Lower domestic propane demand offset by exports

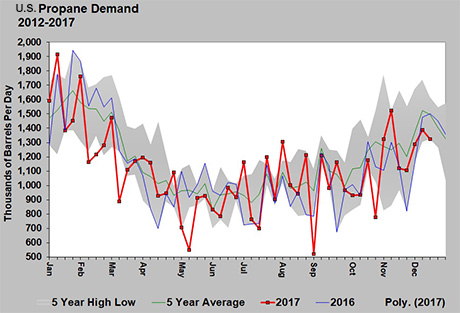

It is difficult to believe, but domestic propane demand is running slightly below last year’s levels for the same time of year, even though this has been a slightly colder winter heating season.

The drop in domestic demand looks to be roughly split between retail and petrochemicals. The U.S. Energy Information Administration (EIA) reports average demand at 1.105 million barrels per day (bpd) so far this year. During the same time period last year, EIA reported demand at 1.136 million bpd. Based on industry data, petrochemicals have averaged 11,000 bpd less from January through November this year compared with last year.

We are at loggerheads to figure out why domestic demand appears to be running roughly 20,000 bpd less than last year with this winter running colder. Some of it could be weaker crop drying. The other possibility is that consumers came out of last year with higher inventory levels due to the mild winter. Then we could conclude this winter has not been cold enough to lower inventory at the consumer level, resulting in lower demand numbers for the start of this winter, despite more cold.

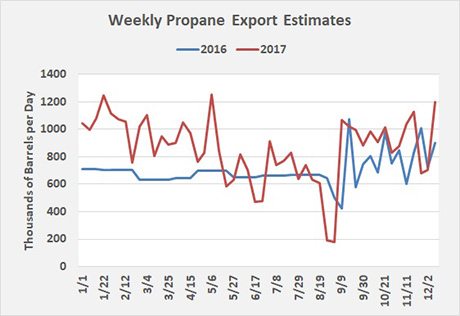

Last year, from the peak inventory level of 104 million barrels to the middle of December, U.S. propane inventory dropped 8.377 million barrels. From this year’s peak inventory of 82.183 million barrels, inventory has dropped 10.838 million barrels. Since EIA estimates total propane/propylene production to be up about 84,000 bpd this year from last year, the larger draw on inventory has to be the result of higher export rates. Exports have increased more than production, and the decrease in domestic demand for inventories has fallen more this year than last year.

That has certainly been the case with the EIA weekly estimates, which show exports 161,000 bpd higher this year than last year through the middle of December.

What is a bit concerning about all of this is if domestic demand were to kick into high gear for a while, inventory could fall quickly unless exports give way to the need for domestic supply.

A rather ominous number is that from this point last winter until the inventory low was reached in April, nearly 60 million barrels were drawn on U.S. inventory. If that happened this year, inventory would be at 15.365 million barrels. We can only imagine what prices would be if inventory fell that low, or where prices would have to reach to limit both export and domestic demand and preserve inventory at a comfortable level.

Obviously, no one in the retail propane industry wants prices to remain contained because of weak domestic demand. Thus, the hope is that exports will decline significantly in the first quarter of 2018. We got a taste of the impact of exports dropping off when inventory builds occurred during the two-week period that ended Dec. 8. As a result, propane prices dropped about 12 cents.

The worst possible pricing scenario is not yet a given. However, the question remains the same now as it was at the beginning of this winter: Will the world demand less U.S. propane when prices double from where they were last year?

Higher prices will certainly discourage demand both domestically and abroad for U.S. propane supply. However, we can’t ignore where inventory levels, inventory decline trends or export rates currently stand.

We also believe domestic demand has been running about as low as it is going to get this winter. Petrochemicals are already near the minimum demand that we have historically seen and weather outlooks are looking more supportive of heating demand going forward.

All of this adds up to plenty of upside price risk for the remainder of the winter, despite the bearish sentiment that gripped the market earlier this month. For that reason, we would be careful about dumping positions that will provide price protection later this winter because of the recent bearish feel to propane markets.

Call Cost Management Solutions today for more information about how Client Services can enhance your business at (888) 441-3338 or drop us an email at info@propanecost.com.