Small shift in propane price strength worth noting

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, explains why a small shift in propane price strength is worth noting.

We noted a significant development in propane trade on Friday that has prompted today’s Trader’s Corner. First, let’s look at what had been happening so we can better understand the significance of the change.

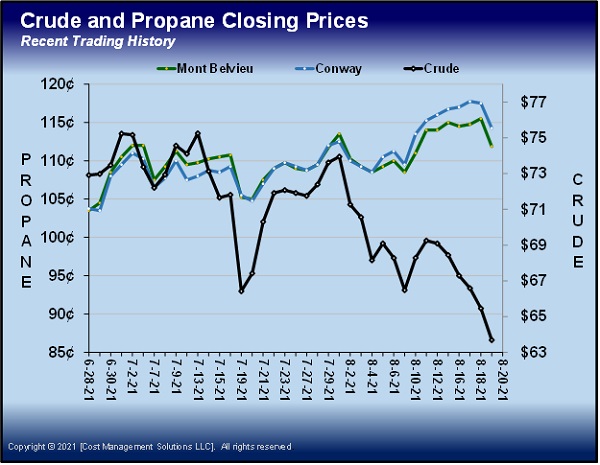

Chart 1 is on page 2 of our Propane Price Insider report every afternoon. It simply plots the price of propane and crude on the same chart so we can easily monitor and detect anomalies. Note the significant separation between crude and propane that had been occurring this month. For about two weeks, propane prices increased even as crude prices fell.

When this occurs, it is because propane traders, analysts and producers are noting propane fundamentals – which affect supply and demand – are supportive of higher prices. Essentially, demand is outpacing supply, causing a reduction in inventory. We have been reviewing these factors regularly in recent Trader’s Corners.

The major fall in crude’s price this past week finally was too much of a weight on propane markets, causing propane prices to fall. Still, propane was tending to lag the fall in crude, causing its relative value to crude to increase even as propane prices fell.

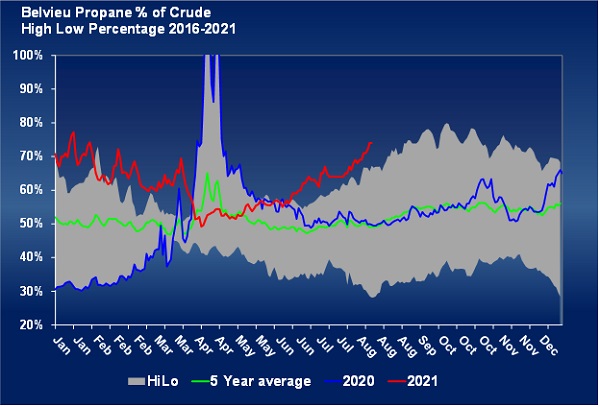

You have been seeing Chart 2 regularly because the tightness in propane supply is causing propane’s relative value to crude to go against its normal trend. Propane’s value relative to crude can increase even if its price falls – if the percentage that crude falls is greater. If propane’s relative value to crude continues to rise even when propane prices fall, it is a good indication that propane fundamentals haven’t really changed and are still supportive.

This has certainly been the trend since April. But on Thursday afternoon, crude rallied late to trim losses, but propane markets did not, causing propane at some pricing points to post a larger percentage loss than crude. Given the recent trend, we expected propane prices to outperform crude either by outpacing crude if crude went higher or lagging the fall in crude if it went lower on Friday. But that is not what happened.

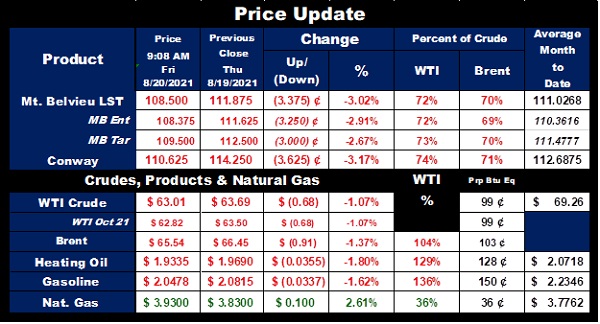

Chart 3 is the Price Update Table that our daily readers get every few hours. Note the time and date these prices were captured: 9:08 a.m. CST on Friday, Aug. 20, 2021.

We have highlighted what stands out here. Note the percent drop at propane pricing points compared to the percentage change in WTI crude. The percentage drop in propane is about three times that of crude. That is a significant departure from what has been going on for weeks.

Perhaps propane will recover and get back on its trend to separate from crude rather quickly. Maybe a seller or two who hadn’t been motivated suddenly decided to get active, skewing propane values for only a short period of time.

We would not overreact to one morning’s trading activity, but this is like an early warning signal that shouldn’t be ignored. For propane to fall more than crude at all is a departure from what we had been seeing, but to drop nearly triple that of crude really stands out.

If we were flying a plane and an early warning signal went off, we wouldn’t ignore it. We would become cautious and start doing system checks to see if it looks like everything is performing normally. Perhaps this is just a faulty sensor, but our response should not be to assume that. We should instead make sure the plane is still flying normally.

Will this departure from the norm continue into this week? Will any of our system checks indicate why the alarm sounded in the first place? Was this just momentary turbulence or a faulty sensor, or is something really changing here?

If you are a potential buyer of propane, all of the upward movement in prices and the supportive fundamentals are putting you under a lot of pressure to do something to protect against higher prices this winter. This small shift in propane’s price action to close out last week is worth noting. It is a reason to be cautious and see if propane’s price strength returns this week before taking winter positions. Again, this could be an anomaly, but a day or two of observation to see what develops is prudent.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.