Inventory position differences only partly explain price-spread trend

For several weeks, the Energy information Administration has reported above-average inventory builds. However, the builds have not been evenly distributed throughout the nation. Most of the builds have come in Gulf Coast inventory, while Midwest inventory gains have been much lighter.

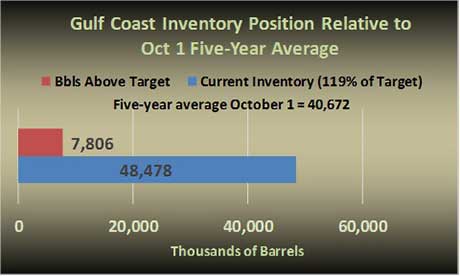

The chart above shows the current status of Gulf Coast inventory compared to where inventory has averaged starting in winter over the last five years. Over the last five years, Gulf Coast inventory has averaged 40.672 million barrels at the first week of October. Gulf Coast inventory is already at 48.478 million barrels, or 7.806 million barrels above the five-year-average start of winter.

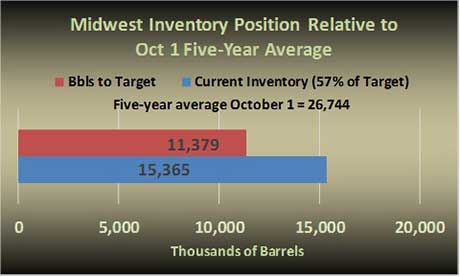

The situation is quite different in the Midwest. Over the last five years, Midwest inventory has averaged 26.744 million barrels at the first week of October. Current inventory stands at 15.365 million barrels, or 11.379 million barrels less than the five-year-average-start-of-winter position.

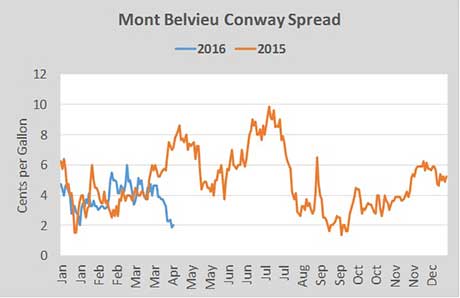

At least partly as a result of the vast differences in inventory positions, the price spread between Mont Belvieu and Conway propane has been tightening in recent weeks.

The chart above shows the price spreads between Mont Belvieu and Conway over the last two years. Mont Belvieu has been higher than Conway throughout the entire two-year period.

Note how at the end of March 2015 Mont Belvieu’s price was nearly 6 cents above Conway’s price. However, the spread has recently dropped to less than 2 cents. Last year during the same time, Mont Belvieu’s premium to Conway was increasing and stayed elevated throughout most of the summer months.

Interestingly at this time last year, Gulf Coast inventory was 118 percent of its five-year average at the beginning of its winter inventory position, which is essentially the same as it is today. Midwest inventory was 65 percent of its average beginning-of-winter level, not far from the 57 percent it stands at today. Yet the price spread is moving in totally different directions. So there seems to be more at play here than just the discrepancy in inventory positions between the Gulf Coast and the Midwest.

This could certainly be an indication of adjustments in the ability to handle Midwest or Canadian production. It could be a change in where barrels are moving to out of Canada or export options for the Utica/Marcellus production in the United States.

In any case, the price spread is an indication that traders do not believe that Conway propane should be steeply discounted to Mont Belvieu at this point. Last year at this time, that was not the case. This has us on alert for the potential of a different pricing environment for Conway supply this year.

Charts: Cost Management Solutions

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.