Midwest propane supply scenario similar to 2013

A report from the U.S. Energy Information Administration (EIA) reminded us of just how similar the current supply and distribution issues in the Midwest are to those that took place in 2013-14.

As many of you recall, the 2013-14 winter challenged the industry to endure and, in some cases, address supply and distribution challenges and major price spikes. That winter led the National Propane Gas Association to assess how it could better serve its members on supply issues. That winter also forced many propane retailers to increase bulk storage infrastructure and consider how it could better prepare their customers for such issues.

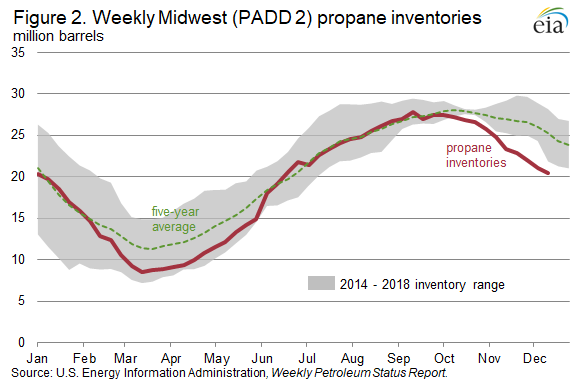

This year, as of Dec. 13, propane inventories in the Midwest totaled 20 million barrels, or 4.7 million barrels (19 percent) below the previous five-year (2014-18) average, the EIA reports. Lower-than-average propane inventories were driven by higher consumption and lower supply, the EIA adds. A late and wet corn harvest in the Midwest resulted in increased agricultural propane demand, which overlapped with propane demand for space heating. In addition, the supply of propane was lower due to disruptions in rail shipments from Canada. The region received early hours-of-service waivers for commercial drivers, and the Federal Energy Regulatory Commission got involved to help provide regional relief.

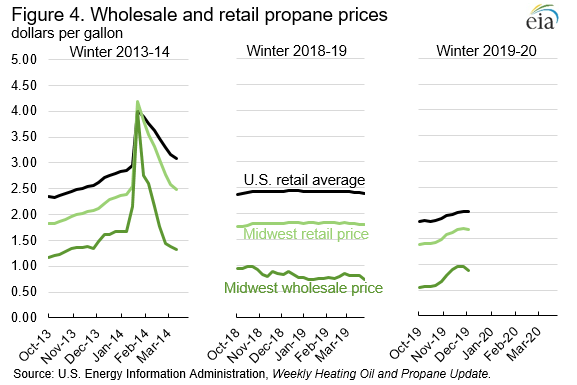

In the fall of 2013, the EIA recalls, similar events unfolded. A large, late and wet corn harvest required large amounts of propane for drying, reducing local inventories and raising prices. Not long after, a polar vortex arrived in the Midwest, bringing temperatures that were significantly lower than normal to the area and resulting in a spike in propane demand for space heating. These events caused propane prices at Conway to increase rapidly and peak at $5 a gallon on Jan. 23, 2014; supply chains were strained and widespread shortages were reported.

Falling inventory, rising prices

Between the week ending Oct. 4 and the week ending Dec. 13, Midwest propane inventories decreased by 7.0 million barrels, compared with the five-year average decrease of 2.6 million barrels for the same time period, EIA data shows.

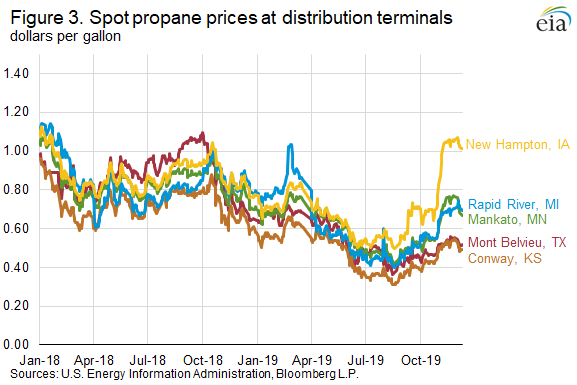

As a result of tight propane supplies, wholesale propane prices at several of the large propane distribution terminals in the Midwest have increased.

Between Sept. 3 and Sept. 12, the EIA reports, wholesale propane prices at the New Hampton, Iowa, distribution terminal increased by 13 cents a gallon to 69 cents a gallon as a result of the corn harvest and associated grain drying that began in Iowa. Once states farther north began to draw on the same supplies, prices at other terminals in the Midwest also increased. On Nov. 7, the wholesale propane price at Conway, Kansas, exceeded the price at Mont Belvieu, Texas, for the first time since June 2019. Prices rose throughout the region in response; from Oct. 30 to Nov. 8, the price at Mankato, Minnesota, was up by 15 cents a gallon, and the price at Rapid River, Michigan, was 11 cents a gallon higher. New Hampton, Iowa, wholesale propane prices responded by rising again another 23 cents a gallon during that period and have remained at more than $1 a gallon since then.

These higher wholesale prices have resulted in higher retail propane prices in the Midwest, the EIA reports. The Midwest average retail propane price on Dec. 9 was $1.68 a gallon, an increase of nearly 30 cents a gallon since Oct. 7, the start of the heating season. However, retail propane prices are still lower than at the same time last year, the EIA notes; the propane price at Conway is about 13 cents a gallon lower, and the Midwest average retail price is similarly 14 cents a gallon lower.

With the winter beginning officially last weekend, the situation in the Midwest is worth watching in early 2020 – not only for impacts in that region but also potentially for those in the surrounding states and regions.

Looking back on 2019

The situation in the Midwest – and the year’s end – made us wonder about other supply-related stories on which we reported in 2019. Here are our top five stories from 2019 (in no particular order) impacting the supply and distribution segment of the propane industry.

- 3Eight Energy to help propane retailers build supply partnerships

- NGL Energy Partners purchases wholesale propane business from DCP

- Enterprise eyes 1 million bpd of LPG loading capacity in Houston

- AltaGas opens first marine export facility in Canada

- Michigan court rules Enbridge Line 5 tunnel project constitutional

Suppliers Guide

Be sure to check out our January issue, which will feature our annual Propane Suppliers Guide, a directory of the industry’s top product sources.