More on propane demand

Trader’s Corner, a weekly partnership with Cost Management Solutions, analyzes propane supply and pricing trends. This week, Mark Rachal, director of research and publications, takes a closer look at demand.

Catch up on last week’s Trader’s Corner here: Revisiting propane inventories

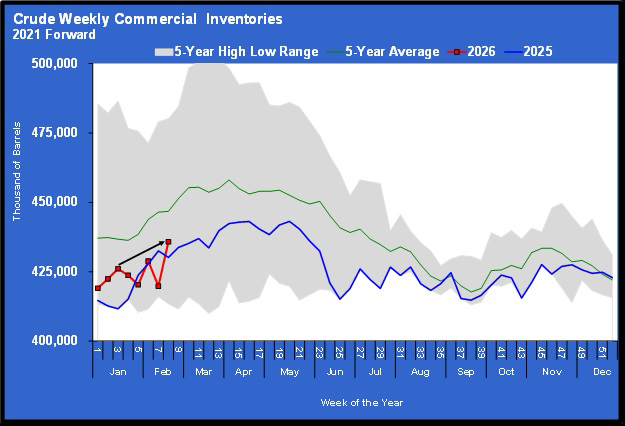

In last week’s Trader’s Corner, we showed how propane inventories have recovered over the past few weeks after being very concerning up until that point. Though there remain some concerns, such as Midwest inventories and ready-for-sale (RFS) inventories, U.S. propane inventories overall are back on last year’s pace, which resulted in a record high inventory position by last winter.

Even the areas of concern had nice improvements for the week ending June 27, which was the last date the EIA collected data. Midwest inventory was up 1.447 million barrels, making a deficit to last year of 4.936 million barrels. However, Midwest inventories are just 3.92 percent below the five-year average, which we consider the primary target. RFS inventories increased 2.438 million barrels, putting the deficit to last year at 9.6 percent.

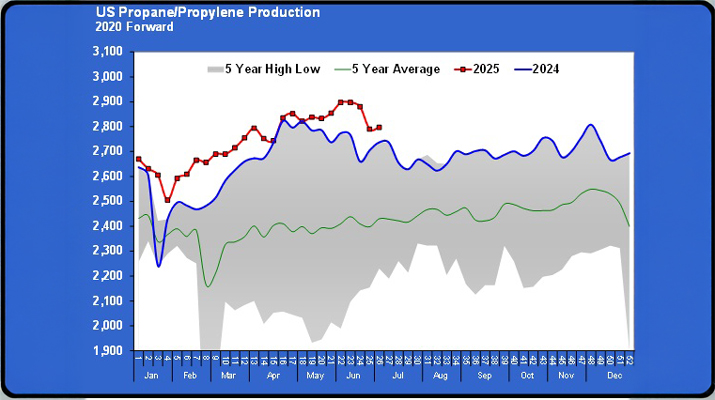

Last week, we pointed to a drop in demand recently as a key reason for the nice recovery in inventory over the last five weeks. In this Trader’s Corner, we are going to look more closely at demand.

The chart above plots total demand, which includes both domestic and export demand. It plots this year’s demand and provides for the last two years as reference points. Note that demand for this year has fallen below last year and in fact, a week ago, hit the 2023 level. It is not coincidental that propane inventories have recovered during the stretch that demand fell below last year’s levels.

You will note on the charts we use for illustration that we are right at the point where demand is at its lowest, and we are nearing the point where demand will trend higher for the remainder of the year. Obviously, we have been in the time when progress on inventory replenishment is expected. It is good for propane buyers that we have gotten that replenishment. It was late, but far better than never.

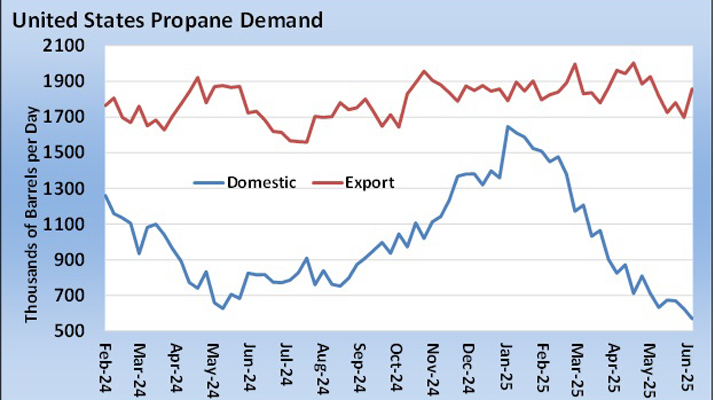

The chart below breaks the above total demand into domestic and international or export demand.

The top line is export demand, and the bottom is domestic demand. Though there is weekly volatility in export demand, it is far more consistent than domestic demand over the course of the year. If we want to know why companies are putting more effort into exporting propane than selling it domestically, it is because of the seasonal swings in domestic demand. Those seasonal swings just don’t match up with propane production.

Most propane exports are going to petrochemical operations that have a demand profile that is much closer to the propane production profile. In fact, if propane production has an off period, it is in the wintertime when domestic demand is the highest.

Cold weather can cause production problems both at the well heads and at the fractionators. Refineries also often do maintenance in the winter when the demand for gasoline is lowest. All three impact propane supply negatively.

Production is steadier through the summer, as is export demand, while domestic demand falls sharply. That means that producers need more storage and other costly assets to accommodate domestic demand relative to export demand. When they can make a premium exporting propane, it is hard to convince them that it is a good investment.

We are about to enter the period where total demand is going to start climbing. The chart below depicts that very clearly.

The bars are the percentage that domestic demand is of total demand. From July through January, demand overall is going to increase, but domestic demand will be a higher percentage through that period.

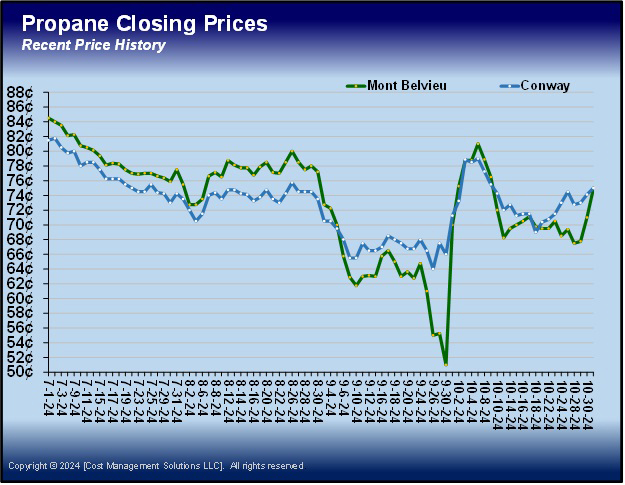

Given that propane prices for this winter are still a little elevated, that is discouraging for a propane buyer. Certainly, it would be appropriate to think that increased demand will mean the buying opportunity for this winter has already gotten as good as it is going to get. But there is still hope. Strange things can happen.

Propane prices fell last year during the month of July. That could happen again. With winter pricing about 3 cents higher than the 10-year winter average for propane, a similar pullback might give buyers the opportunity they need to buy price protection for this winter without a lot of undue risk.

We would not hold out hope that what happened last September will happen again this September, though a buyer can always hope. Last September, Energy Transfer had issues with its export terminal and with a pipeline, causing prices to tumble at Mont Belvieu.

Buyers can’t plan for these types of events to occur, just take advantage when they do. But, with propane inventories back in good shape, there is a chance for a dip in propane prices before winter. Maybe nothing compared to last September, but still enough to increase the chance that winter price protection will work out for the buyer.

Charts courtesy of Cost Management Solutions

To subscribe to LP Gas’ weekly Trader’s Corner e-newsletter, click here.