Fuel-use propane production, its effect on supply/demand

U.S. propane supply is growing, but not as much as in past years.

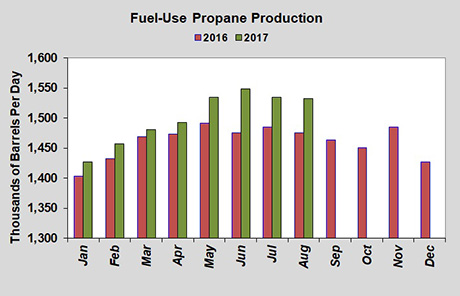

The chart above shows the official U.S. fuel-use propane production through August. Though the weekly estimates provided by the U.S. Energy Information Administration include propylene production, this data does not. Propylene, which goes to petrochemical operations, has been removed from the figures used to develop the chart since it does not contribute to supply available to propane retailers.

At the beginning of the year, we estimated that U.S. fuel-use propane supply would be up 50,000 barrels per day (bpd) from 2016 and average 1.511 million bpd. The last official data for August showed combined fuel-use production from refineries and natural gas processing at 1.532 million bpd, down from 1.534 million bpd in July.

Year-to-date production has averaged 1.501 million bpd and looks on target to be around our original estimate. Production averaged 1.463 million bpd through August 2016, making the year-over-year increase 38,000 bpd.

Natural gas production slowed at the beginning of the year but has been on the rise more recently, which should help maintain the type of year-over-year growth seen in the last four months, compared with the slow growth from January through April.

In August, natural gas processing contributed 1.223 million bpd of fuel-use propane supply, while refineries produced 309,000 bpd in fuel-use propane. Natural gas processing provided 80 percent of fuel-use propane.

The rapid rise in propane supply seen from 2011 through 2015 has certainly slowed over the past two years. For example, fuel-use propane supplied in 2015 averaged 140,000 bpd more than in 2014. Supply growth in 2016 was just 61,000 bpd higher than 2015 as natural gas production slowed. As shown in the chart, the growth in supply this year will likely be below 2016’s rate of growth.

Meanwhile, propane exports continue to grow, and more units are turning fuel-grade propane into propylene. For example, Enterprise just announced its new propane dehydrogenation (PDH) facility in Mont Belvieu is starting up and will reach full operational rates by the end of November. At capacity, the unit will consume 30,000 bpd to 35,000 bpd of propane. Essentially, that would consume all of the new growth in supply seen this year, which is 38,000 bpd.

More exports, more PDH units and slower rates of growth in propane supply have certainly tightened the propane supply and demand balance. Current prices are reflecting that tightness.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.