Midwest propane retailers face trying times

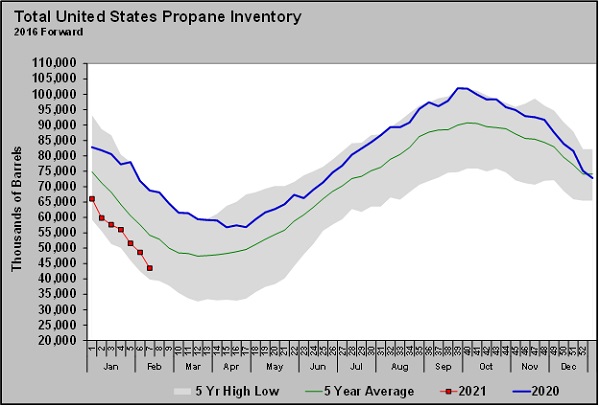

Last week, the U.S. Energy Information Administration (EIA) reported a 5.158-million-barrel draw on U.S. propane inventory. Prior to the report, a survey of industry analysts showed an average expectation for a 3.32-million-barrel draw on inventory. Over the past five years, the average draw on inventory during week seven of the year has been 3.369 million barrels.

Chart: Cost Management Solutions

It was not particularly surprising to see such a large draw given the severe winter weather that was in play. The data for the last EIA report was collected on Feb. 19, before the effects of the winter storm had passed. That certainly leaves room for another above-average draw on inventory to be reported in the next EIA report.

Even with last week’s large drop, inventory was still above the five-year low for week seven of the year. It is the dramatic change in inventory between last year and this year that has everyone’s attention. Inventory is 24.641 million barrels, or 36.2 percent, lower than at this point in 2020. At this time last year, inventory was setting five-year highs and was still setting five-year highs as winter started.

The current trajectory of inventory must change, or propane prices will remain high. The pandemic had major influences on supply and demand. Hopefully, the pandemic’s influence will lessen in 2021, but it will likely be a year or more before we are back to a normal situation.

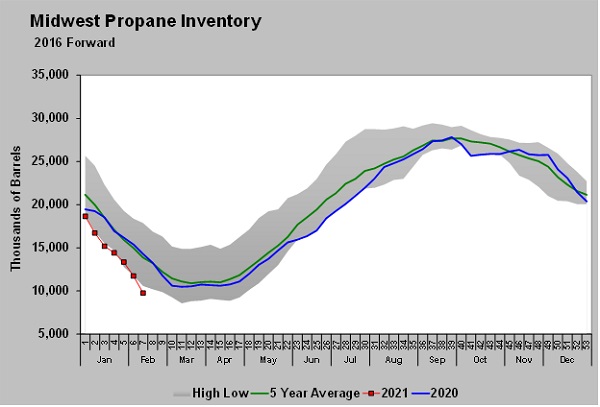

Perhaps the region of the country that has been the most impacted by changes beyond the pandemic is the U.S. Midwest.

Chart: Cost Management Solutions

Even before the pandemic, Midwest inventory was running at or below its five-year average. That average is coming down. The high production rate in the Midwest relative to demand has producers looking at moving more production out of the Midwest. In addition, Canadian producers developed markets in Mexico and Asia to avoid shipping their supply to the relatively low-valued Midwest market.

A key issue in the Midwest is that the demand is very seasonal. There isn’t the petrochemical demand or export demand enjoyed on the coasts to help balance supply and demand. Midwest producers needed to access 365-day demand, and that comes from shipping production to the coasts.

Relatively mild winters have exaggerated the need to move more supply out of the Midwest. Many of the contracts to move product out of the Midwest are firm and longer term. So even if prices increase temporarily at Conway, the product is still getting moved out of the region.

It was also very telling this year that prices at Conway became high, but Canadian producers did not dramatically increase shipments to the U.S. despite sitting on a pile of inventory.

The bottom line is that the Midwest has been oversupplied and low-valued long enough that it now lacks investment from producers to meet its needs in high-demand periods. The result was reflected by the spike in prices this year.

The relatively low retail prices in the Midwest compared to the rest of the nation have made it difficult for propane retailers to invest in storage or employ other means to help with supply security. Right now, it is hard to imagine Midwest producers changing their focus on getting barrels out of the Midwest. That means any improvement in supply security would have to come from propane retailers. For propane retailers to take on that responsibility, they will have to improve margins to invest in more storage, rail terminals or other measures to improve supply security.

We have been discussing the need for this transition for a long time. The reality is that it will take a lot more high-price situations like the one just experienced for Midwest consumers to value supply security and pay to have it. We are talking decades during which low price has been the most valued factor. You don’t change that paradigm overnight.

Every retailer we know wants to be a reliable supplier. The greatest fear of most is not having the supply their customers need when they need it. But it is certainly a trying time for Midwest propane retailers. They are getting squeezed from both the supplier side and the customer side, and neither of which show much interest in helping to improve the situation.

Call Cost Management Solutions today for more information about how client services can enhance your business at 888-441-3338 or drop us an email at info@propanecost.com.