Industry survey: Daunting year in propane forges renewed vision

Results of Gray, Gray & Gray’s annual propane industry survey capture what made the year spanning April 2020 through March 2021 a challenging one for many marketers, and throw into relief marketers’ strengths and weaknesses in facing those challenges.

In doing so, the survey points toward fresh solutions propane companies can incorporate into their plans for the future – a future most survey takers look toward with confidence.

In doing so, the survey points toward fresh solutions propane companies can incorporate into their plans for the future – a future most survey takers look toward with confidence.

“It was a demanding year for propane marketers on many fronts, with constant governmental pressures related to the COVID-19 pandemic and climate,” says Marty Kirshner, partner and chair of the energy practice group at Gray, Gray & Gray. “But the results of our survey speak to the resilience and perseverance that has long been a trademark of our industry.”

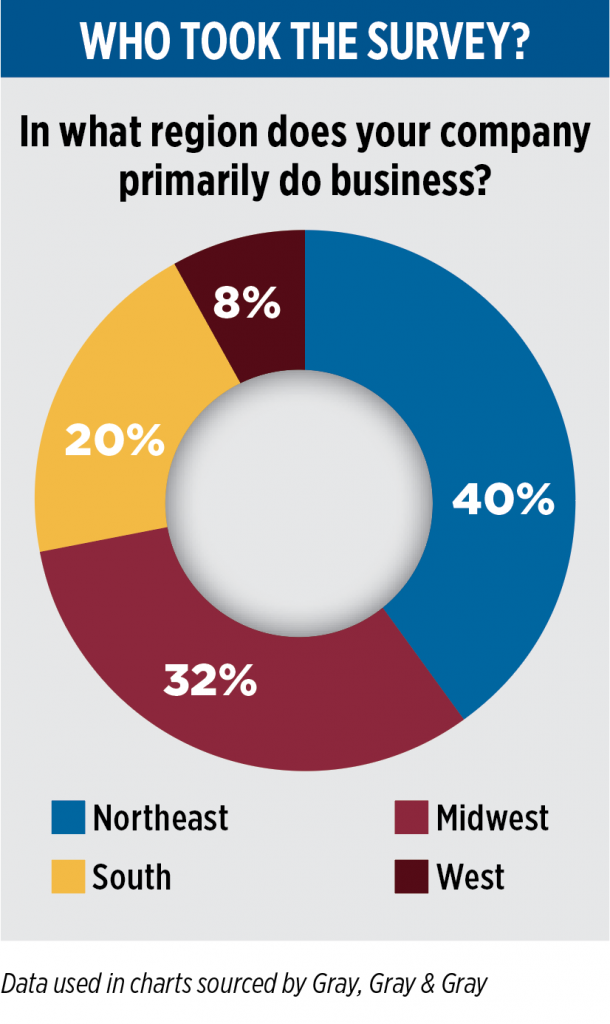

In the survey’s third year of nationwide distribution, respondent demographics have grown more representative of the national industry. Companies that participated in the survey have, on average, 34 employees and are located primarily in the Northeast (40 percent) and Midwest (32 percent). In the survey’s first year of nationwide distribution (2019), the Northeast accounted for 67 percent of the total, while the Midwest accounted for just 10 percent.

In addition, this year’s survey data is augmented by real-world back-office data – such as number of deliveries and service calls – supplied by business intelligence and technology firm Angus Energy.

Pressure points

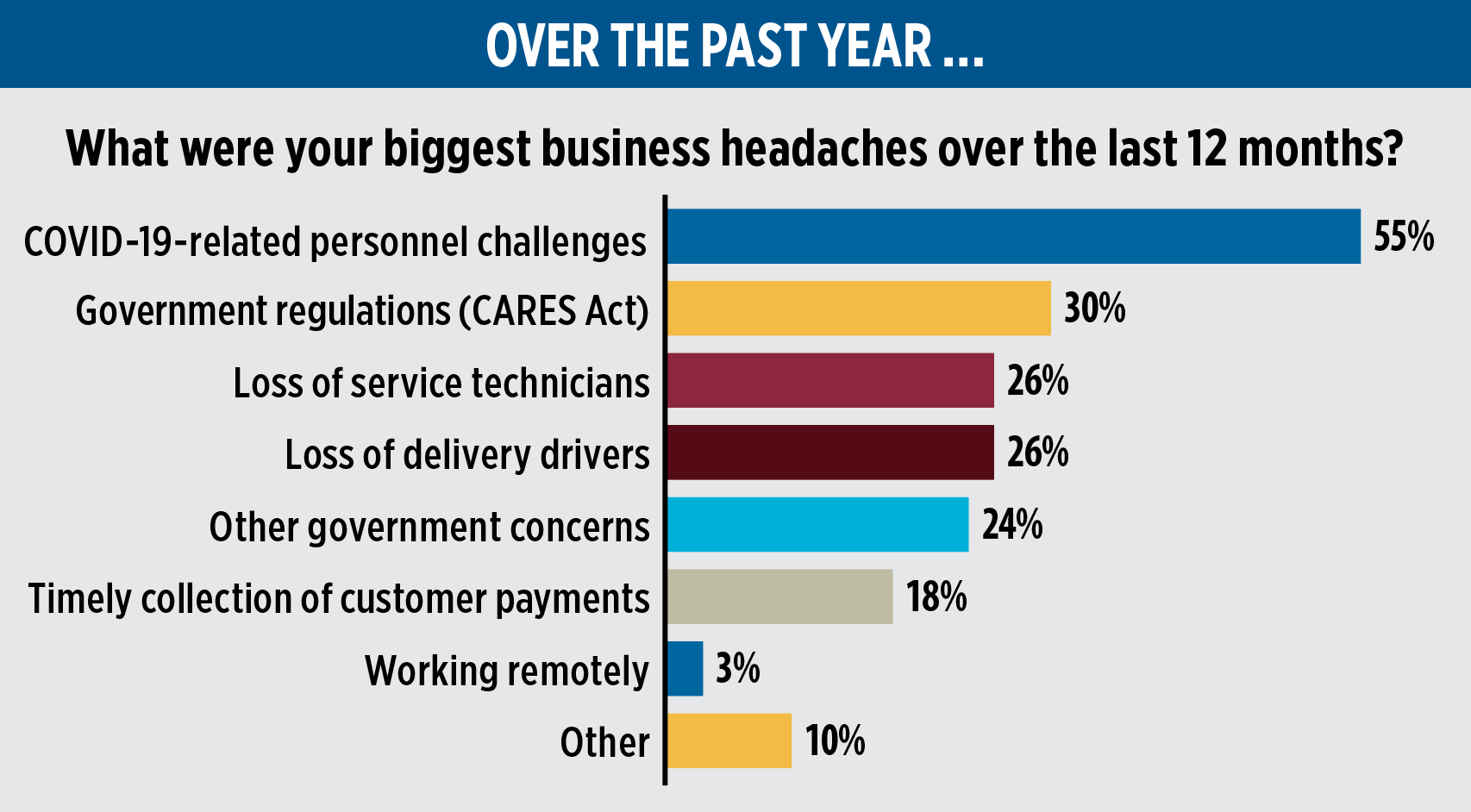

When asked about their biggest business headaches over the past year, the majority (55 percent) indicate COVID-19-related personnel challenges, and another 30 percent note CARES Act regulations, including management of Paycheck Protection Program loans and employee retention credits.

Other government concerns, including taxes and environmental regulation, were the biggest headaches for 24 percent of respondents.

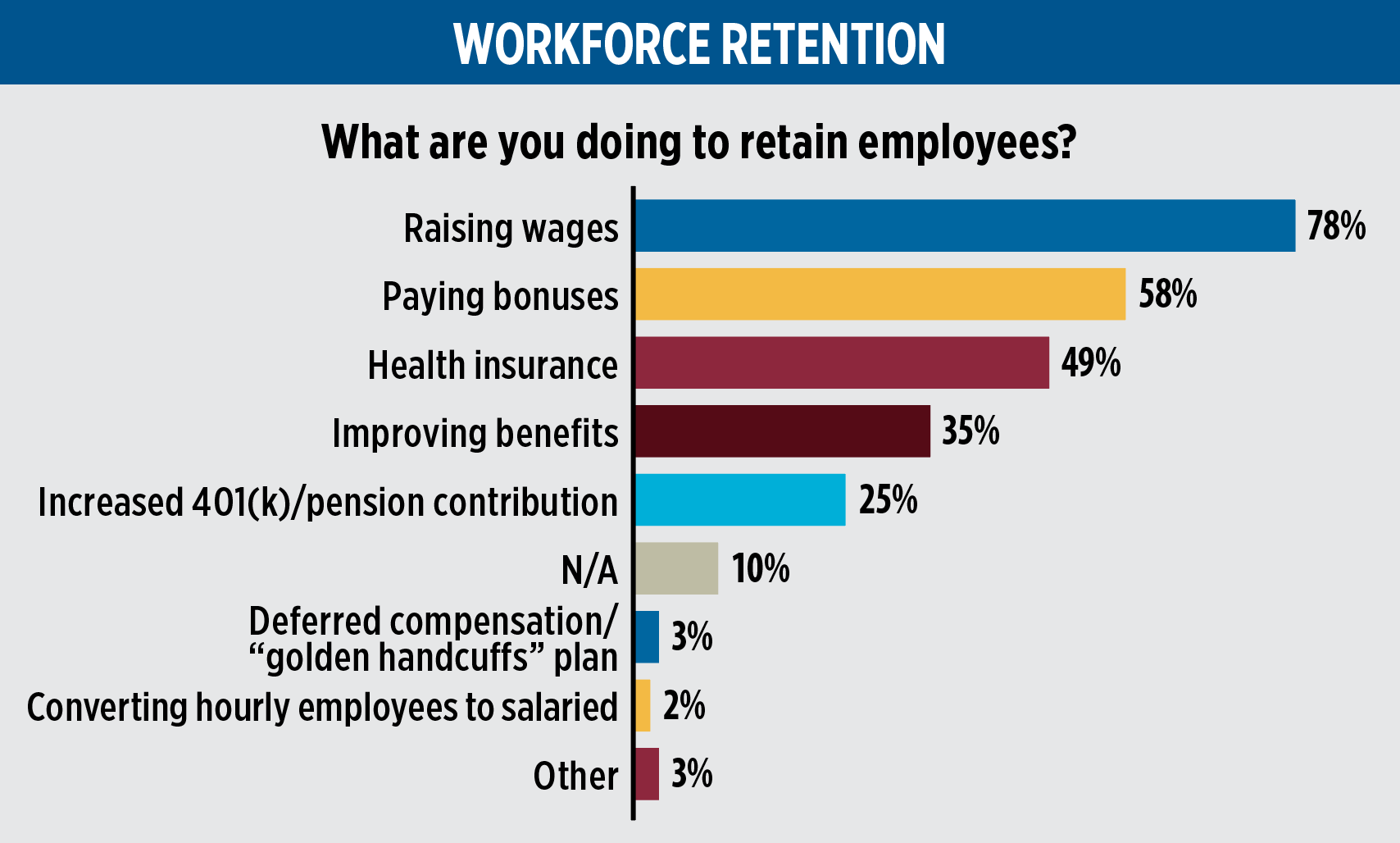

These pressures involved increased operating costs, such as raising wages, which 78 percent of respondents report doing to retain employees.

These pressures involved increased operating costs, such as raising wages, which 78 percent of respondents report doing to retain employees.

Asked what operating expenses increased in the past one to two years besides payroll, health insurance and liability insurance drew the most attention – 62 percent and 61 percent of respondents, respectively.

Kirshner says everyone can expect a 3 percent to 5 percent increase in insurance costs each year, but propane marketers are seeing “astronomical increases” of 20 percent to 25 percent. He attributes those increases, in part, to protection against supply- and distribution-related losses. He also says health insurance premiums likely went up due to COVID-19 claims this year. Forty-nine percent of survey takers say they’re adding health insurance coverage to retain employees.

“If you haven’t evaluated your insurance and put it out to bid, so to speak, that’s the best thing you can do to fight increasing prices,” says Kirshner.

Following increased insurance expenses are increased vehicle expenses (51 percent of respondents), updating software (36 percent) and environmental expenses (7 percent).

While some vehicle expenses reported by survey takers were largely unavoidable – such as higher fuel and steel costs, not to mention delays on the part of maintenance providers – vehicle servicing generally should not be the biggest expense outside of payroll, says Kirshner.

“If your biggest expense is vehicles and it’s because of repairs, then you don’t have a vehicle replacement program in place,” says Kirshner. “Or if you do, it’s not working and you need to implement one, and it’s time to upgrade your fleet.”

Surprising to Kirshner, only 4 percent of respondents report implementing or increasing a delivery fee to recover additional costs due to COVID-19. The vast majority – 91 percent – say they have not.

Most customers, says Kirshner, will not complain about a few extra dollars on their statement, and marketers can easily waive fees for those who do. Meanwhile, the majority of customers who pay the fee generate substantial revenue for the company without additional labor.

Marketers derive similar benefits from implementing budget plans, price protection plans and service contracts. Data supplied by Angus Energy shows that the lifespan of a customer with a budget plan, pricing plan and service contract is almost 10 years, whereas the lifespan of a customer without any of those programs is about 1.5 years.

“If you don’t have a service contract program,” says Kirshner, “you’re not only leaving money on the table, you’re compromising the average life of your customers, and you’re putting yourself at risk. Having a service contract is a very sticky thing to have.”

Rethinking recruitment

Related to pandemic woes was high turnover. Sizeable shares of respondents say that losing service technicians (26 percent) and drivers (26 percent) were their biggest business headaches this year.

While many industries have experienced labor losses during the pandemic, Kirshner points to a more holistic explanation for this result: In short, more employees are retiring from the industry than entering it.

While many industries have experienced labor losses during the pandemic, Kirshner points to a more holistic explanation for this result: In short, more employees are retiring from the industry than entering it.

“I believe that the single biggest investment that a company needs to make over the next five years is in recruiting and retention,” says Kirshner. “I think too much advertising money is spent trying to find new customers, and that money needs to be repurposed into finding and retaining employees.”

Raising wages isn’t enough, says Kirshner. Companies should reconsider what it means to invest in their people, and redesign roles to provide flexible schedules, education and advancement opportunities – characteristics younger generations expect from their workplaces. Kirshner offers a few examples to help propane marketers broaden their thinking:

⦁ Perhaps a driver has a spouse and young children, and would better serve the company on a late shift, rather than an early-morning shift, so he can watch the children during the day.

⦁ Perhaps companies offer promising young employees coming out of high school some college tuition and explain how that education may help them move into management one day.

⦁ Only 3 percent of respondents reported remote work as their biggest business headache over the past year, which suggests to Kirshner that propane companies have already demonstrated nimbleness in adjusting to the future of work.

Confidence holds

Despite political and environmental pressures, a significant majority of companies reported they were highly confident (49 percent) or confident (37 percent) that they would remain a viable energy provider.

Despite political and environmental pressures, a significant majority of companies reported they were highly confident (49 percent) or confident (37 percent) that they would remain a viable energy provider.

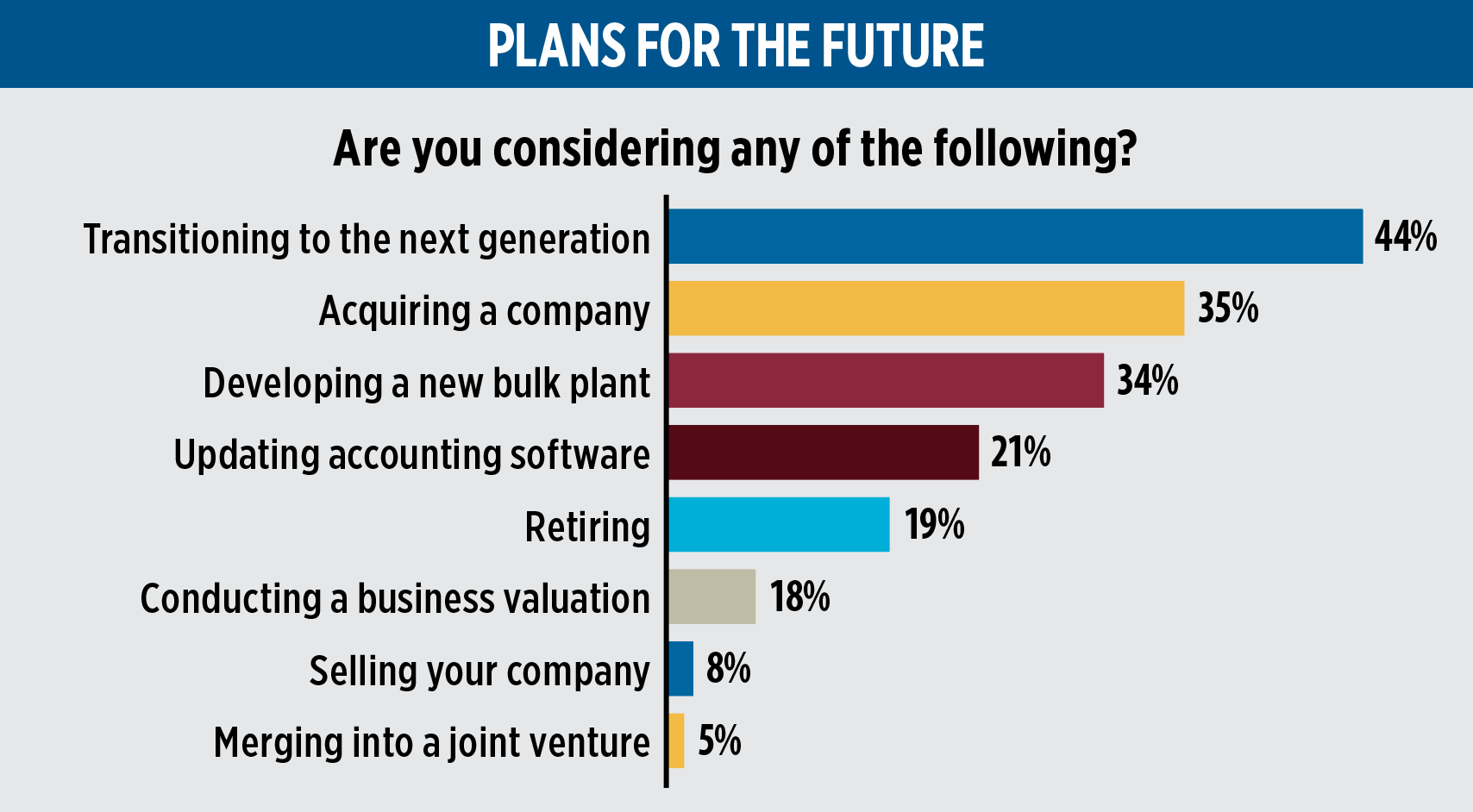

And their plans for the future suggest that level of confidence extends to a next generation of ownership. A substantial number of companies say they’re planning to stay in the propane business either by transitioning to the next generation (44 percent) or acquiring another company (35 percent), a sign of optimism for the future of the industry.

For companies considering selling, it’s never been a better time. The looming potential of a capital gains tax increase and the headwinds some regions, like the Northeast, are facing from the electrification movement have led to more transaction movement, says Kirshner.

“The values of companies are higher than they’ve ever been in propane,” he says.

Propane marketers can find complete survey results – including a regional breakdown of overall results – on Gray, Gray & Gray’s website.

Featured image: jansucko/iStock / Getty Images Plus/Getty Images