Last week’s warning signals didn’t pan out

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why a small shift in propane price last week did not end up being the early warning signal expected.

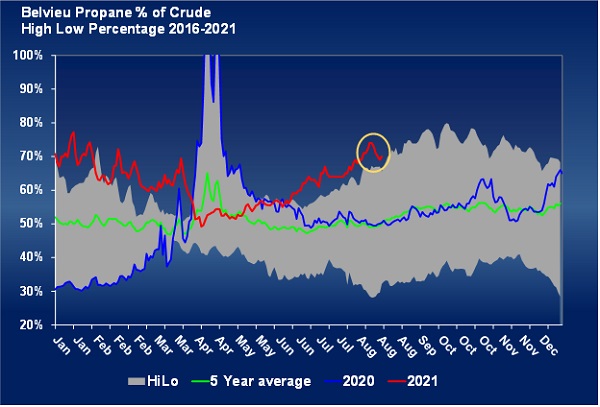

Last week’s Trader’s Corner focused on softness in propane’s price relative to crude. We noted that, for weeks, propane had overperformed relative to crude, driving its value to 75 percent of that of West Texas Intermediate (WTI) crude. But Friday, Aug. 20, propane was carrying over a development from Thursday afternoon where it was underperforming crude significantly, prompting our analysis.

The relative weakness in propane lasted a week.

We updated the same chart we used last week to show this relative weakness (Chart 1). In the oval, you can see how propane’s value to crude dropped significantly over six trading days. Mont Belvieu LST went from trading at 74 percent of WTI to 69 percent of WTI during last week.

We pointed out the relative weakness in propane for those considering buying propane. Such a dramatic shift in propane’s relative performance could have been indicative of a fundamental change in propane that might see prices continue to fall a little longer. We thought it might be worth waiting to see if this relative price weakness persisted and if it were a harbinger of changes in some of propane’s bullish fundamental trends.

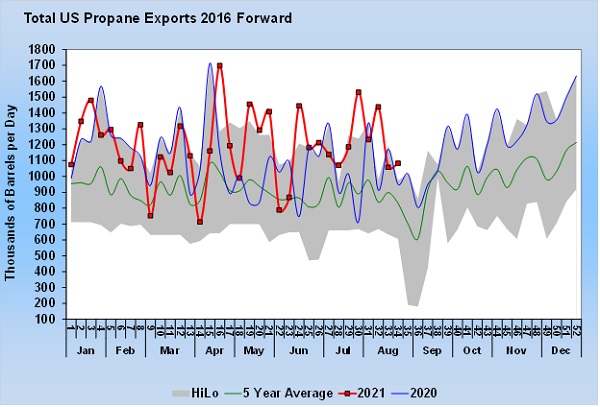

We had just seen a 380,000-barrel-per-day (bpd) drop in propane exports the previous week and wondered if the softness in propane’s price could have been the result of less demand from foreign buyers. It would have been beneficial for buyers if another drop in propane exports would have occurred. Unfortunately, that wasn’t the case.

U.S. propane exports didn’t go up much last week, just 25,000 bpd to 1.083 million bpd. That was well below some of the high export rates seen this year – some coming in just the past few weeks. Unfortunately, it was a new five-year high for week 34 of the year. It simply wasn’t enough of a two-week drop in export rates to move the needle on inventories.

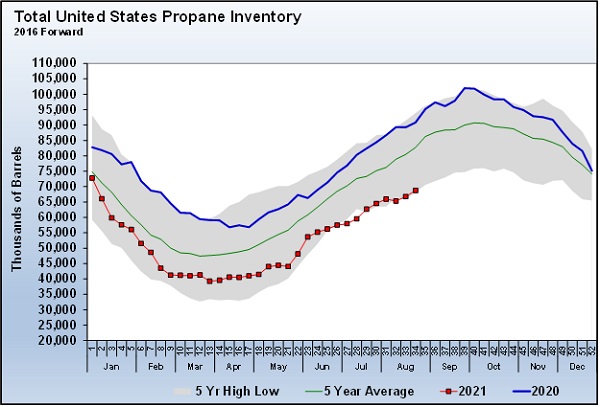

Yes, propane inventories did increase 1.988 million barrels during the week that ended Aug. 20. However, the build was below the five-year average build of 2.284 million bpd for week 34 of the year – not good when inventory is 22.084 million barrels, or 24.3 percent, behind last year and 16.9 percent below the five-year average inventory position for this time of year. Inventory remains near its five-year low.

Propane once again underperformed crude on Wednesday, Aug. 25, when this data was released, but on Thursday, the relative weakness in propane prices evaporated. Propane prices went up on Thursday even as crude prices fell. At the time of this writing on Friday, Aug. 27, propane prices were keeping up with sharply rising crude prices.

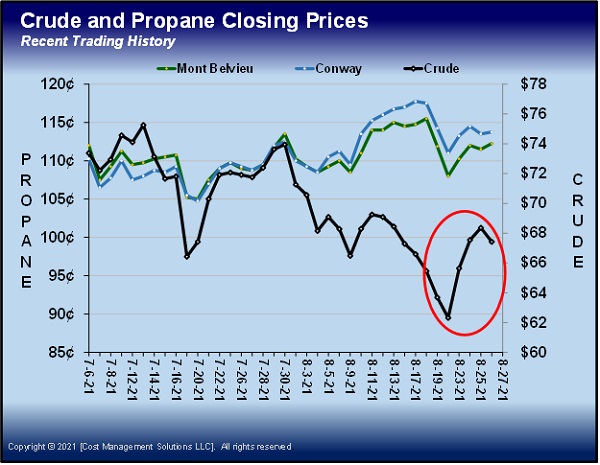

Propane finished Friday, Aug. 20 (writing of previous Trader’s Corner) at 108 cents for Mont Belvieu LST and 111 cents Conway. Crude then made a major rebound this past week, dragging initially reluctant propane along with it. WTI had closed at $62.32 on Friday, Aug. 20, and was trading at $68.61 on Friday morning of Aug. 27 as we wrote. As a result of crude’s rally and the lack of improvement in propane’s fundamentals, Mont Belvieu LST propane was trading at 114.25 cents and Conway 115.75 cents as we wrote.

The bottom line is we simply did not get what we had hoped the early warning might tell us, which was the start of a longer soft trend in propane prices that would have perhaps provided a better buying opportunity. In fact, the buying opportunity, if there was one, occurred when the warning signs were flashing on Friday, Aug. 20. Instead of urging caution for buyers on Friday, it turns out we should have been clamoring for buying action.

Our defense is that, Friday, Aug. 20, crude was facing a lot of headwinds. It was certainly hard to anticipate such a major rally this week that would pull prices up with it. The catalyst for that rally was a drop in the value of the U.S. dollar as traders became convinced the Federal Reserve would not tighten its monetary policy at its meeting that just finished.

The rally was fed by a fire on a major production platform in Mexico, cutting 421,000 bpd of production, about one-quarter of that nation’s output. And then this past Friday, U.S. producers were shutting wells and abandoning production platforms in the Gulf of Mexico as a tropical storm, soon to be a Hurricane Ida, headed into the Gulf of Mexico. Chart 4 shows the major turn in crude’s price. You can see above how propane did remain relatively weak, lagging the rally in crude until Thursday.

Friday, Aug. 20, crude looked destined to continue to fall, and propane was suddenly underperforming crude. It seemed the perfect environment to be cautious and see if a better buying opportunity would develop. Unfortunately, that was not the case.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.