LPG Week panelists ponder present, future issues

Scared markets. Unique circumstances. Undeserved concern?

When it comes to propane supply and demand dynamics in 2021, there’s a lot to unpack.

Some of the LPG industry’s supply leaders and market insiders tried to do just that last week in Dubai during the World LPG Association’s flagship event – LPG Week.

Panelists during a “Supply and Demand in Transition” session echoed some of the themes heard consistently this year – those having to do with high prices and low inventories. But the breadth of panelists’ knowledge on the topic became evident as they dug deeper over 90-plus minutes, answering questions from moderator Julia Sieger.

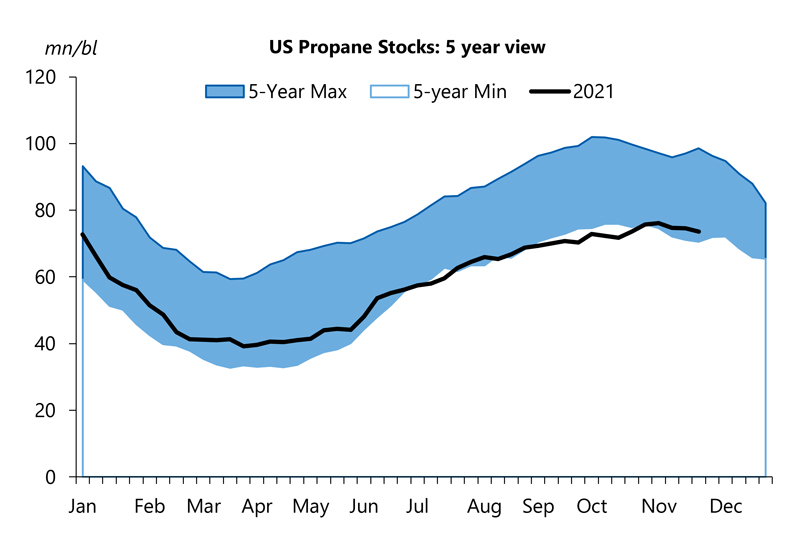

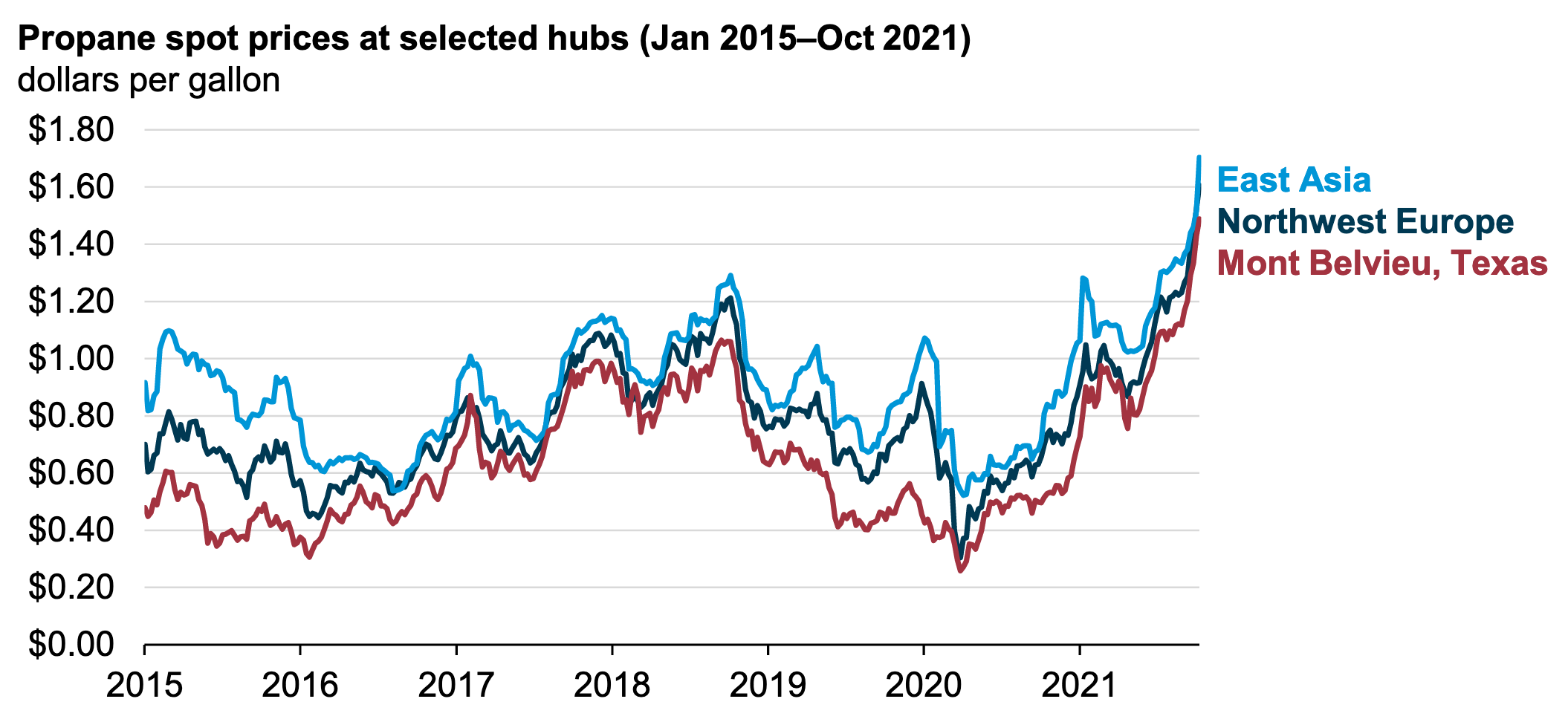

In the U.S., propane prices rose to nearly 150 cents a gallon earlier this year as inventories sank to five-year lows. Clearly, this became a tighter market than in recent years, said David Appleton, vice president for LPG at Argus Media.

“When that black line gets low, the market simply gets scared,” he said, referencing a U.S. inventory chart that showed levels near or below the five-year minimum average.

That’s why Appleton labeled this “a supply-driven period of high prices.” One of his slides revealed supply concerns around the world that he feels contributed to higher global prices – constricted refinery availability in Europe, supply disruptions in Algeria, fires at major plants in Russia reducing exports, and limited supply in Saudi Arabia due to OPEC+ limiting crude output.

“The key driver has been the fact that we’ve seen U.S. stocks are lower … compared to previous years,” he said.

He acknowledged the recent pullback in pricing – due in part to a drop in crude prices and a lack of winter demand thus far – and said the market is better balanced than it was two or three months ago. But it wasn’t that way in the summer.

Appleton recounted how Argus data showed high propane demand during the summer compared to other years – “which is a little bit unusual,” he said.

“That suggests there is some storing going on because people are scared about prices and inventories, which in turn makes inventories go lower,” he added. He called it a “self-fulfilling prophecy.”

“That’s not real demand,” he said. “Perhaps that explains why we’ve seen a bit of a crash over the past couple of weeks.”

Rob Donaldson, senior vice president at Targa Resources, felt “pricing probably got a little bit overdone” and was stronger than it needed to be over the past few months because people thought LPG production would follow a fall in crude production.

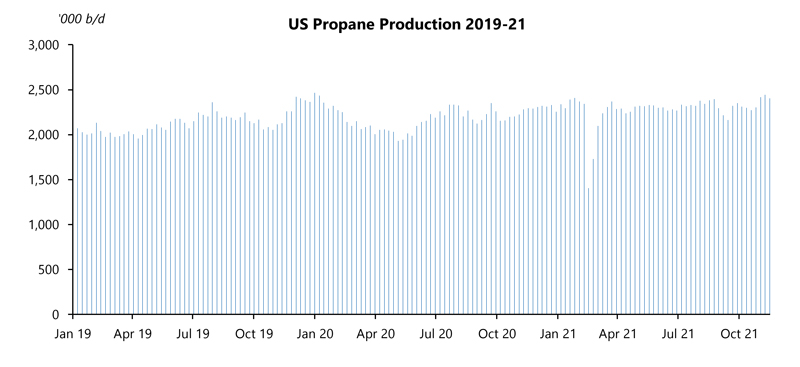

“In fact, LPG production was up, so I think the concern around supply was undeserved,” he said.

A resilient fuel

LPG has gained notoriety for its resilient nature since the pandemic began in March 2020. It’s already a resilient fuel due to its chemical makeup, but producers never turned away from LPG and natural gas liquids when crude crashed at the outset of COVID-19.

“Production in the U.S. continues to be a favorable story, even with some of the challenges around regulations and what we see in the press,” said Donaldson, noting investments in onshore infrastructure that helps move products to global buyers and saying there’s “a nice symmetry” between production growth and demand growth.

The U.S. has produced between 2.2 million barrels and 2.5 million barrels of propane per day throughout the year, Appleton noted. “That’s very robust and important for the market going forward because we have all this need for more LPG into this year and beyond,” he said.

The key question, Appleton asked, is whether that robustness in production will be able to match the U.S. export requirements going forward because they are continuing to rise. The international market is getting bigger, as India has become an enormous player; China remains important with its need to fuel propane dehydrogenation (PDH) plants; and the rest of Asia – excluding Japan, China, Korea and India – looks to more than double its LPG import requirements between 2010-30.

The U.S.’ path to becoming one of the world’s top propane suppliers was borne from “an era of cheap LPG,” Appleton explained.

Abundant shale gas and oil in the U.S. and falling prices drove the investments in export terminals, import terminals, PDH plants and other infrastructure. All of that LPG needed to find a home.

But with that infrastructure in place and a need around the world to fuel growing demand, will that type of low-priced environment remain? Argus, for one, doesn’t think so and is forecasting a tighter market going forward, especially when the world comes out of the pandemic.

The panelists, including IHS’ Walter Hart, also spent time discussing LPG’s longer-term future and what renewable LPG might mean for the supply mix.

Attendees of LPG Week can watch the entire session on demand through March. Visit lpgweek.com.