Inventory movement raises questions about propane prices

Join Cost Management Solutions for a free 30-minute Virtual Hedging webinar on Tuesday, July 30 at 10 a.m. CT. Register here.

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains the relationship between propane exports, inventories and prices.

Catch up on last week’s Trader’s Corner here: LP Gas Growth Summit offers venue to talk supply strategies

We take ownership of things that affect our lives and our livelihoods, even when we don’t have direct control of those things. As propane retailers, we don’t drill for oil and gas wells that produce the hydrocarbons that continue the propane we sell. We don’t own the natural gas processing plants, refineries or fractionators that yield the fungible propane we use. Nor do we, in most cases, own the trucks, railcars or pipelines that deliver our valued propane to our bulk tanks. But we certainly have a vested interest in all of those things, and, justified or not, we feel ownership in that propane all the way through the value chain.

Because of those feelings, it doesn’t feel good when we pay higher prices for propane and see a lot of U.S. propane being shipped overseas.

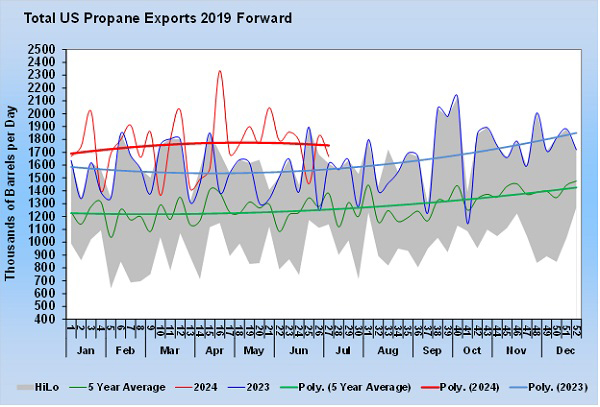

The chart above shows propane exports. First note how much higher this year is than the five-year average. Weekly volumes are volatile, so we focus on the trend lines. This year’s volume is also much higher than last year. So far this year, exports have averaged 1.752 million barrels per day (bpd), putting them 200,000 bpd higher than last year through the same period. If there is any good news in that chart, it is that this year’s export line is trending down currently. Further, we think the sustainable export rate is about 1.8 million bpd even though in some weeks exports are reported higher than that rate. Consequently, exports are near maximum until more capacity is added.

Though it doesn’t feel good to have “our” propane exported, it is a good thing. What it means is that we have an abundance of propane in this country. Last year, the U.S. averaged 1.001 million bpd of domestic propane demand while production ran 2.451 million bpd. Those upstream of retailers in the supply chain are providing more than double what U.S. retailers and their petrochemical cousins (who also take “our” propane) need.

Without exports, propane would be free. That is hardly an incentive to invest in all of that infrastructure needed to get the propane needed at the retail level. Free markets will do their thing, and propane exports are an essential part of the thing. Sharing is a part of abundance, and we would rather have abundance with sharing than scarcity.

Propane inventories

It is that mindset that brings us to share something about U.S. propane inventories.

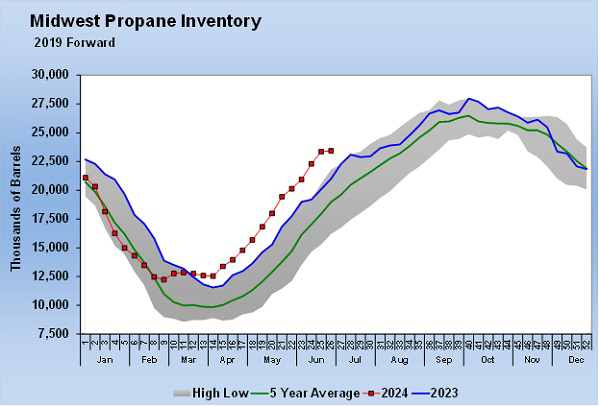

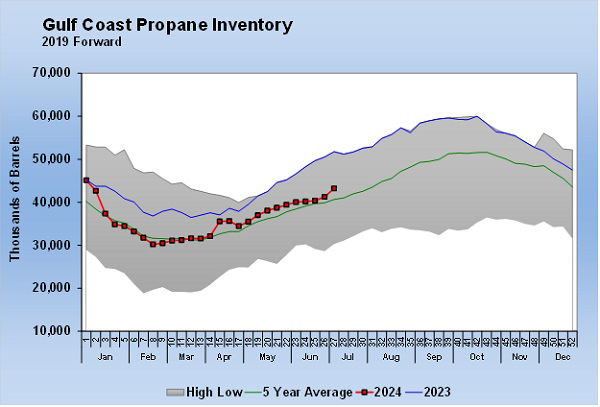

The U.S. Energy Information Administration reported that for the week ending July 5, Midwest propane inventories increased just 74,000 barrels. Meanwhile, Gulf Coast inventories increased nearly 2 million barrels. Midwest inventories have been running at a surplus to last year since late March.

Meanwhile, Gulf Coast inventories have been running a deficit against last year.

Propane prices

Even though the current price difference between Mont Belvieu and Conway would not suggest propane would be moving from the Midwest to the Gulf Coast, the inventory data makes us wonder if some did. Or perhaps a producer that has the option of sending production to either hub made the switch to the Gulf Coast. We note in the Midwest chart that a similar thing happened last year – just a little later in the year.

The first reaction as a Midwest propane dealer is, “What are they doing with ‘our’ propane?” Indeed, the Thursday after this inventory data was released, Conway propane’s price went up, while Mont Belvieu prices went down. Consequently, a buyer in the Midwest would have an initial reaction that “This development is not good for me.” But that may not be true.

On Friday, Conway propane was down with Mont Belvieu propane, and both went against crude, which was up on that day. Markets do not like imbalances. The inventory deficit to last year on the Gulf Coast has been a worry and a support for propane prices. We think that support carried over to Conway’s price as well, even though Midwest inventories were in much better shape.

We would argue that improving the inventory position on the Gulf Coast will bring relief to propane markets and perhaps take some of the pressure off prices. By association, we think that Conway propane prices would ultimately benefit from the tighter Gulf Coast inventory being resolved, even if it means giving up the surplus in the Midwest. In general, our philosophy would be if the market is comfortable with inventories everywhere, it is good for all pricing points. Conversely, if the market is concerned about inventories in any one region, it is a support for all pricing points.

Sharing is not always easy, but we think retailers in all regions will benefit if the inventory position on the Gulf Coast is improved, even the region that may be doing the bulk of the sharing. Midwest dealers can only hope if some of “their” propane is being sent south that the fine gesture comes back to them twofold. Subdue the thought of “no good deed goes unpunished” if you can.

All charts courtesy of Cost Management Solutions