Measuring the impact of Canada’s propane supply picture on the US market

Cost Management Solutions has always been impressed by the abilities of the Canadian propane industry. It seems to adapt to changes and challenges quickly and often appears to be well ahead of the direction of propane fundamentals.

Canadian producers were aggressive in moving barrels to the United States in 2015. As we look at the data, they had good reason with the inventory high coming out of 2014. It also appears producers were ahead of the curve in anticipating this year’s mild winter.

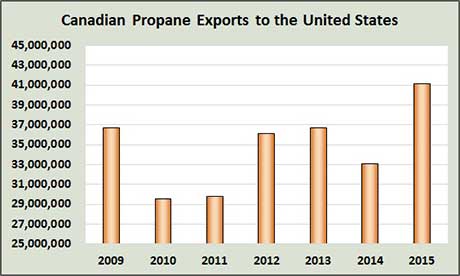

According to Canada’s National Energy Board, Canada exported 41.12 million barrels of propane to the United States during 2015, an increase of 8 million barrels over 2014.

We believe much of the increase in 2015 can be attributed to the light exports in 2014 that built up Canadian inventory.

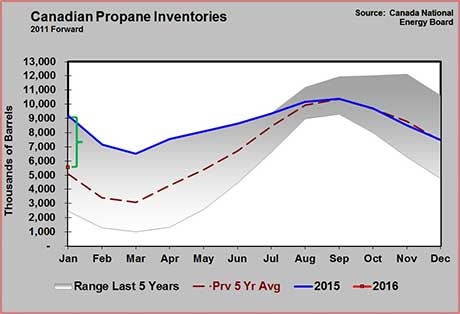

In January 2016, Canadian propane inventory was 3.6 million barrels below where it was in January 2015. That decrease was almost equal to the decrease in exports between 2013 and 2014. This indicates that Canada’s propane exports in 2015 were greatly influenced by the need to get rid of the surplus inventory that had built up in 2014.

In addition to pulling inventory down, Canadian producers likely had more barrels to export with this year’s mild winter conditions. So they dumped another 867,000 barrels into exports as they aggressively moved barrels south.

We credit them for being aggressive and cleaning up their inventory position even in a mild winter. With inventory now about average, a likely stronger winter next year and decreased drilling activity, we do not expect the same aggressiveness in 2016.

We think that will favor the odds of a firmer propane pricing structure from Canada this year. A U.S. retailer looking for the bargain basement prices it got last summer may be surprised when those deals aren’t available this year.

In 2015, Canada exported an average of 112,269 barrels per day (bpd) to the United States. We would anticipate a rate closer to 2013 levels of 100,419 bpd this year at most. We would not be surprised to see exports to the United States drop even more than that if winter weather forecasts continue to look strong.

For more Cost Management Solutions analysis of the energy market that helps propane retailers manage their supply sources and make informed purchasing decisions, visit www.lpgasmagazine.com/propane-price-insider/archives/.