Inventory builds are slowing; propane market takes note

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explores why inventory builds are slowing down.

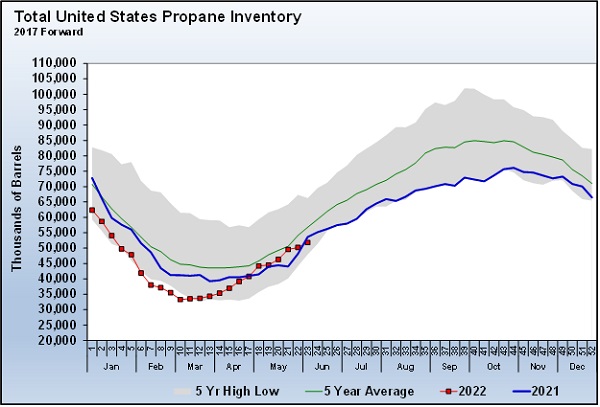

U.S. propane inventory builds have been below average this month. When we discussed propane fundamentals at the end of May, we said we were sure the inventory-build period could not have gone much better than what it had so far. During the first week of March, inventory hit its low for the year at 33.308 million barrels. The first week of March is the earliest the inventory drawdown ends and the inventory build begins, so we got an early start on inventory accumulation. Then, throughout March, April and May, the inventory builds were generally above average. By the end of May, inventory had gained 16.264 million barrels, climbing to 49.572 million.

The inventory builds have been light this month, coming in below average and below industry expectations.

At the end of May, inventory had significantly erased the deficit to last year that was present as winter ended. In fact, inventory was setting new five-year lows when the inventory drawdown ended. When it ended, inventory was 7.891 million barrels below 2021, a major support for propane prices. By the end of May, inventory was 5.505 million barrels above 2021 and very near the five-year average for week 21 of the year.

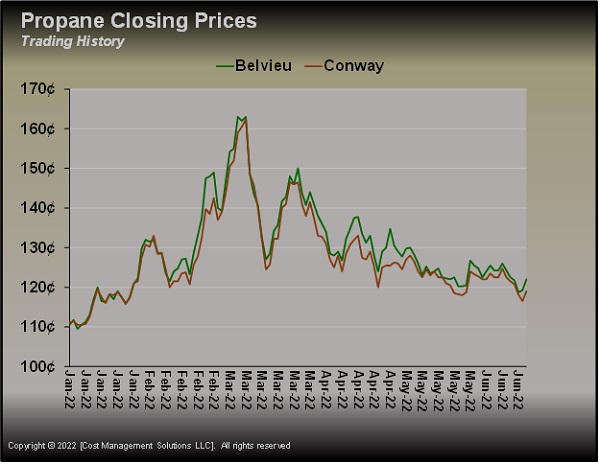

Chart 2 shows what the improvement in inventory did to propane prices. At the beginning of the inventory build, prices were above 160 cents, and by the end of May, they were below 120 cents. But you can also see the uptick in propane prices over the last couple of weeks, as the inventory accumulation has lost momentum.

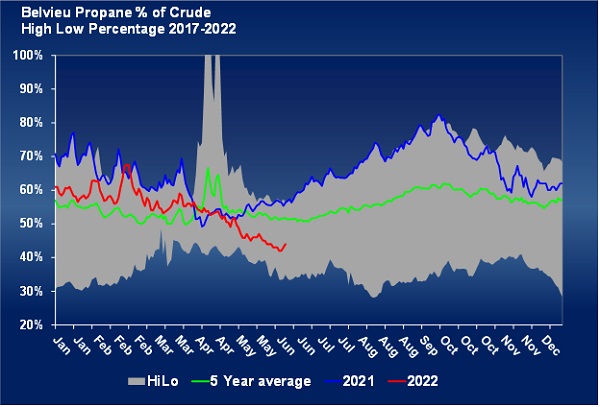

The lost momentum is also being reflected in propane’s value relative to crude. At the beginning of the inventory-build period, the market had propane valued at around 60 percent of crude. By the end of May, propane was just above 40 percent of the value of WTI. This was certainly an indication that propane’s fundamentals were improving compared to crude’s. This allowed propane’s value to come down even as crude’s price went higher. Had the inventory not built as strongly as it did, we could easily be looking at 164-cent propane today.

As good as the overall inventory-build period has been, the developments of the last couple of weeks are worth noting and monitoring. Propane’s inventory is now below last year. Its price is rising and its value relative to crude is suddenly on the uptick. Hopefully this is a temporary development, but for now the market is taking note. An above-average inventory build this week and the gains over the last couple of weeks could easily be given back. A developing downturn in crude could help as well.

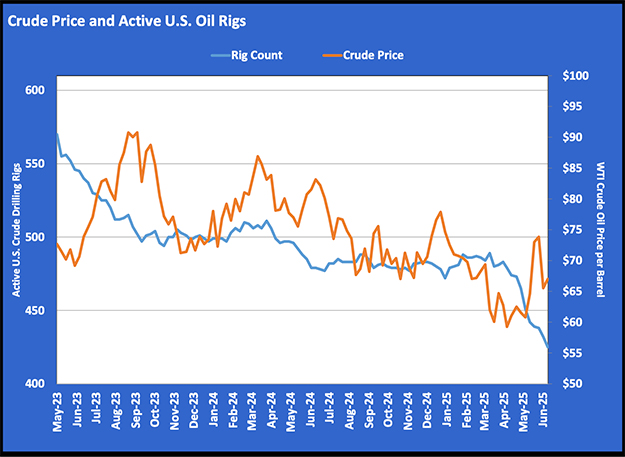

The good news is that there isn’t anything jumping off the page as a major issue. Propane production is still very good and is easily offsetting lower propane imports. Propane exports have been good, but the gain has only been 75,000 barrels per day (bpd) this year, compared to a gain in production of 148,000 bpd over the same period. Growth in domestic propane demand this year is certainly not what we had seen during the pandemic. Domestic demand is up just 3,000 bpd this year. The drop in propane imports has been 25,000 bpd year to date, but we don’t think anyone has been surprised by that drop.

So, the recent weaker inventory builds that have been supportive of propane’s price may be temporary. But buyers need to be aware that propane’s relative value to crude is still very good, and its price is still nearly 40 cents below the high for the year. If the trends of the last two weeks persist, it might be a good time to consider a first layer of price protection for next year. To be sure, we wouldn’t bet the farm either way. There are simply too many economic and geopolitical factors in the market that could change the pricing environment for energy quickly and dramatically. It’s going to be a year in which we need to give ourselves room to adjust.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.