Fundamentals should keep prices well above last year’s low levels

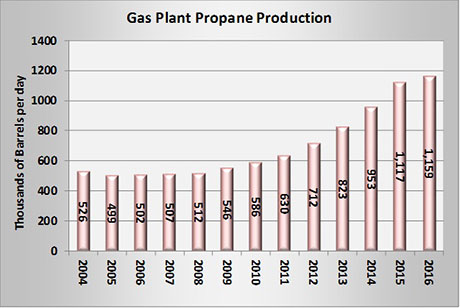

In 2016, 79.3 percent of U.S. propane supply came from natural gas processing. For years, massive natural gas drilling programs have been pushing up the amount of propane coming from natural gas processing.

Ten years ago, natural gas processing provided 502,000 barrels per day (bpd) of propane supply, while refining provided 301,000 bpd of fuel-use propane supply. In 2016, natural gas processing accounted for 1.159 million bpd, with refineries providing 302,000 bpd. The growth in propane supply over the last 10 years can be attributed to the shale gas revolution that has swept across the United States.

The growth in propane supply has been extraordinary, especially from 2012 to 2015. However, the growth in supply has slowed dramatically.

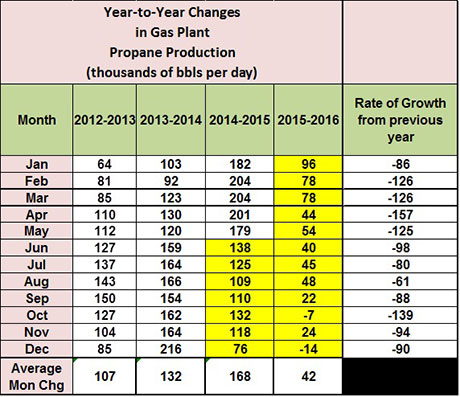

Between 2015 and 2016, the growth in propane inventory was held to just an average of 42,000 bpd. That compares to a rate of growth of 168,000 bpd between 2014 and 2015.

The table above shows the dramatic slowdown in growth of propane supply from natural gas processing. The last column shows that in every month in 2016, propane supplied from natural gas processing plants was lower than in the previous year.

For years, prior to June 2015, each month showed an increase in the rate of propane supply compared to same month the previous year. Since June 2015, each month has showed slower growth than the previous year. In October and December 2016, propane supplied from natural gas processing was less than the same month in 2015.

Essentially, there was no growth in propane supplied from natural gas processing in the last quarter of 2016. The supply drop from natural gas processing has been augmented with an increase in fuel-use propane from refineries. Refineries provided an average of 19,000 bpd more propane supply in 2016 than in 2015. In the fourth quarter of 2016, refiners supplied 29,000 bpd more propane supply than they did in the fourth quarter of 2015. Still, the growth in refinery supply is limited and is a long way from offsetting the slowdown in supply from natural gas processing.

We expected supply from natural gas processing to start improving in 2017 since crude prices have gone higher, improving the economics in drilling liquids-rich natural gas plays. Rigs drilling for natural gas in the United States stood at 151 as of Feb. 24, up from 81 at the end of August. As the new wells are completed, we expect to see some impact on propane supply, but the growth is likely to be slow.

The United States holds between 1.6 and 1.7 million bpd of propane export capacity. The highest weekly estimate on exports so far has been 1.313 million barrels. With the growth in propane supply now very slow, there should remain enough export capacity to prevent a bottleneck in supply that drove propane prices down to the 30-cent range coming out of last year’s mild winter.

Certainly, having back-to-back mild winters is bearish for propane prices. Many might expect prices to fall like they did last year when a low of 30.13 cents was reached for Mont Belvieu and 27 cents for Conway. Those lows came at the end of January.

At that time, West Texas Intermediate (WTI) crude was running about $30 per barrel and propane inventories came out of winter at 62.226 million barrels. This year, crude is above $50 per barrel and propane inventory is at 49.307 million barrels and still falling.

Last year, when the low propane prices were posted, propane was valued at 44 percent of crude in Mont Belvieu and 39 percent of crude in Conway. There is simply no justification at this point to push propane prices to those relative valuations to crude, much less below them. Currently, Mont Belvieu is trading at 48 percent and Conway 43 percent of WTI crude.

At this point, fundamental conditions suggest propane lows for this year should stand at 20 to 30 cents above last year’s lows in our view. As we told a client the other day, 60 is the new 40 in the world of propane, and it could be that 60 is the new 30.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.