Growing propane supplies adding stability to the market

When analyzing propane supplies and prices, there is always a lot of focus on the demand side. How much is being exported and used for petrochemicals is always on the minds of propane retailers, since exports and petrochemicals are competition for the product upon which a retailer’s livelihood and security depends.

Propane supply gets less attention than demand, but is more important in setting the pricing environment. If there is enough supply, all three demand areas can get what is needed at a reasonable price.

Retailers have certainly seen the impacts of too much supply over the last five years, including favorable supply costs. Supply far outstripped domestic demand from both retailers and petrochemical companies during that period.

Now export capacity has increased to the point of being able to move the excess not needed domestically, which has put upward pressure on prices. Having enjoyed the benefits of low prices due to oversupply, it is not surprising that exporters are seen as villains by just about any domestic consumer of propane.

Since there is no going back, the key to peaceful coexistence for the big three demanders of propane is ample supply. The good news is that supply has been growing which has, so far, been keeping propane prices reasonable. In fact, propane prices are now very close to their long-term relative values to West Texas Intermediate (WTI) crude. Propane valued at around 70 percent of WTI crude’s value was the norm until the oversupply conditions over the last five years.

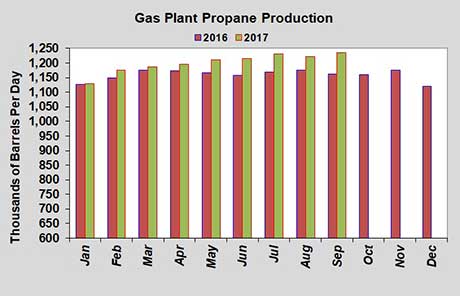

The latest official production data from the U.S. Energy Information Administration is for September. The chart below shows fuel-use propane supply from natural gas processing this year compared with last year.

Last year, propane supplied from natural gas processing averaged 1.159 million barrels per day (bpd). Year-to-date for 2017, the average has been 1.2 million bpd for an increase of 41,000 bpd. It is not the rate of growth that we have seen in years past, but it is still growth in supply.

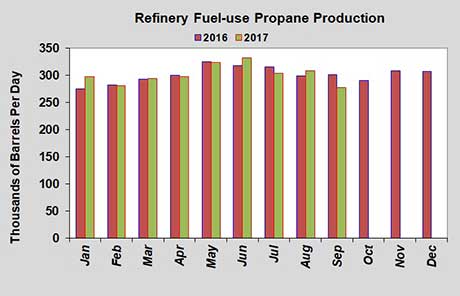

Refinery fuel-use propane production has averaged the exact same 302,000 bpd it did last year. There was a significant drop in propane supply from refineries in September due to the effects of Hurricane Harvey. We still believe there will be a slight year-over-year increase in fuel-use propane from refineries when the year is complete.

Natural gas production is on the rise again. Liquified natural gas exports are increasing and that could help boost U.S. natural gas prices, encouraging even more drilling and production. The economy is improving, which could increase refinery throughput of crude resulting in more propane supply.

Globally, there are reports of increased propane production from the Middle East, which could provide stronger competition for U.S. origin propane. Some reports suggest there has been a global shortage of LP gas, but that the market will become more balanced in 2018.

The bottom line is that infrastructure issues have deflated U.S. propane values over the last five years and more export capacity has allowed U.S. values to become more in line with the global market. However, if the forecast for global supply to catch up to global demand is accurate, the worst of the appreciation in U.S. supply could be behind propane consumers. That doesn’t mean we aren’t still at risk to upside price pressure this winter, but the longer-term prospects for propane and LP gas prices in general may call for a more stable environment going forward.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.