Lower propane prices drive winter outlook

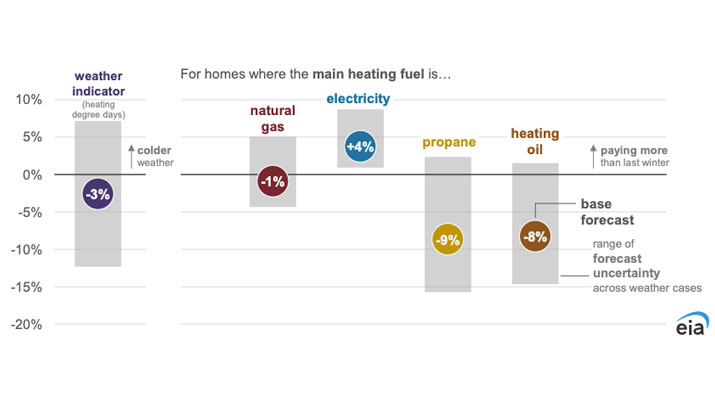

Households heating primarily with propane will pay less than they did last winter on average across the United States, according to the U.S. Energy Information Administration’s (EIA) Winter Fuels Outlook.

The EIA estimates that propane households this winter will pay an average of $1,210, which is a 9 percent decrease from last winter, under its base case. Household propane expenditures drop significantly – 16 percent from last winter (totaling $1,116) – if temperatures are 10 percent warmer and rise 2 percent from last winter (totaling $1,355) if temperatures are 10 percent colder, according to the outlook.

EIA’s annual outlook compares the four fuels (propane, natural gas, heating oil and electricity) that combine to heat 96 percent of U.S. homes. Propane makes up 5 percent of that heating load – or 6.3 million households heating primarily with LPG, as of 2024, according to the EIA.

Only households heating with electricity are expected to pay more this winter – at 4 percent or $1,130 under the base case – compared to last winter. As EIA notes, residential electricity prices are increasing across the country, at a U.S. average of 4.8 percent.

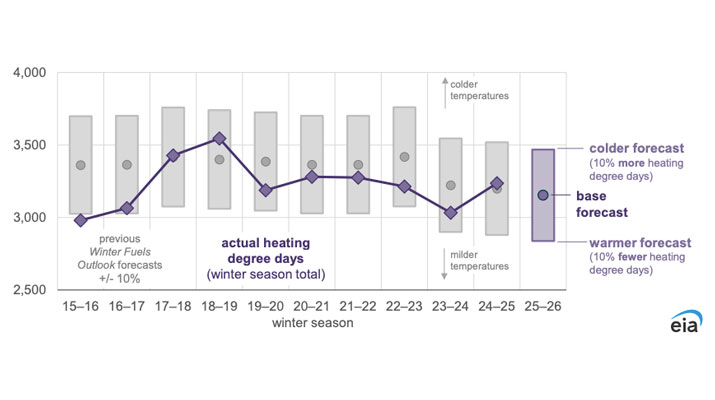

Because the EIA expects winter temperatures and residential energy consumption to be similar to last winter, it’s pointing to energy prices to drive much of the change in expected expenditures. It expects the U.S. retail propane price to average $2.46 per gallon throughout the winter – which is 7 percent less than last winter.

The EIA says retail prices at the beginning of the winter heating season generally reflect trends in the wholesale price. It had forecast the wholesale propane price at Mont Belvieu, Texas, to be 14 percent less than it was last year to start the heating season and the U.S. average residential propane price to be 12 percent less than last year. As of Oct. 27, the average wholesale price was 82 cents a gallon, about 10 cents lower than at the same point last year.

U.S. propane inventories positioned above the five-year average are also working to keep downward pressure on prices. In fact, U.S. propane inventory reached a record level of 103.376 million barrels at the end of September. This was about 12 million barrels more than the five-year average. After a drawdown, total inventory eclipsed 103 million barrels again in mid-October.

Also contributing to the high inventories: Low propane demand for crop drying during a mostly warm and dry fall across much of the U.S. heartland, though the U.S. Department of Agriculture had expected a large corn harvest. Owing to the large harvest, the EIA is assuming an increased use of propane for crop drying in the early winter will offset some of the drop in space heating consumption.

The EIA is forecasting U.S. propane production to increase by about 2 percent this winter compared with last winter and for U.S. propane consumption to fall by 12 percent because of less propane consumption in the residential and commercial sectors.

The EIA says it will update its forecasts throughout the winter concurrently with its Short-Term Energy Outlook releases.

Related Articles

Propane pricing reflects oversupplied market