Infrastructure: friend or foe of propane retailers?

Propane-related infrastructure gained much attention in LP Gas magazine in recent months.

A three-month look at propane supply and distribution issues, especially amid the COVID-19 pandemic, allowed us to delve deeper into topics that seem a bit more front and center for propane retailers at this time of year.

Not only did we learn the finer details about specific projects, but we shared some key messages for propane retailers from the sources we interviewed.

Propane-related infrastructure is a broad category, of course. In recent years, we’ve tended to hear more about the projects designed to move propane out of the U.S. market. Moreover, developments in U.S. infrastructure during the shale boom haven’t necessarily benefited the propane retailer.

For example, the reversal of the Cochin Pipeline in 2014 became one of the biggest, more recent infrastructure-related stories for the industry. Cochin had been moving more than 300 million gallons of propane from Canada into the U.S. Midwest before Kinder Morgan stopped flowing propane into the U.S. and decided to transport condensate westbound. That business decision was based on the growing supply of oil and gas products in the nation’s lucrative shale plays.

The Cochin Pipeline reversal came around the same time as the 2013-14 winter, which challenged propane’s supply and distribution channels in some regions of the country. As a result, the industry was forced to adapt and consider its own alternative solutions from an infrastructure standpoint – rail terminals, additional company and customer bulk storage, or technology advancements.

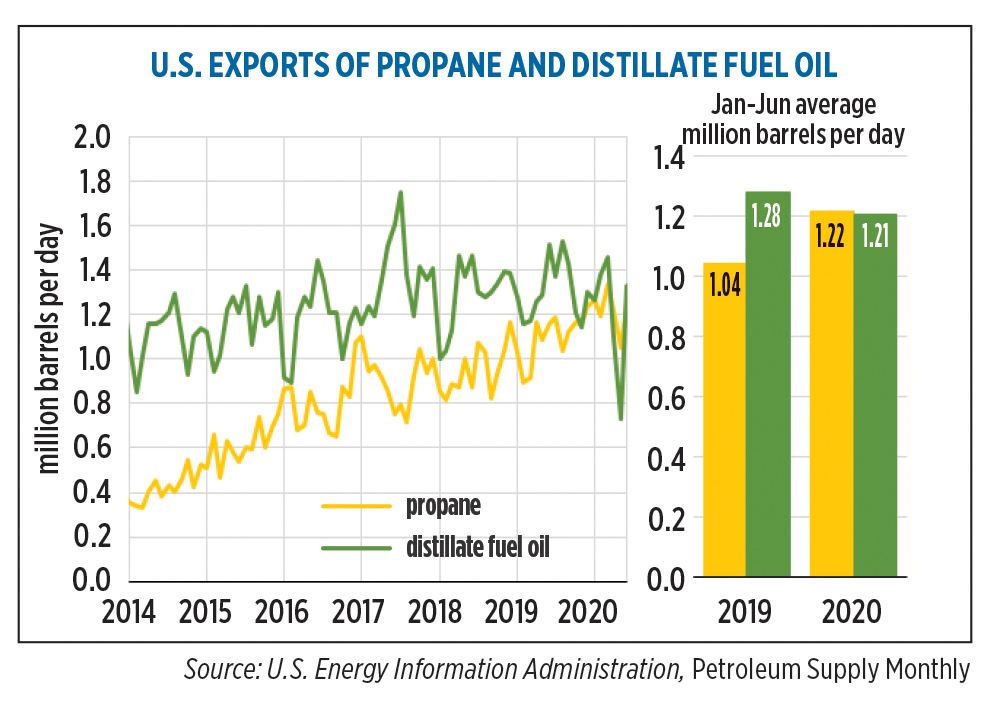

A reduction in Chinese tariffs on LPG stimulated exports in 2020.

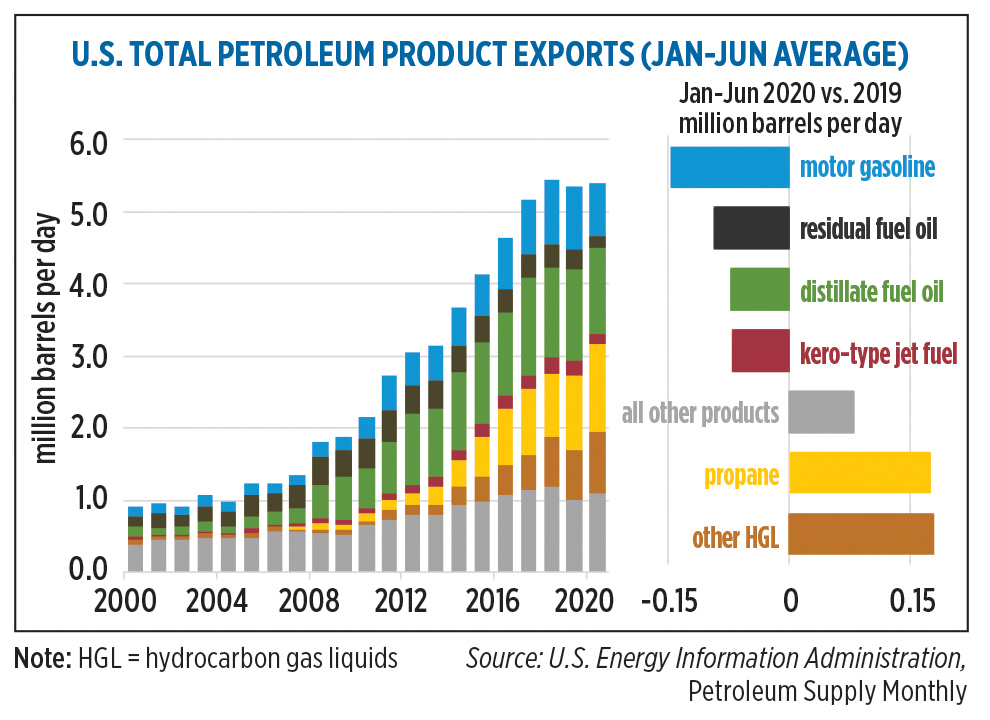

Now in 2020, amid years of soaring propane supply owing to the U.S. oil and gas boom, companies are exporting propane at an increasing rate. In fact, U.S. propane exports averaged 1.2 million barrels per day (bpd) in the first half of 2020, an increase of 175,000 bpd (17 percent) from the same period in 2019. While COVID-19’s impact on the market has yet to be fully realized, word is the export trend will only continue as we move into 2021.

“The Chinese market is going to start heating up as we head into 2021,” says Jeff Thompson, a supply and risk management consultant for Propane Resources. “More facilities and units in China are going to need NGLs. This will keep the U.S. export [market] robust.”

Most propane exports head for Asian markets.

Industry leaders like to remind propane retailers about this dynamic – that the domestic market can’t consume all of the propane available to it. The availability of U.S. propane supply and the profitability that companies realize through export projects will keep this cycle moving at a rapid clip.

Retailers have probably grown tired of hearing they’re not the only “game in town” anymore – not with export facilities such as AltaGas’ in western Canada, Energy Transfer’s Marcus Hook complex in the eastern U.S., and ongoing activity on the Gulf Coast. But those are the underlying messages that market analysts and consultants continue to stress.

Utilize tertiary storage and take control of your own propane supply situation with proper planning and resource utilization, they say. Don’t be lulled into a false sense of security based on ample U.S. propane inventory, especially with the unknowns created by the novel coronavirus pandemic.

“There needs to be more focus on reliable supply from the retail side,” echoes Mark Rachal of Cost Management Solutions, referencing the unknown future of crude demand and production, as well as propane dehydrogenation plant projects in China that could consume massive amounts of propane.

Our look at U.S. propane infrastructure in recent months revealed facts and figures about several new, updated or planned projects. Notable here is that the majority of these projects can help serve the U.S. propane retailer.

Here’s what we shared:

- Blackline owns Sea-3 LLC in Newington, New Hampshire, and Sea-3 Providence in Providence, Rhode Island. In the last several years, the company built a new 16-spot rail rack to go with its five truck-loading bays in Newington, and added 270,000 gallons of propane storage capacity. It now has nearly 27 million gallons of storage at that facility. Providence is slightly smaller at 18 million gallons of storage capacity with three truck bays. Both facilities have import and export capabilities.

- Silver Wolf Midstream formed earlier this year with the goal of acquiring and repurposing a natural gas pipeline in Michigan for propane supply and distribution throughout much of the state. The company is in the final stages of securing an existing 225-mile, 8-in. coated steel line, which it’s naming the Michigan Express Pipeline.

- Energy Transfer has continued to make progress on major capital projects throughout the U.S. The company said it plans to finish work on its Mariner East 2X natural gas liquids pipeline in Pennsylvania by the end of the year and the final phase of the Mariner East projects in the second quarter of 2021, according to Reuters.

- Enterprise Products Partners is planning to open a new propane terminal near El Paso, Texas, in the first quarter of 2021 with a capacity of about 15,000 bpd, the company says.

- Phoenix Park Energy Marketing plans to construct the Southern Gateway Rail Hub, a 30,000-bpd LPG rail terminal in Corpus Christi, Texas, to serve export markets from local LPG supply sources.