Lingering impacts of COVID-19, market factors challenge retailers

One year ago, the stresses and unknowns related to COVID-19 were front and center for propane marketers as the industry prepared for a full winter heating season like no other. The industry persevered like it always does and continued to show why propane truly is an essential energy source.

Going into this winter, the pandemic continues to linger, casting a shadow over at least part of a third straight heating season. However, our increasing knowledge of the virus, the availability of vaccines and the ability of propane marketers to adjust to unforeseen circumstances in order to protect their employees and customers should serve as key differentiators this winter.

A number of industry sources have weighed in on winter preparation, positive developments and still the potential for supply-and-distribution disruptions. Here are some of those insights.

A positive with production

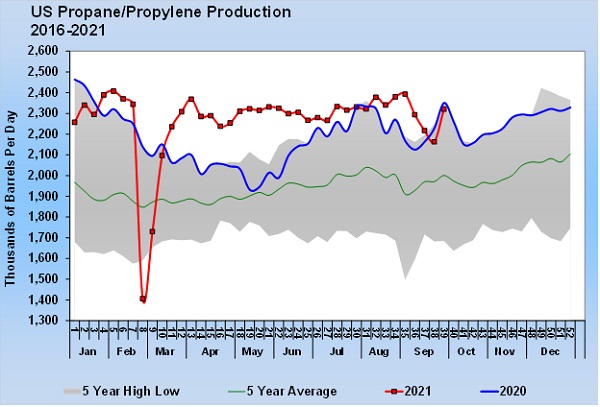

First, there is good news on the propane fundamental side as production levels are returning to pre-pandemic days, according to a producers report by Duncan McGinnis of Aux Sable during last week’s Propane Education & Research Council (PERC) meeting in Florida.

Propane production has overcome the initial impact of the pandemic in 2020, a major winter storm that hit Texas and other parts of the U.S. early this year, and Hurricane Ida over the summer. Not only is production bouncing back, but it’s been running at five-year highs for much of the year. In the first week of November, it hit 2.4 million barrels per day (bpd).

Similarly, rig counts are moving upward after “falling off a cliff” at the outset of the pandemic, McGinnis says. In the third quarter of 2020, rig counts averaged 254 for the total U.S. and 124 in the Permian Basin. Compare that to 501 and 249, respectively, in the third quarter of 2021, according to Baker Hughes in mid-October.

“Things are looking optimistic,” says McGinnis, the vice chairman of producers for PERC, hinting at warmer-than-normal temperatures expected in parts of the country due to La Nina, low crop drying demand preserving propane for winter, and October inventory builds.

“It comes down to what does winter look like and where do we see those periods of cold weather creating some [price] spikes?” he says.

McGinnis still posed the questions: Have we contracted enough supply for winter needs? And are our suppliers storing enough supply for winter needs?

Concerns still exist

Chart: U.S. Energy Information Administration

Weeks earlier, at the National Propane Gas Association’s (NPGA) fall meeting in Atlanta, optimism didn’t permeate the room quite as much.

The pricing-and-supply situation appeared more concerning, leading some industry members to recall the 2013-14 polar vortex winter, marked by regional price spikes and distribution challenges. They’re prepared to delve into their playbooks, which include communication with the states, conversations with pipeline operators and other propane transporters, the prioritization of rail and hours-of-service waivers.

Moreover, the pandemic has brought about increased staffing challenges and supply chain interruptions – across industries and for products of all types. Propane isn’t immune to this environment. In addition, new federal vaccine mandates for employers with more than 100 employees may compound the challenging staffing situation in the U.S.

With all of this as the backdrop, NPGA President and CEO Steve Kaminski says his team has been prepping Congress and reaching out to agencies about supply and logistics issues should they arise this winter.

Exports and inventory

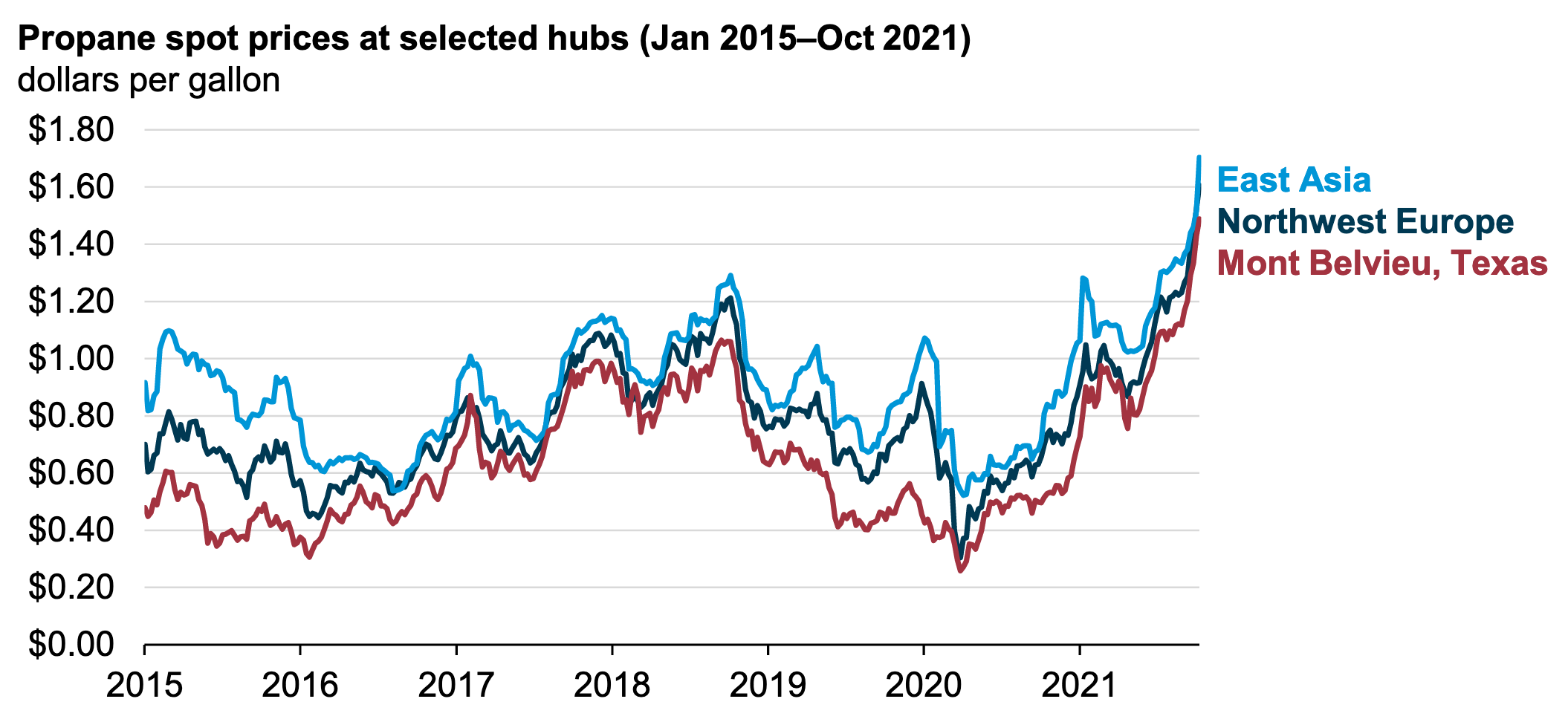

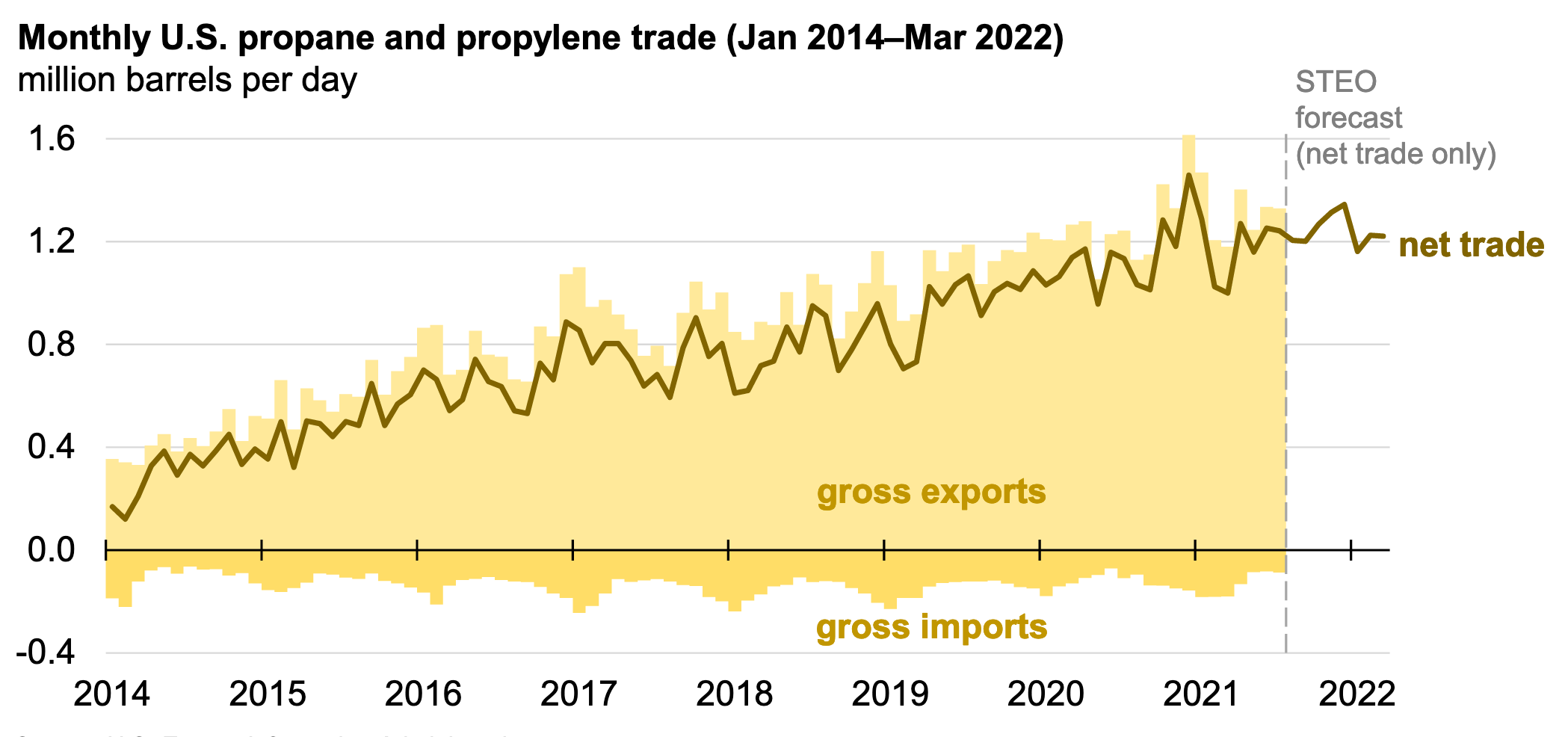

Much of the talk this year has focused on U.S. propane exports increasing as a result of heightened demand, mainly by the petrochemical sector, in Europe and Asia.

U.S. propane exports averaged more than 1.3 million bpd during the first seven months of 2021, the most on record during that period, according to the U.S. Energy Information Administration (EIA).

This strength in U.S. exports – buoyed by OPEC+ crude oil production cuts reducing associated global propane supplies – resulted in a seven-year high in Mont Belvieu propane prices in October ($1.52 a gallon), McGinnis notes, with more than half of the domestic production earmarked for exports.

“We’re witnessing a fundamental phase shift in how our product is being used globally,” says Steve Kossuth, vice president of Global LPG Supply at UGI Corp. “What caught the industry by surprise is the price Asia is willing to pay for U.S. propane exports.”

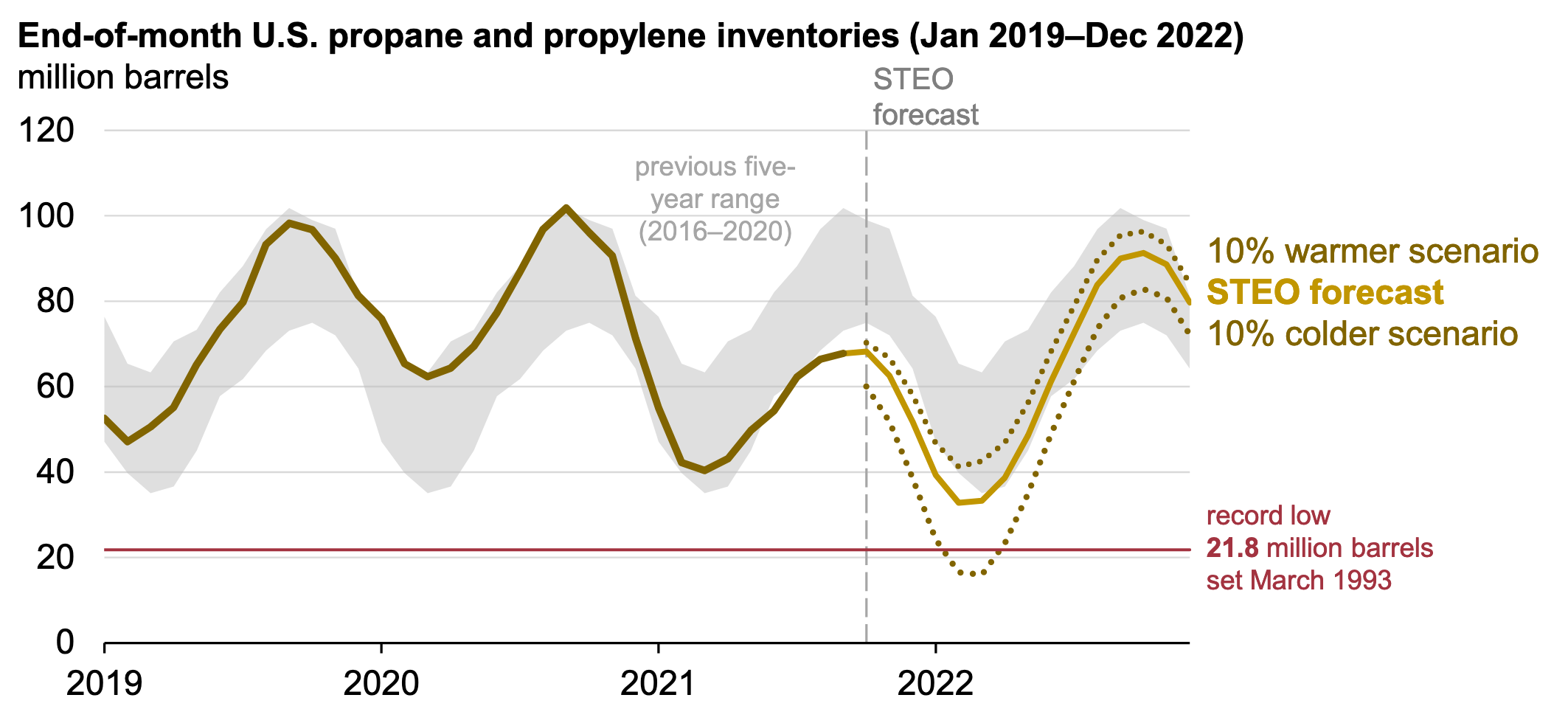

The global propane market dynamics have contributed to relatively low U.S. inventory levels, which have trended near the bottom of the five-year average this year.

In EIA’s latest report, U.S. propane/propylene stocks decreased by 1.3 million barrels to 74.8 million barrels as of Nov. 5. This is 12.6 million barrels, or 14.4 percent, less than the five-year average inventory levels for this same time of year.

EIA says propane inventories will remain at their lowest levels in more than five years, but inventory deficits to the five-year average will likely not widen significantly during the heating season.

Developments in Canada are also having an impact on U.S. propane inventory, as McGinnis notes. More export activity in western Canada – with barrels also going to Asia – is lessening propane imports into the U.S. Plus, a new propane dehydrogenation facility under construction in Alberta – part of Inter Pipeline’s Heartland Petrochemical Complex – will create an additional 22,000 bpd of local demand in 2022.

With the U.S. price advantage to Asian markets shrinking, McGinnis notes the potential for increased volumes to stay onshore to support domestic winter demand.

“The market tends to work itself out,” he says.