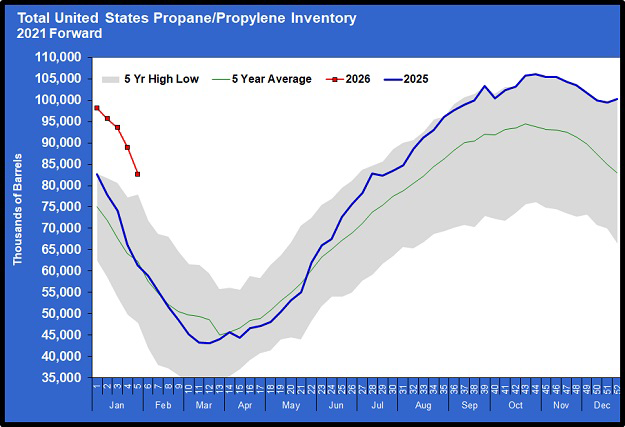

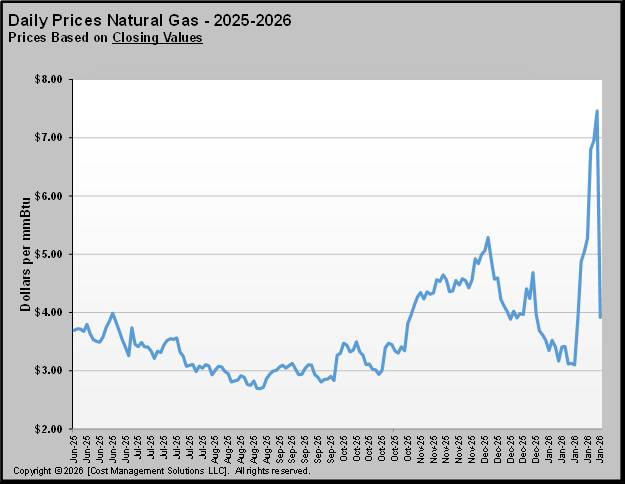

April propane was trading more than 20 cents above May when April expired. When May became the front month, MB propane prices dropped that front-month premium. But we wonder if that is only going to be temporary. We have already seen May prices creeping up from where they opened on May 1. Early in the morning on May 1, MB ETR propane traded as low as 66 cents. That was about 9 cents below where it was trading the previous day. But as we write just a day later, on May 2, MB ETR is trading at 74 cents. We fear this price creep may continue throughout the month if the low inventory positions, especially RFS inventories, do not improve.

Let’s look at the numbers behind the tightness in propane inventories from a study we did last week. We will break this review down into two parts. First will be the impact of higher demand, which we initially blamed for the low inventory, and then fractionation.

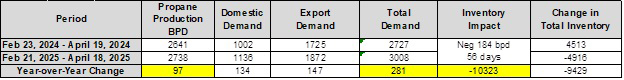

Remember that the EIA did not start reporting RFS inventories until the week ending Feb. 23, 2024, so that is when the period for our study begins. Note that propane production was up 97,000 barrels per day (bpd) year-over-year during the late February to mid-April period. The conclusion is that it has not been a drop-off in propane production from oil and gas wells that has led to low propane inventories.

However, note that both domestic and export demand is up year-over-year for a combined 281,000-bpd increase in demand. If we subtract the increase in supply from the increase in demand, the net is a 184,000-bpd negative impact on U.S. supply that over 56 days would yield a 10.323-million-barrel draw on inventory.

The EIA has reported a draw on inventory of 9.429 million barrels. The reason for the difference is that propane imports are up about 20,000 bpd year-over-year. In other words, the increase in total demand has been greater than the increase in U.S. production and imports, requiring 9.429 million barrels more draw on inventories during the period this year compared to last year.

The problem was that RFS inventories were down 12.176 million barrels from the previous year at the time of the study, which meant that the increase in demand couldn’t be the full story as to why RFS inventories are low. That brings us to fractionators.

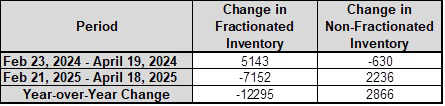

Last year during the period of the study, fractionated or RFS inventory increased 5.143 million barrels, but this year, they have fallen 7.152 million barrels. The result is a 12.295-million-barrel year-over-year change in RFS inventory. At the same time, inventory upstream of the fractionators decreased 630,000 barrels last year, while they increased 2.236 million barrels this year. That is a 2.866-million-barrel year-over-year impact on the propane inventories that are still in Y-grade upstream of the fractionators. Also, note that the negative number last year means that fractionators were processing at a rate higher than propane production. In other words, our assumption that the fractionation rate that was 98 percent of production was good was not correct. It would appear the fractionation rate was over 100 percent of production last year during the period the study covers.

So, we conclude that the increase in demand year-over-year has contributed to about 77 percent of the current RFS propane supply tightness, while lower fractionator throughput has contributed around 23 percent of the problem. We know there were fractionator issues earlier in the year, but we thought they were resolved. Now we are not so sure that is the case.

To avoid May propane prices creeping up over the course of the month, where prices are in a similar situation to April, a combination of three things needs to happen:

- Domestic demand needs to be at seasonal levels, which is likely to occur.

- Demand from foreign buyers must become more elastic relative to price. It appeared foreign buyers were willing to pay whatever it took in April to get propane. Perhaps that was to get ahead of tariffs. Let’s hope foreign buyers become less tolerant of high prices over the course of May and the rest of the summer. In other words, let’s hope that foreign buyers revert to their normal price-sensitive selves. We think that is likely to occur as things become clearer on the trade and tariff fronts.

- Fractionator throughput needs to improve. We have no idea if that will occur. Only operators know where things stand and what they plan to do.

So, the free pass we issued to fractionators a couple of weeks ago is now officially revoked. We hold them accountable for 23 percent of the RFS propane inventory tightness and hope that whatever ails them will be cured sooner rather than later. Otherwise, replenishing inventories is going to be a slower process than we have been suggesting. Of course, the result will be higher prices and fewer opportunities to get winter price protection at favorable numbers.

In our opinion, this means that propane buyers will probably need to be vigilant in the coming weeks in their lookout for pullbacks in prices that might provide an opportunity to get price protection at reasonable numbers. Until the propane fundamental picture improves, buy opportunities might be more dependent on drops in crude and short-term events. Currently, propane fundamentals are not boding well for a prolonged period of price softness, so opportunities might be fleeting. We are hoping the three things we listed above will go in the favor of propane buyers, but while we are hoping for that, we need to stay alert for short-term buy opportunities.

All charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.