Fundamentals point to higher propane prices this winter

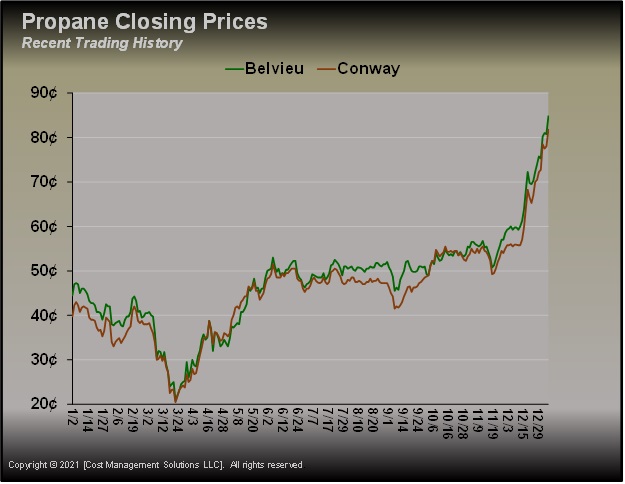

Chart courtesy of Cost Management Solutions

The landscape for propane has certainly changed between the beginning of 2020 and the beginning of 2021. In this week’s Trader’s Corner, we are going to compare key metrics for propane between the two years.

The most logical place to start is the price of the commodity. Having details behind price changes helps, but the price of a commodity is really all you need to show that the landscape had changed over the past 12 months.

On Jan. 2, 2020, the first trading day of the year, Mont Belvieu (MB) LST propane traded at 44.5 cents. During the start of the pandemic, MB LST fell to an annual low of 20.75 cents. On Jan. 7, 2021, MB LST propane closed at 84.75 cents.

Over the past 12 months, MB LST is up by 40.25 cents, or 90.4 percent – nearly double. Since the March 23, 2020, low, MB LST is up by 64 cents, or 308 percent – more than triple.

Chart: Cost Management Solutions

The results for Conway propane have been similar. Conway traded at 39.75 cents at the start of last year, falling to 20.5 cents near the beginning of the pandemic. On Jan. 7, 2021, it closed at 81.75 cents. That was a gain of 42 cents, or 105.7 percent, over the past 12 months. The gain from last year’s low has been 61.25 cents, or 299 percent.

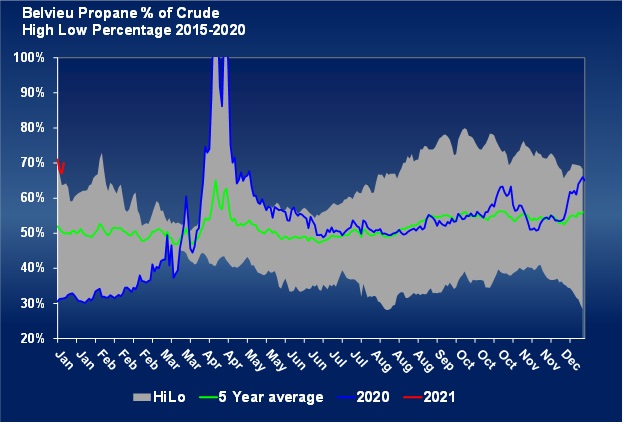

Propane has significantly outperformed crude over the past 12 months.

At the beginning of 2020, MB LST propane was valued at 31 percent of the value of West Texas Intermediate crude. MB LST is now trading at 70 percent of the U.S. benchmark crude. This comparison shows that propane’s value has not just risen with the overall energy market. It has significantly outperformed crude, showing that propane’s fundamentals (supply and demand) have become more bullish or more price supportive.

Chart: Cost Management Solutions

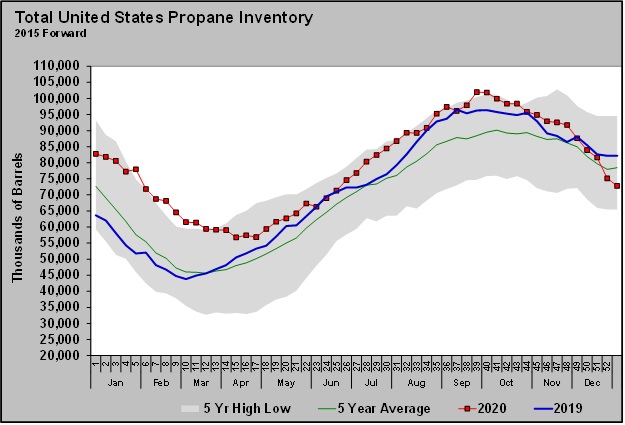

Inventories will begin the year lower than 2020.

In 2020, propane inventory began the year more than 19 million barrels over where it had begun in 2019. Had it not been for the pandemic, which has done major damage to the U.S. oil and gas industry, it could have been a much different pricing environment today. But the pandemic caused U.S. natural gas production and refinery throughput, the two sources of propane supplies, to decrease substantially.

Even so, propane inventory held above the prior year and the five-year average most of 2020. Prices were climbing after the initial pandemic dip, but not as rapidly as recently. Still, as the chart shows, during the worst of the production and refining decreases in April, propane inventories converged with the prior year. Then, in November and December, domestic demand and very strong foreign demand put more pressure on inventory, pulling it down to below 2019 levels and the five-year average.

Chart: Cost Management Solutions

Inventory ended 2019 at 82.188 million barrels and ended 2020 at 72.777 million barrels. Current inventory is still solid, but the 9.411 million-barrel, year-over-year decline creates a more bullish pricing environment.

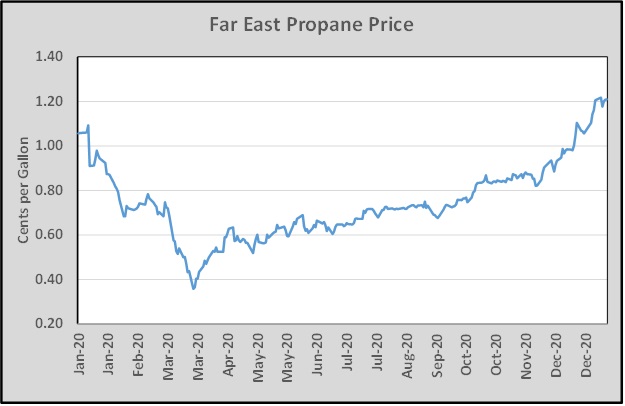

A key factor in propane’s price strength this winter has been strong demand from foreign buyers.

Far East/Asian buyer interest is very strong. Currently, the Far East market is at $1.21 per gallon. That is a 43-cents-per-gallon premium to MB LST, keeping export economics favorable. As long as export demand remains strong, there is likely to be continued pressure on inventory and thus support for propane prices. We could also see overall demand retreat as domestic heating demand slows, but domestic demand is going to be around a couple of more months.

Next winter, propane prices are running around 70 cents at Mont Belvieu, so not as high as the January price. If you don’t like that price, then you could be waiting until the end of winter for a shot at something better. Even then, export demand may need to fall and crude prices may need to stay around current levels or lower to get better pricing for next winter. No doubt the landscape looks much different than it did at the start of 2020.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.