LPG supply chain leaders sound off about winter prep

Do you have a plan for this winter? Do you have a backup plan?

The themes of planning, preparation and communication – principles that help guide us in our personal and professional lives – are dominating the airwaves this summer as leaders throughout the LPG supply chain are sounding off.

Company leaders from the LPG production, midstream and transportation segments of the industry have come together on a series of National Propane Gas Association (NPGA) webinars to discuss best practices in the months and now weeks before retailers hit the road en masse to make propane deliveries – during a pandemic, no less.

The discussions have produced key points for the industry to follow before and during the winter; first, the planning and backup planning element.

Bruce Leonard of Targa Resources reminded retailers to have a contingency plan in case the terminal “up the road” – the one from which a retailer always buys – runs out of gas or the industry faces a regional supply disruption.

“We cannot predict what’s going to interrupt our supply situations,” he said, so having a backup plan can differentiate between running out of gas and potentially losing customers, and filling the supply gap when other companies can’t.

Leonard expressed frustration over the retail industry sometimes receiving a “black eye” – from the public and media – when deliveries to customers are interrupted, for a variety of reasons, when there’s so much supply available throughout the country.

He urged the industry to plan now and “get in front of this.”

“The question is not [about] supply,” Leonard said. “The question is [about] logistics and it’s [about] planning.”

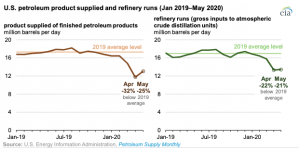

Midstream panelists anticipate variability and volatility in the market this winter. Refineries have been operating at less than full capacity, owing to demand destruction for petroleum products from COVID-19 shutdowns and impacting a traditional supply point for propane retailers.

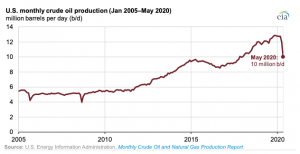

Production of crude oil decreased in the U.S. in May by about 2 million barrels per day, the largest monthly decrease since January 1980, according to the U.S. Energy Information Administration (EIA). Refinery runs were 22 percent lower in April compared with the full year 2019 average, the EIA also reported.

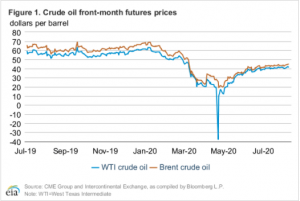

The benchmark West Texas Intermediate (WTI) crude oil average spot price dropped from $58 a barrel in January to $17 a barrel in April. WTI increased to $29 a barrel in May as production decreased and demand increased. The WTI price in August hovered around $42. The global benchmark Brent crude reached $70 a barrel in early January before dropping and hovering around $45 in August.

Lower prices for crude oil mean the potential for having less crude oil production and refinery throughput, and ultimately less propane production.

If retailers decide to diversify their supply sources as added safeguards this winter, they should communicate with their suppliers and honor their commitments no matter the market situation, said John Powell of Crestwood.

“We like to work with customers who like to work with us,” he said, echoing another theme (customer loyalty) that’s been shared by multiple companies during the webinar series.

Preparation for this winter also means guarding against the spread of COVID-19. Just as the industry responded after the pandemic took hold in March, it now must prepare a safe and calculated response for the full six months of the heating season.

Some companies have been heeding that call, whether they’re formulating new plans for training or arming drivers with masks and hand sanitizer.

The webinar on transportation also explored the topic of safety and training of transport drivers loading propane at terminals. With COVID-19 safeguards slowing the process of training at terminals, panelists urged companies to get their transport drivers carded as soon as possible to overcome the hurdle of training during the peak of winter.

In this case, preparation for winter means the industry collectively having a greater population of trained drivers at multiple facilities. Retailers can play a part too by communicating with their transportation companies or propane suppliers about requirements at the terminal from which they’re pulling product, said Jon Long of Hilco Transport.

“When training in the heat of battle, you’re already playing catch-up,” said Steve Kossuth of UGI Corp., who has been moderating the webinar discussions.

Whether communicating about employee work schedules, pipeline or rail issues, or any other intel about the movement of product this winter, panelists said an open dialogue among retailers, suppliers and trucking companies will help ensure a reliable, steady supply of propane this winter.

As Art Ogden of LP Transportation shared on one call, “We’re in the trucking business, but we’re [also] in the communications business.”

Powell of Crestwood noted how it takes weeks, if not months, to move supply from its origin to its final destination.

“Constant communication really helps streamline the process” as a way to ensure midstream assets are being used across the board, he said.

NPGA will hold its final webinar of the series, a harvest and fundamentals update, on Sept. 10.

Infrastructure assets

Midstream panelists highlighted several infrastructure assets positioned to increase propane availability to the downstream market.

In the Northeast, Blackline’s Sea-3 facilities offer 45 million gallons of refrigerated storage capacity between Newington, New Hampshire (27 million gallons), and Providence, Rhode Island (18 million).

Newington, which operates around the clock seven days a week, has five truck-loading bays and 16 new rail spots. Providence has three truck bays, and both facilities have import/export capabilities.

Crestwood grew its footprint across the central and eastern U.S. this year when it acquired 7 million barrels of NGL storage and seven LPG terminals from Plains. The company now has about 10 million barrels of NGL and LPG storage capacity and 13 LPG terminals.

In the South, Enterprise Products Partners is constructing a new propane terminal near the El Paso, Texas, market, reported Tug Hanley, senior vice president of pipelines and terminals.