Inventory history provides perspective on current levels

Last week, the U.S. Energy Information Administration reported U.S. propane inventory had fallen to 36.759 million barrels for the week ending March 16.

The draw on inventory for the week was 2.061 million barrels. A survey of industry experts showed an average expectation for a 1.2-million-barrel draw. The five-year average draw for week 11 of the year has only been 75,000 barrels. In fact, it is not unusual to see Gulf Coast inventory increasing during week 11 to begin the summer build period.

The above-average draw on inventory occurred primarily due to a 232,000-barrel-per-day (bpd) increase in exports. U.S. domestic demand fell sharply during the week by 306,000 bpd, but remained 133,000 bpd higher than the same week last year. Combined domestic demand and exports were 2.283 million bpd compared with production and imports of 1.989 million bpd, resulting in the 294,000-bpd draw on inventory.

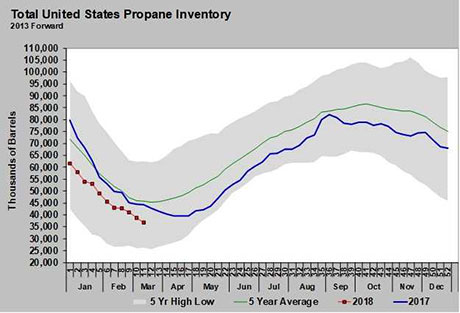

As the chart above shows, inventory levels are below the five-year average (by 9.064 million barrels) and last year’s levels (by 7.574 million barrels).

The inventory level is low compared with the last three years, when U.S. inventory began the winter at record high levels. At this point in 2015, inventory was at 54.284 million barrels; in 2016, it was at 62.5 million barrels; and in 2017, it was at 44.333 million barrels. Compared with those three years, the current inventory level feels a bit ominous. However, we must remember those late winter inventory levels the previous three years were the result of huge starting inventory levels. Those high-starting inventory levels were due to U.S. propane supply far exceeding demand and a lack of export capacity to deal with the imbalance.

When looking at late winter inventory levels from 2003 through 2014 – before that supply imbalance occurred – the average inventory position was 29.682 million barrels at this point in the year. So while the current inventory position of 36.759 million barrels is low compared with the last three years, it is not in uncharted waters.

If we see a few more weeks like last week, with a inventory draws that exceed the normal draw by more than 2 million barrels, we could see more upward price pressure. For reference, inventory dropped to a low of 39.643 million barrels before it started to build last year. So best-case scenario, we already know this inventory build will begin at 3 million barrels below that mark.

The typical inventory low was around 25 million barrels between 2003 and 2014. With all the growth in production late in 2017, we don’t expect to see draws on inventory much longer unless exports stay robust; therefore, it would be a major surprise if inventory fell to anywhere close to that 25-million-barrel mark.

At current demand, days of supply are at 16, which is very low. At 25 million barrels, days of supply would be down to 11. If that would occur, a lot more upward price pressure on propane would have to develop. Prices would have to increase enough to back out a considerable amount of the export volumes.

It’s late in the winter heating season and propane retailers are no doubt worn out. However, it is already time to prepare for next winter. Watching how these inventory scenarios play out over the next few weeks will likely play a key role in shaping buying plans for next year’s supply.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.