Major propane price correction continues

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, discusses a drop in propane prices.

Propane markets are in the midst of a major price correction. Mont Belvieu LST propane closed at 112.50 cents on Thursday, and Conway was at 114 cents. Those closes marked a 39.5-cent and a 37.75-cent drop, respectively, from the year’s highs set early in October. Prices looked positioned to drop again on Friday. These are corrections of around 25 percent and counting, which is very significant.

Propane prices have dropped primarily due to a lack of domestic demand. Winter simply doesn’t want to get started. Also, crude’s rally that began in August ended at the end of October. We would call the end of that uptrend on Oct. 26. West Texas Intermediate (WTI) is down $8.06 per barrel, or 10 percent, since then from the close on the 26th. That has added an additional bearish element to propane markets.

Let’s take stock of where we are. We should have at least four months of winter ahead. The lack of winter has really helped reduce the inventory deficit to last year and the five-year average. Still, U.S. propane inventory remains 18.319 million barrels below where it was this time last year.

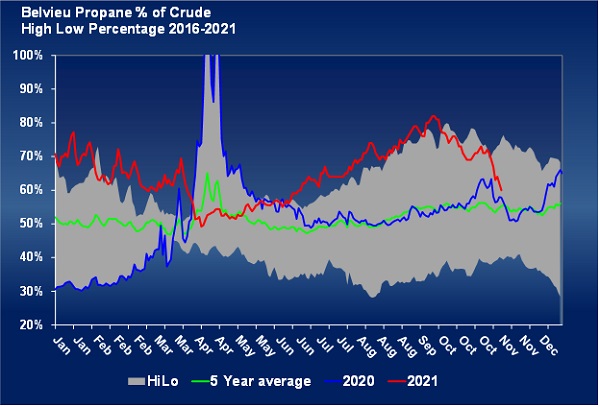

Chart 1 compares propane’s value to WTI crude’s value. This chart shows the relationship between Mont Belvieu LST propane and WTI crude. The chart for Conway wouldn’t be a lot different.

Mont Belvieu LST propane’s value reached 82 percent of crude’s value on Oct. 1. It is now down to 60 percent. Propane was at 58 percent of crude at this point last year, just a 2 percentage point difference with its current relative valuation. Yet, propane’s inventory position is still 19.7 percent behind last year. If winter weather appears, we could certainly see the market feeling it had overcorrected.

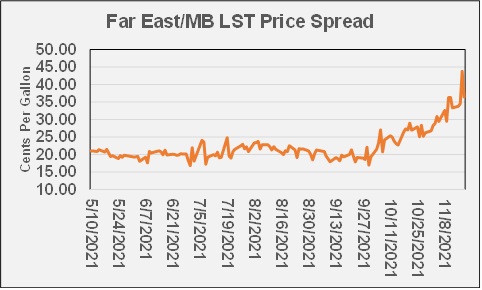

Chart 2 shows the spread between Far East and Mont Belvieu LST propane prices.

The value of propane in the Far East is increasing relative to the value of propane on the U.S. Gulf Coast. This suggested that market has not experienced the lack of domestic demand of the U.S. market.

A chart for Europe would also show the spread is growing. That should mean that U.S. propane exports will remain robust. Exports set five-year highs for the 45th and 46th weeks of the year over the past two weeks.

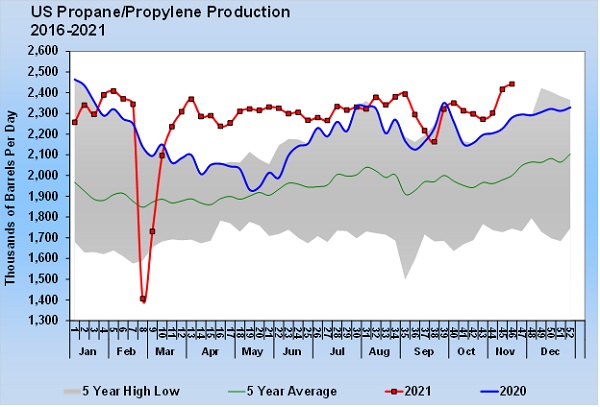

A very pleasant surprise has been an improvement in U.S. propane production.

After been flatlined for most of the year, propane production has surged in the past two weeks. In fact, last week’s 2.442-million-barrel production rate was an all-time high.

On the whole, we still think there is upside price risk, and this pullback gives us an opportunity to set prices at a far better point than was available last month.

Consider the one-month price strategy. Someone implementing that in October would have come out about breakeven. It would have worked against us in November, but with the big pullback, the odds of succeeding with that strategy in December are greatly increased.

Markets are still going down now, so we don’t have to jump too quickly, but any turn should probably be viewed as a buying opportunity for either the one-month strategy or even longer-term positions.

A few weeks ago, it felt like prices would never stop going higher, but they did. Today, it feels like prices will never stop going lower, but they will. We like this as a buying opportunity on the turn higher.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.