Nationwide survey captures industry in transition

This year’s survey offers busy retailers a useful tool to assess their businesses. Photo: iStock.com/kozmoat98

Day-to-day business affords propane retailers few opportunities to step back, assess where they currently stand and determine a path forward. Finding the right tools to inform those decisions sometimes proves more challenging.

Accounting and business advisory firm Gray, Gray & Gray understands that challenge and seeks to provide propane retailers a valuable resource with its annual propane industry survey.

“Our goal in conducting the survey is to create a ‘snapshot’ of the propane industry,” says Marty Kirshner, director of client services and head of the Energy Practice Group at Gray, Gray & Gray. “The information we present gives propane dealers a look at the state of their industry. More importantly, the data can also be used to benchmark their own company’s performance against industry standards.”

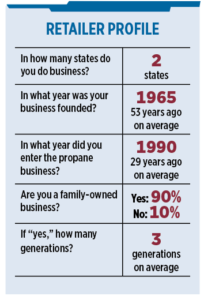

This year’s online survey gathered a wide range of operational and financial information from propane retailers across the country for the year spanning April 2018 through March 2019. It offers many data points of interest, from wages and fee structures to what retailers plan to do next with their businesses.

What’s clear is that the propane industry is coping with difficult changes, including market maturity, succession planning and labor shortages. What’s also apparent is that marketers are facing these difficulties head-on, proactively seeking new avenues for growth.

Survey scope, industry snapshot

While Gray, Gray & Gray has conducted the survey since 2016, it is the first year the firm expanded its distribution to propane marketers nationwide.

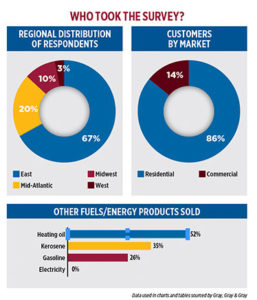

The survey’s debut on the national level resulted in somewhat skewed data on the regional level. The majority of survey takers – 67 percent – are based in the East. And a significant segment of respondents – 52 percent – report selling heating oil in addition to propane, a business model more common in the Northeast than in other regions.

Kirshner explains that retailers on the East Coast familiar with Massachusetts-based Gray, Gray & Gray may have been more inclined than others to take the survey and that the firm expects a more evenly distributed response in future years as the survey gains traction.

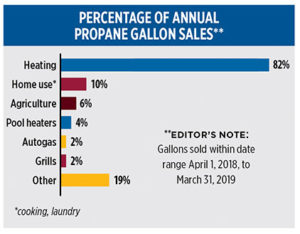

The results nevertheless address concerns of national interest. The data captures a mature industry still reliant on residential heating, for instance. Respondents indicate that 86 percent of their propane customers were residential accounts and that of gallons sold that year, heating comprised 82 percent. Other uses of propane in the home – to power stoves, laundry machines or other appliances – are a distant second to heating, with survey takers who offer these services indicating they accounted for 10 percent of gallon sales during that time frame.

Growing pains

The most notable consequence of market maturity and an aging workforce is industry consolidation.

“We are in a mature industry, and many larger companies are in acquisition mode to build value in their business,” says Kirshner.

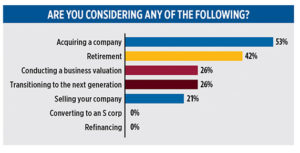

Moreover, 42 percent of respondents say they are considering retirement. When the next generation of a family-owned business does not want to take over, selling the company is sometimes the only option.

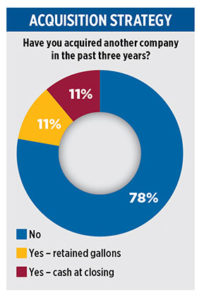

It’s nevertheless an attractive option, as buyers are apparently plentiful. Fifty-three percent of survey takers – even more than those looking to retire – are thinking about acquiring another company.

This level of interest suggests forward momentum in the industry, despite concerns about market maturity. Kirshner interprets ongoing merger activity as a “positive sign,” demonstrating a commitment to growth.

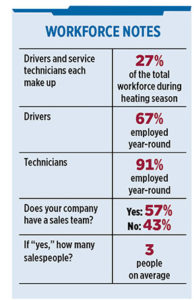

Where succession is secure, companies still need to address aging staffs. As many drivers and service technicians reach retirement age, retailers are struggling to find qualified replacements.

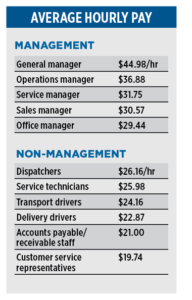

This imbalance explains why hourly wages are up for all positions compared to previous surveys.

“It is a supply and demand situation,” says Kirshner. The fewer the candidates, the more propane retailers are willing to pay for talent.

These workforce woes – like increased merger activity – may simply signal the growing pains of an industry in transition. Increased wages suggest that many retailers are willing to invest in constructive changes to build strong futures for their businesses.

Sales managers, for instance, saw the highest spike in hourly wages according to the survey.

“Companies are hiring more experienced and successful – thus, more expensive – sales managers to help grow gallons organically,” explains Kirshner. “They see this as a viable option to avoiding an acquisition and taking on additional debt.”

Organic growth strategies

When asked how they were trying to grow gallons organically, marketers’ most popular response – at 33 percent – was converting customers to propane from other fuels like heating oil.

Fuel oil marketers are expanding their propane lines for a variety of reasons, whether it’s better margins or supply concerns. While this result may partially reflect the survey’s focus on Eastern dealers, it also highlights the broader importance of diversification in the energy space.

And for dealers looking to expand the use of propane beyond home heating, the options are, as one might expect, diverse.

Marketers are raising wages to recruit the next generation of employees. Photo: iStock.com/Kris Hanke

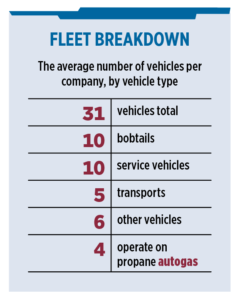

Those considering making the leap into autogas are certainly not alone, suggests the survey, even if those who have tried it report the fuel accounts for a minimal portion of gallon sales – just 2 percent – during the survey period. Respondents also expected slimmer margins for those autogas gallons than residential ones: target margins for autogas were 63 cents per gallon compared to $1.28 per gallon for residential heating.

Kirshner explains that tighter margins may be a function of the competitive bidding process involved in securing autogas accounts, as well as a greater focus in some cases on volume over margins. He nevertheless emphasizes that autogas is “an excellent diversification opportunity that can ‘fill in’ summer months.”

Propane retailers seem to agree it’s a great opportunity, if the percentage of marketers using, or at least thinking of using, propane autogas in their own fleets is any indication of the market’s potential for growth. Fleet conversion can be useful for marketing the fuel to prospective customers.

Current use of autogas in propane fleets is split almost evenly, with just over half of respondents saying they run at least a portion of their fleets on autogas. Forty-seven percent are open to the idea of doing so in the future, while 42 percent indicate they are unsure. Few respondents – only 11 percent – refuse to consider incorporating autogas in the future. Whatever barriers to entry currently exist, then, the data suggests plenty of room to grow.

Outside autogas, respondents reported pursuing organic growth in residential applications other than heating. Sixteen percent say they are trying to gain market share with water heaters, the second most popular response after converting from other fuels. Eleven percent are exploring outdoor living products such as pool heaters and gas grills. To a lesser extent, survey takers are focusing on fireplaces and working with builders and contractors.

Given the variety of opportunities in the residential market, Gray, Gray & Gray’s Energy Practice Group sees expanding into home services as a viable growth strategy.

“We see a future of propane dealers becoming ‘home services’ companies that also happen to deliver fuel,” Kirshner says.

The more things change

Just as important in retailers’ minds as new markets and applications are good service and marketing. At 11 percent each, these tactics rank as high as outdoor living for achieving organic growth. In many ways, then, the basic tenets of running a successful business have stayed the same.

Gray, Gray & Gray sees LPG retailers becoming “home services” companies. Photo: iStock.com/Mikefahl

And they apparently work. Respondents attribute 48 percent of new sales to marketing – whether by traditional means (e.g., print, radio, TV and direct mail) or via digital platforms (e.g., email, websites and social media). Customer referrals and the sales team are a close second and third, at 36 percent and 35 percent, respectively.

Of course, even these pockets of stability are seeing healthy changes. Marketing methods, for instance, are evolving rapidly. According to Gray, Gray & Gray, attribution of digital marketing for sales growth is up 10 percent from the previous survey, one final example of how retailers are embracing change.