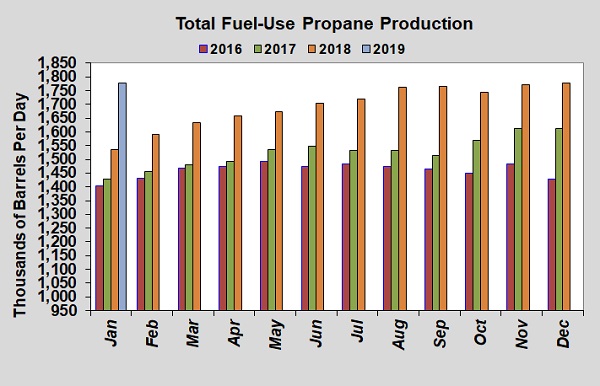

Fuel-use propane production off to strong start

Official data for January showed U.S. natural gas plants and refineries combined to produce 1.779 million barrels per day (bpd) of fuel-use propane (excludes propylene). Of that total, 297,000 bpd was from refining operations and 1.482 million bpd was from natural gas processing.

Total fuel-use production in January 2018 was 1.536 million bpd, making the year-over-year increase for the month of January 243,000 bpd. Growth from January 2017 to January 2018 was 109,000 bpd, demonstrating how strong supply growth has been this year.

For all of 2018, the average increase in production each month was 169,000 bpd. The gain of 243,000 bpd in January gets 2019 on a pace for much higher growth in 2019.

Propane production is driving propane prices. Until data shows domestic demand and export can handle it all, excess production will continue to drive prices lower.

This past week, the U.S. Energy Information Administration (EIA) reported a 1.161 million-barrel build in U.S. propane inventory. That was lower than the 1.65 million-barrel build that market analysts expected. It was also lower than the 1.514 five-year average build for week 17 of the year.

The EIA report also showed U.S. propane exports remaining robust at a record 1.341 million bpd. It marked the first time ever exports had been over a million bpd for six consecutive weeks. Yet, even with the light inventory build and the robust exports, propane prices continued along their downward trajectory.

The market was focused on another data point – propane production. Propane production dipped below 2 million bpd for a couple of weeks, but gained 68,000 bpd last week to 2.066 million bpd. The impressive number was the year-over-year growth of 223,000 bpd.

It looked like the export market had softened up last week, so we are on the watch for an export rate drop when the EIA reports on Wednesday. With this kind of production occurring, exports can’t have a hiccup, or the market is going to punish propane prices. It appears this past week’s softness in propane is the market anticipating a drop-off in exports for the week ending May 3.

Stay tuned.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.