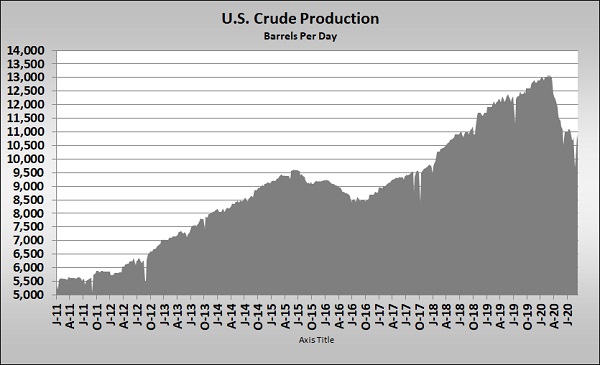

Has U.S. crude production peaked?

The Federal Reserve Bank of Dallas released the results of a survey of oil industry executives last week. The survey found that 66 percent of the 154 executives surveyed believe that U.S. crude production has peaked.

We dedicated numerous Trader’s Corners during the first half of the year to the fall in crude production and the deep financial stress put on the U.S. oil industry. In our Trader’s Corner written on May 4, we stated the following: “Lenders are preparing for a huge number of bankruptcies in the energy industry. It is possible many players will never come back. We believe we have likely seen the high-water mark for crude production in the United States for some time to come.”

We thoroughly explored the massive drop in crude prices related to COVID-19 and the potential impact on future production because of the consequences for propane production. Much of the rapid growth in propane supply recently has been attributed to increased crude production. There has been an overproduction of propane due to the unbridled expansion in U.S. crude production, which has depressed propane’s price.

At the beginning of 2011, when the chart begins, U.S. propane production was 1.113 million barrels per day (bpd). Propane production more than doubled to a peak of 2.464 million bpd for the week ending Jan. 3 of this year. U.S. crude production peaked at 13.1 million bpd during February and March.

For the week ending Sept. 18, the latest from the Energy Information Administration (EIA), U.S. crude production was estimated at 10.7 million bpd and U.S. propane production at 2.228 million bpd. That put propane production at 236,000 bpd below its peak.

During the rapid expansion of U.S. propane supply, there have been periods where production exceeded the ability to process or export. Those periods have been marked by very low propane prices. But export, fractionation and transportation capacity have caught up to production. With the decrease in production, there is now spare capacity. This will lower the potential for the kinds of steep dips in propane’s value we have seen in recent years.

Major oil companies such as BP and Shell are completely reshaping themselves in anticipation that global crude consumption is going to start declining. They believe the decreased consumption seen during COVID-19 has accelerated the move to renewable energy. Many believe that work-from-home will continue beyond the pandemic. That is expected to reduce refined fuels consumption. There has also been an exodus from some inner cities during the pandemic. A lot of the benefit of living near the business district of cities is diminished due to telecommuting. Also, restrictions on restaurants and bars have reduced the benefits of living near those facilities. There is a transition back to the suburbs to avoid the higher rents in the business district, which could very well mean greater propane consumption for home heating.

Very little propane consumption is associated with transportation. Even if refined fuels consumption decreases, it doesn’t necessarily mean propane consumption for transportation will follow suit. In fact, as the desire for cleaner fuels increases, propane’s percentage of the transportation market could increase.

It is also our view that if the global economy recovers, there is little reason to believe the petrochemical demand for propane will be diminished significantly, if at all. In fact, there is huge new demand for propane coming with the completion of propane dehydrogenation units designed to turn propane to propylene. China has just completed one such unit that could consume 2.2 million metric tons of propane per year. There are 12.4 barrels of propane per metric ton – that is 27.29 million barrels of propane per year. At current production levels, that one plant is equivalent to more than 12 days of U.S. propane production.

If U.S. crude production has peaked and major crude players are correct in anticipating a decline in crude demand, then more propane supply will have to come from purely natural gas wells to meet the needed demand. Again, as the world looks for cleaner energy, natural gas demand should increase.

Still, one can see a scenario where the chances of dips in propane prices that have come from a lack of infrastructure may not occur as crude demand decreases. One can also see scenarios where overall propane demand will not come down with refined fuels demand, which could lead to upward pressure on prices.

The U.S. is well-supplied for this winter, so we are not anticipating a spike in propane prices at the hubs. Though we must warn that doesn’t mean we can’t have spikes in prices in local markets due to infrastructure issues. U.S. producers are gearing everything around meeting demand from petrochemicals and exports. That is where the real growth is going to come from. The lack of infrastructure investment to meet U.S. domestic heating demand is likely to continue, which could create issues if domestic demand stays firm or grows.

The takeaway is this: Propane has been in an oversupply situation for years, which has diminished the need for supply-side risk management. But, there are potentially significant shifts in the supply/demand balance as we look further out, which could increase the need for price risk management in the coming years. There may be some windfall coming for propane if the shift back to the suburbs continues, but we must be prepared to make sure that propane is an attractive option for consumers. That could mean more supply-side risk management including hedging, investment in storage on the retail level and even cooperation on the retail level for developing supply facilities. It could also mean we need to redouble our effort to transition away from a buy-and-mark-up model to more budget billing. The more propane can price like a utility and less like a service station, the better the chances of success.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.