Is it time to buy propane price protection this winter?

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, evaluates propane prices and whether or not propane price protection should be considered for this winter.

Propane prices dropped around 19 percent during the month of September and dropped even more over the first couple of days of October. Prices have recovered some, but it still may be a good time to buy price protection for this winter and maybe beyond.

We will look at several reasons to consider price protection, but we are going to begin with the simplest one that should also give the buyer the most confidence. We believe that, in general, if we can buy propane at or lower than what we paid the previous year, we should take advantage. No matter what we present as reasons to buy, propane prices could still go lower. Once we make the decision to get price protection either through storing, pre-buying or using swaps, there is a risk to falling prices.

However, there are times when taking that risk is worthwhile, and one of those is when the market allows you to buy at or better than last year’s price. Propane retailers are sometimes hesitant to take advantage of potential good buys most often because they fear prices will fall, putting their competitors at an advantage. That situation could result in lower margin or even losing customers.

For a moment, let’s imagine we don’t have to let what our competitors “might” be able to do dictate our decisions. Let’s focus instead on the proposition between us and our customers. Right now, an October-March strip of propane swaps could be struck at an average price of 95 cents. That is in Mont Belvieu (MB), so a dealer would have to add the normal differential in pricing at MB and the cost of propane in his tank plus margin to determine what the customer would pay. At this time last year, that same strip of swaps would have struck at 126 cents, 31 cents more.

In a world of inflation where everything, including crude, gasoline, heating oil and natural gas are all higher (in some cases much higher) than last year, we could be offering propane at a lower price than last year and, should we choose, at a better margin. In fact, that same strip for the two winters beyond this one is even lower. Keep in mind that the Federal Reserve is predicting that inflation will not be back to its target rate of 2 percent until 2025. So, if we were not fearing the unknown of what our competitors “might” do, that seems like a very nice value proposition to offer our propane consumers. We could cover the next three winters at an average price of 87 cents (MB) and offer our customers better than 30-cent lower prices over a period of projected higher-than-normal inflation.

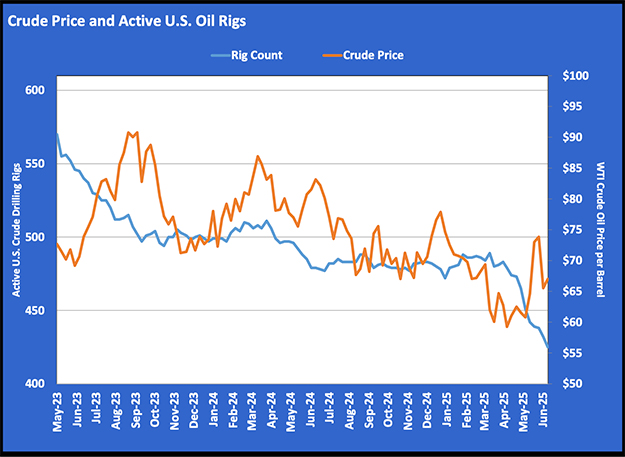

Propane prices have been driven down from their highs first and foremost by a drop in crude’s price. Crude has been in a four-month downtrend in prices that is currently showing its strongest signals yet that an uptrend may be ready to start. Crude has broken above technical resistance after buyers were encouraged by a cut in OPEC+ production. OPEC+ cut its production quota by 2 million barrels per day (bpd) starting in November. Since many of its members are already producing below quota, the actual decline in supply will be closer to a million bpd. That is still significant considering crude supply was already expected to be tight in 2023 despite the potential for lower demand during economic weakness. Sanctions that the EU has put on Russia will take full effect in December, and Russia’s allies have shown a little more reluctance to buy its crude as Russia has lost the momentum in its war in Ukraine.

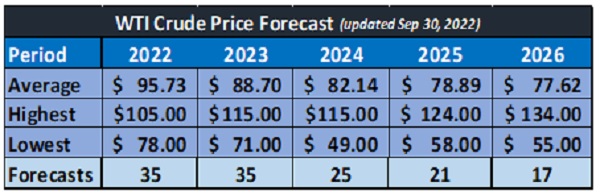

On Sept. 30, a new analyst’s survey showed expectations for crude’s price lower.

The forecasts were down slightly from last time, but that was before the OPEC+ production cut was known. Some of the analysts on this survey have already sent out notices that they are upping their forecasted price for 2023. At this point, there is a good chance of crude prices being at or higher in 2023 than they are currently. At the least, crude is unlikely to be a major drag on propane prices. Keep in mind our recent Trader’s Corners. Releases of crude from strategic reserves are about to end, and production has not increased enough to replace them.

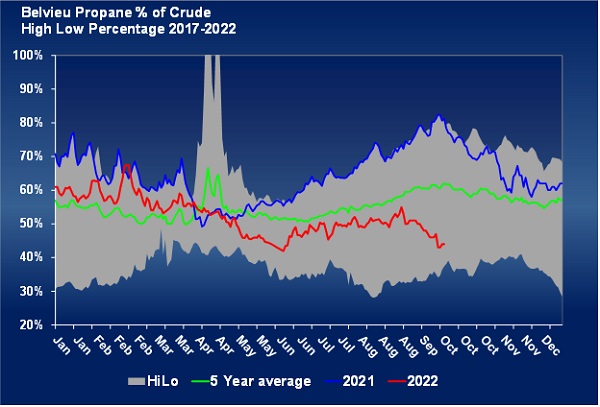

Propane prices relative to crude’s price are very low for this time of year.

As we write, MB propane is trading at 42 percent of WTI crude. That is a very low relative valuation that has resulted because of a surprisingly strong build in propane inventory over the past five weeks that has put it around the five-year average for this time of year. Over the last five years, propane has been valued at 62 percent of crude at this point in the year and was at 81 percent at this time last year. Propane has fallen relative to crude because of the build in inventory, forecasts for mild temperatures during October and low crop-drying demand. This relatively low value to crude represents upside price risk. Looked at in the other direction, it could represent a buying opportunity.

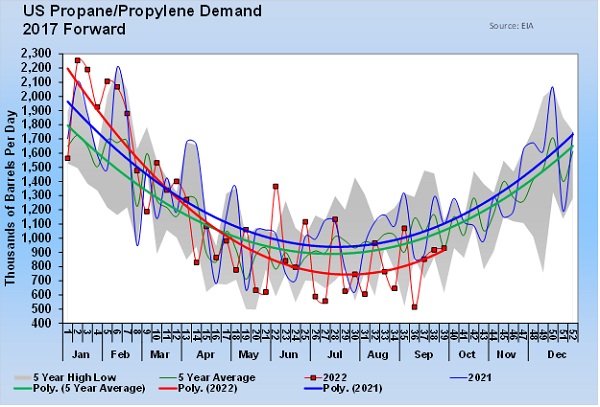

We have mentioned it in previous Trader’s Corners, but we have concern about the potential for pent-up demand. Consumers may be putting off buying propane until the last minute because budgets are stretched due to higher costs for basics such as food, utilities, gasoline and just about everything else.

Propane inventory hit its low during the first week of March this year. The inventory-build period for this year began the next week. During the time since, U.S. propane demand has averaged 893,000 bpd compared to 1.066 million bpd during the same period last year. That is a 173,000-bpd, 16 percent, drop. There is the potential for at least some of that decline to be delayed preparation for this winter, which represents pent-up demand increasing upside price risk.

In April, we thought any buy made when front-month propane reached around a dollar per gallon would be a safe bet for this winter. The lows of September and early October exceeded our expectations. When prices fall like they have in the last five weeks, it can make us a little hesitant to see any price as an opportunity. Yet, we still think buys made when front-month propane reached a dollar were the right decision. That makes us even more confident in buys now that front-month propane is at 91 cents.

Even if prices dip again and our competitors are astute enough to buy at the lowest price of the year (which we always assume they will for some reason), we still think buys here are safer than normal for a few reasons:

- The most obvious is if we are offering lower prices than last year, our customers are going to be less motivated to make a change.

- Steel is very expensive, and the cost of borrowing is up. So, we wonder how many competitors have an abundance of tanks on hand to set for new customers?

- Everyone seems to be struggling to get fully staffed, so will competitors have the personnel available to aggressively go after new business?

There will always be those dealers out there who measure success on volume sold. But more and more, we find retailers seeing that as a losing strategy. We hear dealers talking margin over volume, quality over quantity. Given the current economic conditions, we see no reason that trend will not continue. One way to support that trend is to buy when the market gives us an opportunity. We believe enough upside risk remains to view current prices as an opportunity.

Even if we are wrong, we don’t think the threat to our business from that competitor who always buys at the lowest price of the year to be that strong. Seriously, does that competitor really exist? Is it possible we are competing against Bogeyman Propane that is a figment of our own nightmares? Maybe, maybe not. But what we do know is that our customers are real, and we have the opportunity to offer them a very nice value proposition for this winter and beyond should we choose.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.